The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Europe's Office Buildings Facing Greater Obsolescence, Value Depreciation Than Ever Before

Commercial News » Europe Commercial News Edition | By Michael Gerrity | April 30, 2012 10:47 AM ET

According to Jones Lang LaSalle's Offices 2020 Research Program, over the next decade European office buildings face an increased risk of value depreciation and obsolescence as structural change in three factors will combine to accelerate risk.

According to Jones Lang LaSalle's Offices 2020 Research Program, over the next decade European office buildings face an increased risk of value depreciation and obsolescence as structural change in three factors will combine to accelerate risk.The rate of increase of office obsolescence, where the building is no longer desirable or fit for use, will accelerate due to increasing sustainability legislation, advancing workplace technology and evolving employer requirements.

As a result, substantial amounts of office stock will depreciate in value and be converted to alternative uses. For example, in Amsterdam, take-up of office space over 1,000 sq m totaled 160,000 sq m in 2011, whereas over 93,000 sq m of office space was allocated for uses such as hotels and residential. In Birmingham, take-up over 1,000 sq m totaled 31,100 sq m in 2011. This compares with 50,000 sq m which was allocated for alternative uses. This trend will intensify as legislation and technology continue to evolve.

Bill Page, Head of EMEA Offices Research at Jones Lang LaSalle said, "The majority of European office buildings are old. In Germany for example, 59% of non-domestic building stock dates from between the 1950s and 1990s. In the UK, 22% of commercial building stock dates before 1960, whilst in Paris, two-thirds of office stock is over 20 years old. Old buildings will require even more investment and upkeep to ensure they are fit for purpose. This comes with greater risk."

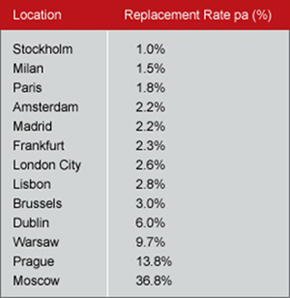

On top of high volumes of adaption for alternative uses, current low rates of replacement of offices in Western Europe, of between 1% and 3%, mean that as stock continues to age, greater strain is placed on investors and occupiers to future proof current assets and safeguard rental income, reduce voids and attract companies willing to take space in the building. This is even more challenging in an environment of limited capital expenditure and product that will essentially be controlled by banks for some time yet.

Jones Lang LaSalle's Managing Director for France and Southern Europe, Benoît du Passage, tells World Property Channel, "Whilst depreciation and obsolescence are not new for real estate, they impact offices more than any other commercial sector. Staying ahead of the game is a perennial issue. In France, anecdotal evidence suggests that investors are already pricing in the cost of upgrading buildings to the standards required by Grenelle II, the environmental laws. This will impact property valuations, especially secondary product that may require more substantial financial investment."

Jones Lang LaSalle's Managing Director for France and Southern Europe, Benoît du Passage, tells World Property Channel, "Whilst depreciation and obsolescence are not new for real estate, they impact offices more than any other commercial sector. Staying ahead of the game is a perennial issue. In France, anecdotal evidence suggests that investors are already pricing in the cost of upgrading buildings to the standards required by Grenelle II, the environmental laws. This will impact property valuations, especially secondary product that may require more substantial financial investment."Page further commented, "Office buildings are complex development projects that can take many years to move from architect's vision to finished built product. But the industry and demands of corporate occupiers are evolving at a quicker pace. Companies want flexible buildings that meet evolving sustainability and technology standards, employees want a pleasant work environment. Buildings that fall short of the legal requirements and are unsuitable will either be allocated for other use or, in extreme circumstances demolished."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Investment in Asia Pacific Multifamily Properties to Double by 2030

- Multi-story Warehouses Are 15 Percent of Sydney's New Industrial Stock

- Manhattan Office Leasing Activity Lags in Q3 as Sentiment Remains Cautious

- Nonresidential Construction Spending Increases in America

- Office Conversions on Pace to Double in U.S.

- Hong Kong Office Vacancy Rates Stabilize After 4 Months of Increases

- Commercial Mortgage Debt Outstanding in U.S. Jumps to $4.60 Trillion in Mid 2023

- Architecture Billings Index in U.S. Remains Flat in July

- Commercial Mortgage Delinquencies Rise in America

- U.S. Data Center Demand Explodes in U.S., Driven by AI Growth in 2023

- Demand for Electric Vehicle Manufacturing Space Jumps Across the U.S.

- Global Cross Border Commercial Property Capital Flows Implode 52 Percent Annually in 2023

- 2023 Financing Constraints Rapidly Drive Down Construction Starts in U.S.

- New York City Named as U.S. Leader in Climate Change Resilience

- Tokyo is the City of Choice for Global Retailers in 2023

- Despite VC Cooldown, Life Sciences Represents 33 Percent of New Office Construction in 2023

- Despite Reduced Credit, U.S. Multifamily Developer Confidence Remained Positive in Q2

- Brisbane Office Market Enjoying Strong Leasing Activity in 2023

- Commercial Lending Dampened in 2023 by U.S. Market Uncertainty

- Asia Pacific's Commercial Investment Market Continues to be Challenged in 2023

- Despite Global Economic Uncertainty, Commercial Investment in Japan Grew in Q2

- U.S. Commercial Lending to Dive 38 Percent to $504 Billion in 2023

- Apartment Markets Across America Continue to Stabilize in 2023

- Cap Rates for Prime Multifamily Assets in U.S. Stabilize in Q2

- Ireland Office Market Making a Comeback in 2023

- U.S. Office Sales Total $15 Billion Halfway Through 2023

- AI and Streaming Drive Global Data Center Growth Despite Power Constraints

- Asia Pacific Logistics Users Plan to Expand Warehouse Portfolio in 2023

- Manhattan Retail Rents Continue to Rise in Q2

- Manhattan Office Leasing Activity Down 29 Percent Annually in Q2

- Commercial Property Investment in Australia Dives 50 Percent in 2023

- U.S. Architecture Billings Uptick in May

- Employees Return to Office Trend Growing in Asia Pacific Markets

- Exponential AI Growth to Drive Asia Pacific's Data Center Market

- Large Opportunity to Transform Australia's Office Market in Play

- Australian Industrial Rent Growth to Continue in 2023

- Corporate Relocations in U.S. at Highest Rate Since 2017

- North American Ports Volume Drops 20 Percent Annually in 2023

- Office Investment in Asia Pacific Remains Strong Despite Weaker Sentiment

- Australia's Build-to-Rent Properties Uptick on Lender's Wish List in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More