The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Central and Eastern Europe Enjoying an Uptick in Commercial Investment Activity

Commercial News » Europe Commercial News Edition | By Michael Gerrity | July 11, 2014 9:32 AM ET

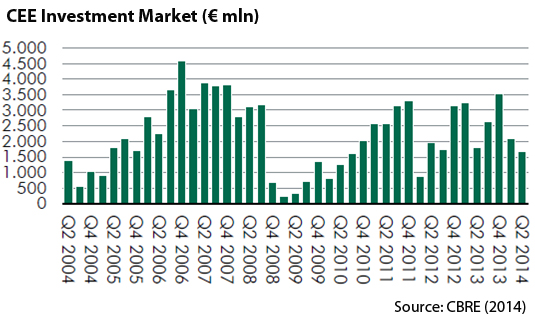

According to CBRE, the first half year results pushed commercial real estate investment volumes in Central & Eastern Europe (CEE) (excluding Russia) to â¬2.5bn, an increase of 15% on the same period for 2013.

Romania saw the greatest rise in commercial property investment volumes with close to 300% increase year-on-year, however, coming from low levels of activity. This can be explained by continued low interest rates, increasing allocation of institutional investors to real estate, relatively high yields and the belief that economic growth should be solid in the coming years.

The Czech Republic and Hungary also saw significant increases in investment volumes with uplifts of 36% and 35% respectively. These two countries in particular have benefitted from the challenge that many investors have had in finding the product they are looking for in Poland. This lack of supply has had a positive impact on neighboring countries, which also can offer more attractive yields in the current market.

Despite these increases, Russia and Poland continue to dominate commercial property investment in the region. Together they account for over 60% of the investment volume at â¬1.2 billion and â¬1.1 billion respectively. Poland's real estate market continues to attract strong investment and the Polish economy - after a slight dip in recent quarters - is moving back into growth mode. Poland has moved away from being a niche market and continues to mature into one of the core investment locations in Europe. Russia, however, saw investment flows fall almost 60% over the first six months of the year. This is largely due to the well-publicized tensions with the Ukraine, but also reflects the irregularly high transaction activity in Q1 2013.

CEE Capital Markets Director Mike Atwell said, "The CEE investment market continues to benefit from a renewed interest from traditional CEE investors, but more recently the market has also begun to see new sources of global capital coming into the region. Poland remains the dominant market with numerous transactions ongoing and the forecast is for an overall increase in volumes by the end of 2014."

CEE Capital Markets Director Mike Atwell said, "The CEE investment market continues to benefit from a renewed interest from traditional CEE investors, but more recently the market has also begun to see new sources of global capital coming into the region. Poland remains the dominant market with numerous transactions ongoing and the forecast is for an overall increase in volumes by the end of 2014."Jos Tromp, Head of CEE Research & Consultancy commented, "Continued low interest rates, combined with an improved economic outlook, has ensured commercial real estate remains a favored asset for investors. Within the CEE region, we believe that investor interest is actually stronger than the H1 2014 data suggests. Almost all markets have shown increasing liquidity levels, with the exception of Russia, which was clearly adversely affected by the Ukraine crisis. It is also important to remember that Russian deal flow was abnormally high for the same period in 2013. However, until the situation in the Ukraine settles down we expect cross-border investment into Russia to remain relatively slow".

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Investment in Asia Pacific Multifamily Properties to Double by 2030

- Multi-story Warehouses Are 15 Percent of Sydney's New Industrial Stock

- Manhattan Office Leasing Activity Lags in Q3 as Sentiment Remains Cautious

- Nonresidential Construction Spending Increases in America

- Office Conversions on Pace to Double in U.S.

- Hong Kong Office Vacancy Rates Stabilize After 4 Months of Increases

- Commercial Mortgage Debt Outstanding in U.S. Jumps to $4.60 Trillion in Mid 2023

- Architecture Billings Index in U.S. Remains Flat in July

- Commercial Mortgage Delinquencies Rise in America

- U.S. Data Center Demand Explodes in U.S., Driven by AI Growth in 2023

- Demand for Electric Vehicle Manufacturing Space Jumps Across the U.S.

- Global Cross Border Commercial Property Capital Flows Implode 52 Percent Annually in 2023

- 2023 Financing Constraints Rapidly Drive Down Construction Starts in U.S.

- New York City Named as U.S. Leader in Climate Change Resilience

- Tokyo is the City of Choice for Global Retailers in 2023

- Despite VC Cooldown, Life Sciences Represents 33 Percent of New Office Construction in 2023

- Despite Reduced Credit, U.S. Multifamily Developer Confidence Remained Positive in Q2

- Brisbane Office Market Enjoying Strong Leasing Activity in 2023

- Commercial Lending Dampened in 2023 by U.S. Market Uncertainty

- Asia Pacific's Commercial Investment Market Continues to be Challenged in 2023

- Despite Global Economic Uncertainty, Commercial Investment in Japan Grew in Q2

- U.S. Commercial Lending to Dive 38 Percent to $504 Billion in 2023

- Apartment Markets Across America Continue to Stabilize in 2023

- Cap Rates for Prime Multifamily Assets in U.S. Stabilize in Q2

- Ireland Office Market Making a Comeback in 2023

- U.S. Office Sales Total $15 Billion Halfway Through 2023

- AI and Streaming Drive Global Data Center Growth Despite Power Constraints

- Asia Pacific Logistics Users Plan to Expand Warehouse Portfolio in 2023

- Manhattan Retail Rents Continue to Rise in Q2

- Manhattan Office Leasing Activity Down 29 Percent Annually in Q2

- Commercial Property Investment in Australia Dives 50 Percent in 2023

- U.S. Architecture Billings Uptick in May

- Employees Return to Office Trend Growing in Asia Pacific Markets

- Exponential AI Growth to Drive Asia Pacific's Data Center Market

- Large Opportunity to Transform Australia's Office Market in Play

- Australian Industrial Rent Growth to Continue in 2023

- Corporate Relocations in U.S. at Highest Rate Since 2017

- North American Ports Volume Drops 20 Percent Annually in 2023

- Office Investment in Asia Pacific Remains Strong Despite Weaker Sentiment

- Australia's Build-to-Rent Properties Uptick on Lender's Wish List in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More