The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

46 European Banks to Sell $795 Billion of Real Estate Assets

Commercial News » Europe Commercial News Edition | By Michael Gerrity | July 14, 2014 1:05 PM ET

According to Cushman & Wakefield's Corporate Finance team, European banks and asset management agencies have a gross exposure of â¬584 billion ($795 billion USD) to non-core real estate which is subject to disposal or work-out strategies.

The findings, published this week in the firm's European Real Estate Loan Sales Market H1 2014 update, reveal that despite the record volume of commercial real estate (CRE) and real estate-owned (REO) sales seen so far this year, the deleveraging process throughout Europe is far from over.

Cushman & Wakefield Corporate Finance carried out extensive research into the non-core real estate exposure of 46 banks and asset management agencies throughout Europe for the in-depth report. The nine European 'bad banks' analysed hold over 46% of the total gross exposure to non-core real estate, indicating their importance in the CRE loan and REO sales market in the next few years.

Cushman & Wakefield Corporate Finance carried out extensive research into the non-core real estate exposure of 46 banks and asset management agencies throughout Europe for the in-depth report. The nine European 'bad banks' analysed hold over 46% of the total gross exposure to non-core real estate, indicating their importance in the CRE loan and REO sales market in the next few years.The publication details eight 'mega-deals' - those with a face value over â¬1 billion - which have closed in H1, while another four are currently being tracked. These 'mega-deals' accounted for 71% of the total H1 loan sale volume; this is up from 40% in H1 2013.

Contrary to the trend observed across Europe in 2013, the average size of loan sale transactions has increased in H1 2014 to â¬621 million from â¬346 million in the same period last year - this makes it even more difficult for smaller investors to participate in the sales process.

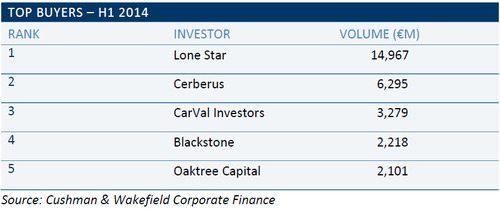

Large US investors such as Lone Star and Cerberus continue to grab the headlines, accounting for 77% of all European CRE loan and REO acquisitions in H1 2014.

Frank Nickel, Executive Chairman of Cushman & Wakefield's EMEA Corporate Finance group said: "US investors have raised an enormous volume of capital targeting opportunistic real estate. 'Mega-deals' prove popular to these buyers since they offer a chance to gain large exposures to key assets and markets in one transaction, saving on both costs and time."

Following a record first quarter dominated by IBRC, Q2 saw activity spread to Southern Europe as vendors look to take advantage of increasing investor appetite in the region. As a result, Cushman & Wakefield's Corporate Finance team estimates â¬16.3 billion of sales completed in the three months to July, over six times the volume closed in Q2 2013 (â¬2.5 billion).

When combined with the Q1 2014 figure of â¬24.7 billion, the total volume for the first six months of this year amounts to â¬40.9 billion. This represents an increase of over 30% on volume for the entirety of 2013 and of 611% on H1 2013.

A highly active H1 has led to Cushman & Wakefield Corporate Finance forecasting that closed CRE and REO sales are now likely to reach â¬60 billion in 2014.

Federico Montero, Head of Loan Sales of Cushman & Wakefield's EMEA Corporate Finance said, "The record loan sales volume seen so far in 2014 has been impressive, although the non-core real estate exposure of â¬584 billion across Europe signifies the enormity of the deleveraging process still to occur. Additionally, the upcoming stress tests being enforced by the ECB will guarantee that the current high levels of activity in the market will be sustained in the next few years."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Investment in Asia Pacific Multifamily Properties to Double by 2030

- Multi-story Warehouses Are 15 Percent of Sydney's New Industrial Stock

- Manhattan Office Leasing Activity Lags in Q3 as Sentiment Remains Cautious

- Nonresidential Construction Spending Increases in America

- Office Conversions on Pace to Double in U.S.

- Hong Kong Office Vacancy Rates Stabilize After 4 Months of Increases

- Commercial Mortgage Debt Outstanding in U.S. Jumps to $4.60 Trillion in Mid 2023

- Architecture Billings Index in U.S. Remains Flat in July

- Commercial Mortgage Delinquencies Rise in America

- U.S. Data Center Demand Explodes in U.S., Driven by AI Growth in 2023

- Demand for Electric Vehicle Manufacturing Space Jumps Across the U.S.

- Global Cross Border Commercial Property Capital Flows Implode 52 Percent Annually in 2023

- 2023 Financing Constraints Rapidly Drive Down Construction Starts in U.S.

- New York City Named as U.S. Leader in Climate Change Resilience

- Tokyo is the City of Choice for Global Retailers in 2023

- Despite VC Cooldown, Life Sciences Represents 33 Percent of New Office Construction in 2023

- Despite Reduced Credit, U.S. Multifamily Developer Confidence Remained Positive in Q2

- Brisbane Office Market Enjoying Strong Leasing Activity in 2023

- Commercial Lending Dampened in 2023 by U.S. Market Uncertainty

- Asia Pacific's Commercial Investment Market Continues to be Challenged in 2023

- Despite Global Economic Uncertainty, Commercial Investment in Japan Grew in Q2

- U.S. Commercial Lending to Dive 38 Percent to $504 Billion in 2023

- Apartment Markets Across America Continue to Stabilize in 2023

- Cap Rates for Prime Multifamily Assets in U.S. Stabilize in Q2

- Ireland Office Market Making a Comeback in 2023

- U.S. Office Sales Total $15 Billion Halfway Through 2023

- AI and Streaming Drive Global Data Center Growth Despite Power Constraints

- Asia Pacific Logistics Users Plan to Expand Warehouse Portfolio in 2023

- Manhattan Retail Rents Continue to Rise in Q2

- Manhattan Office Leasing Activity Down 29 Percent Annually in Q2

- Commercial Property Investment in Australia Dives 50 Percent in 2023

- U.S. Architecture Billings Uptick in May

- Employees Return to Office Trend Growing in Asia Pacific Markets

- Exponential AI Growth to Drive Asia Pacific's Data Center Market

- Large Opportunity to Transform Australia's Office Market in Play

- Australian Industrial Rent Growth to Continue in 2023

- Corporate Relocations in U.S. at Highest Rate Since 2017

- North American Ports Volume Drops 20 Percent Annually in 2023

- Office Investment in Asia Pacific Remains Strong Despite Weaker Sentiment

- Australia's Build-to-Rent Properties Uptick on Lender's Wish List in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More