The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Knight Frank Predicts Even Split of Global Prime Residential Market Growth in 2012

Residential News » Asia Pacific Residential News Edition | By Michael Gerrity | December 30, 2011 9:00 AM ET

According to London-based real estate firm Knight Frank, prime global city markets in 2012 are likely to outperform their mainstream national counterparts, but don't expect all prime residential markets to deliver positive growth.

According to London-based real estate firm Knight Frank, prime global city markets in 2012 are likely to outperform their mainstream national counterparts, but don't expect all prime residential markets to deliver positive growth.Knight Frank tells the World Property Channel that before 2007 the global housing market was a much simpler subject to analyze. Prices and demand rose year-on-year pretty much everywhere and at almost every level of the market. Then came the credit crunch, and things became more complex.

Following the introduction of stimulus measures - the global response to the crisis in late-2008 - a geographical separation opened between the markets in the weakened West and those in the newly resurgent Asia-Pacific, where lower interest rates began to stoke a second boom in pricing.

The stimulus measures also opened a divide between mainstream markets and prime, or luxury, markets globally. Affluent purchasers took advantage of ultra-low mortgage rates, and central bank asset purchases created a wave of investment funds which drove pricing in 'safe-haven' assets higher.

As wealth portfolios recovered after 2009, demand for prime property rose across the world, leading to a sharp upturn in cross border property investment flows.

Asian demand for new-build development purchases in central London is an obvious manifestation of this latter trend. The same phenomenon has been witnessed in Asia, with more than 30% of Singapore's prime market purchases going to non-domestic buyers, and in North America, where rising demand from wealthy Brazilian investors is helping to drive prices in New York and Miami.

See related news story on WORLD PROPERTY CHANNEL:

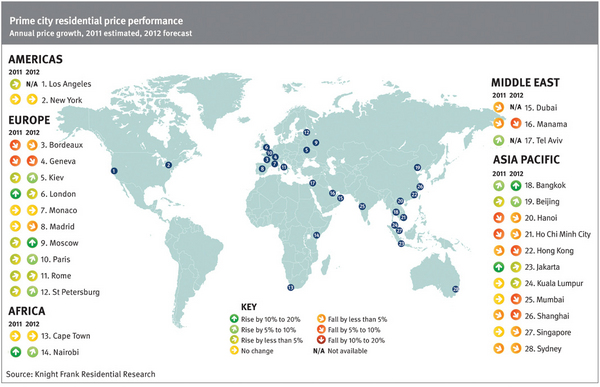

Liam Bailey, head of residential research at Knight Frank says, "Growing global uncertainty and government intervention in the property market, especially in Asia, will weigh on prices in some areas. But some cities, such as Moscow and Bangkok, will shrug off these concerns to register growth of between 10 and 20% in 2012. Paris, Kiev and St Petersburg are all expected to rise by 5 to 10%, with London slotting in next with a rise of 5%."

Bailey further states, "However, Shanghai, Mumbai, Manama, Hong Kong and Geneva are tipped to fall by between 10 and 20%."

Worsening sovereign debt conditions in Europe, weak banking sector performance and a sluggish global economy are weighing heavily on global housing markets. Price growth in the world's mainstream housing markets averaged 0.9% in the year to September, down from 3.5% a year earlier.

With national markets flagging, conditions in the world's luxury city markets are holding up a little better. In 2012, Knight Frank expects prices to either rise or remain flat in around half the cities they monitor.

Following the 2008 credit crunch, the relative outperformance of prime residential property has meant that it continues to be viewed favorably by wealthy investors. This has become more evident as the list of alternative investment options open to investors has shrunk.

While the prime markets may be outperforming their mainstream peers, they are in no way immune from weakening confidence and deteriorating market conditions. Cities across Asia-Pacific are at the sharp end of this process, with weaker sales volumes in many cities starting to feed through into price growth.

Twelve months ago average prices for Asia's luxury homes were rising in value by 16.3% annually. At the end of September this year, the comparable figure was closer to 2%.

Of the cities covered in their forecast, 32% are expected to see luxury house prices fall in 2011, 25% are tipped to remain unchanged, and the remaining 43% are expecting prices to end the year higher than they started. Jakarta and Nairobi are forecast to be the strongest performers in 2011, with prices rising by up to 20% over the year.

Positive price movements this year can largely be attributed to rising cross-border demand from wealthy individual investors (especially in London and Paris), a lack of new supply (Moscow) and strong growth in domestic wealth (Beijing).

For those cities where prices are falling this year, weaker economic activity is a contributory factor in the majority of cases (Geneva, Hong Kong and Sydney), but weakening demand in the Middle East (Manama) and monetary tightening (Mumbai) also feature.

What's Coming in 2012?

For 2012, Knight Frank forecasts a relatively even split, with price falls expected in 44% of cities, no change in 12% and rising prices in 44%.

Perhaps the most interesting trend is the lack of homogeneity across the continents.

In Europe, Geneva and Madrid will see prices decline in 2012, but expect Moscow and Paris to be among the strongest performing markets.

Similar disparities can be observed in Asia. Hong Kong is forecast to see luxury prices decline by between 5% and 10%, while prices in Beijing are expected to rise by a comparable amount.

Seven Asian cities are expected to see negative price growth in 2012. In most cases these price falls have been partly driven by government regulation, which was brought in after 2008 in an attempt to cool housing markets before they experienced US and European style crashes.

These steps were bolstered in recent years, as concerns over speculative investment rose and rising household wealth created price pressures. The measures have proved hard-hitting and have included curbing multiple home ownership, halting bank loans for uncompleted projects and increasing interest rates.

Away from government intervention in Asia, the main reason for price falls in 2012 is the growing global economic uncertainty emanating from the Eurozone and extending to other parts of the world.

Given the seriousness of the economic threat facing the world economy, some might find it surprising that Knight Frank forecasts positive growth in 44% of their key global city markets.

Limited supply in several markets is the pivotal factor, and it is expected to push prices higher in London, Paris, Moscow, Nairobi and Kuala Lumpur.

Knight Frank's head of International Residential Research Kate Everett-Allen says, "Price growth in 2012 will continue to be underpinned by the flight of capital from troubled world regions, a factor which has certainly aided demand in locations like London, Paris, Singapore and Geneva".

Allen continues, "Equally important is the desire of wealthy investors to target property and other real assets over financial products, certainly for as long as the current financial turmoil continues."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Orlando's Housing Market Continues to Slow Down This Fall

- U.S. Mortgage Originations Predicted to Hit $1.95 Trillion in 2024

- Construction Input Costs in America Uptick in September

- Global Home Price Growth Further Slows in Mid-2023

- Home Values in U.S. Begin to Slip Late Summer

- Foreclosure Filings in U.S. Spike 34 Percent Annually in Q3

- U.S. Mortgage Credit Availability Upticks in September

- Retail Market is a Bright Spot for Manhattan Real Estate

- Residential Rents in U.S. Dip in September Amid Growing Apartment Supply

- U.S. Mortgage Rates Continue to Surge in October

- Greater Las Vegas Home Sales Down 10 Percent Annually in September

- Most U.S. Homebuyers Say Buying a Home is More Stressful Than Dating in 2023

- Mortgage Applications Dive 6 Percent Last Week in America

- Despite Peak Interest Rates, Global Housing Markets Improved in Q2

- U.S. Architecture Billings Index Reports Softening Business Conditions in August

- U.S. Home Price Growth Pace Upticks Again in August

- 10,000 Residential Properties Have Negative Equity in Hong Kong

- U.S. Pending Home Sales Dropped 7.1 Percent in August

- U.S. Mortgage Rates Reach Highest Level in 23 Years

- American Bankers See Weakening Credit Conditions Through End of 2024

- Palm Beach Area Residential Sales Uptick in August

- Driven by High Mortgage Rates, Pending Home Sales Drop 13% Annually in September

- Miami Area Residential Sales Slip 13 Percent Annually in August

- U.S. Home Sales Dip 15 Percent Annually in August

- Home Flipping Transactions Down in 2023, Profits Up

- U.S. Listings Inventory Rises 4 Percent in August

- The Fed Leaves Rates Alone for Now in September

- Mortgage Applications Uptick in U.S. Amid High Rates

- Single Family Rent Growth in U.S. Drops to 3-Year Low in July

- Greater Orlando Area Home Sales Down 16 Percent Annually in August

- Home Purchase Cancellations Accelerating in the U.S.

- U.S. Construction Input Costs Uptick in August

- U.S. Mortgage Credit Availability Upticks in August

- Monthly Property Foreclosure Activity Upticks in U.S.

- Greater Palm Beach Area Residential Sales Dip 5 Percent Annually in Mid-2023

- NAR Predicts Several U.S. Housing Market Outcomes

- Demand for U.S. Housing is Dropping as Prices Rise

- U.S. Homeowner Equity Decrease by $287 Billion Over the Last 12 Months

- 1 in 5 Millennials Think They'll Never Own a Home in America

- 1 in 8 San Francisco Home Sellers Is Losing Money at Closing in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More