The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

France's Retail Property Market to Uptick in Q2

Commercial News » Europe Commercial News Edition | By Michael Gerrity | April 16, 2014 8:00 AM ET

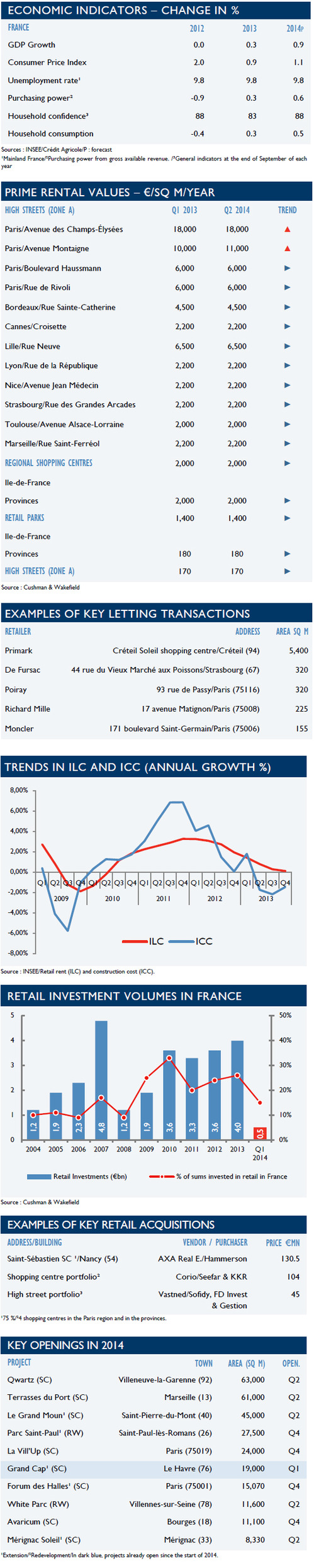

Cushman and Wakefield reports today that after a decline of 0.3% in Q1, France's consumer spending is expected to increase by 0.6% in Q2. While headline inflation is likely to be pushed upwards, consumer spending will be sustained thanks to a stable unemployment rate, a modest increase in purchasing power and a decline in savings.

In this context, several indicators reveal a retail market that is still in a recovery phase. Consumer spending on textiles and clothing items fell by 0.3% yoy but furniture sales grew by 1.2%. Winter sales figures are also mixed: although positive for the shopping center industry, they are generally disappointing for Parisian retailers.

The Rental Market

The Rental MarketCushman and Wakefield says the upturn in consumer spending will, however, not benefit the entire French retail real estate market in 2014. Secondary sites and retail units and developments that lack optimum configuration will, therefore, continue to suffer from retailers' wait-and-see stance.

Aware of the risks associated with opening new shops, some are slowing down their expansion or closing their poorer performing outlets. This trend explains the longer letting periods for certain sites and increased tenant incentives granted, in the context of the legal uncertainty due to the upcoming implementation of the Pinel law.

However, these risks have failed to deter many stakeholders from continuing their developments, thus demonstrating the potential of the French market in the eyes of large national groups developing new upmarket concepts (e.g., Minelli, Intersport) or foreign brands that have recently arrived in France (e.g., Primark, Aldo). The market also remains animated due to the continued arrival of new entrants in various sectors targeting different markets (e.g., Ecco, Rituals, Del Pozo), as well as variations of labels from well-known brands (e.g., H&M Home / Cheap Monday) and the continued rise of designer boutiques (e.g., Bellista / Nocibé, Lego, K-Way).

These various stakeholders tend to focus on the busiest or best known sites in France, be it the largest shopping centers - existing or newly created, or the best high-street locations in Paris and provincial towns. However, some medium-sized cities are also being targeted by big brands looking to boost their nationwide presence by opening franchises (e.g., Desigual, Fnac, and Darty).

The Investment Market

Cushman and Wakefield further reports that only â¬514 million was invested in the retail market in Q1 2014, half of that recorded over the same period in 2013 and with only two transactions greater than â¬100 million (acquisition by Hammerson of 75% of Saint-Sébastien shopping center in Nancy, purchase by KKR/Seefar of a portfolio of four centers). Although retail only represented 15% of total investment in France over the first quarter, in the coming months it is expected to reach levels closer to those of recent years (26% on average over the past five years). In fact, investment volumes will soon be boosted by the completed sale of regional shopping centers (Beaugrenelle) and large portfolios of mixed assets (Risanamento portfolio) and shopping centers (Klépierre portfolio).

French Retail Stock

880,000 m² of retail space was opened in 2013, which represents a slight decrease of 4% compared to 2012. This volume is expected to decrease in 2014 due to a sharp decline in retail park openings. The supply of shopping centers, on the other hand, will continue to renew at a fast rate despite the fact that few projects have opened since the start of the year - the most significant of which being the expansion of Grand Cap in Le Havre, a development showcasing restaurant chains and brands that are new to the local market (Shana, Calzedonia).

This trend of improving existing assets will continue in the coming months with the expansion of regional centers (Forum des Halles, Mérignac Soleil) as well as those of a smaller size. For example in 2014, Mercialys will complete ten extension-redevelopment projects totaling 25,000 sq. m. The most significant new-build projects will be announced in spring. After it is opened, Qwartz will become one of the largest French shopping centers and the first to feature Marks & Spencer and Primark under the same roof. Next to follow will be Les Terrasses du Port, an upmarket center intended to limit the retreat of commercial activity from Marseille's town center.

Current Legislation and Regulation

Following a cabinet reshuffle and the promise of major territorial reform, news on regulations remains highly topical. Published in the Journal Officiel on the 26th March 2014, the ALUR Law includes some important provisions, which force newly opened 'click & collect stores' to request authorization for commercial activity; require owners of vacant and unlet properties to refurbish if no letting takes place within three years; and limit the car parking ratios for retail properties.

That being said, Cushman and Wakefield comments that many issues are left outstanding such as evening and Sunday shop opening times, reform of commercial leases and changes to the law on urban retail planning. These last two issues are among the main elements of the Pinel Bill, which was passed by MPs in February and then referred to the Senate (extended short-term leases, ILC indexation, preferential right given to the tenant in the event of a sale of the premises, investigation of the CNAC for reviewing projects ⥠30,000 m², etc.).

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Investment in Asia Pacific Multifamily Properties to Double by 2030

- Multi-story Warehouses Are 15 Percent of Sydney's New Industrial Stock

- Manhattan Office Leasing Activity Lags in Q3 as Sentiment Remains Cautious

- Nonresidential Construction Spending Increases in America

- Office Conversions on Pace to Double in U.S.

- Hong Kong Office Vacancy Rates Stabilize After 4 Months of Increases

- Commercial Mortgage Debt Outstanding in U.S. Jumps to $4.60 Trillion in Mid 2023

- Architecture Billings Index in U.S. Remains Flat in July

- Commercial Mortgage Delinquencies Rise in America

- U.S. Data Center Demand Explodes in U.S., Driven by AI Growth in 2023

- Demand for Electric Vehicle Manufacturing Space Jumps Across the U.S.

- Global Cross Border Commercial Property Capital Flows Implode 52 Percent Annually in 2023

- 2023 Financing Constraints Rapidly Drive Down Construction Starts in U.S.

- New York City Named as U.S. Leader in Climate Change Resilience

- Tokyo is the City of Choice for Global Retailers in 2023

- Despite VC Cooldown, Life Sciences Represents 33 Percent of New Office Construction in 2023

- Despite Reduced Credit, U.S. Multifamily Developer Confidence Remained Positive in Q2

- Brisbane Office Market Enjoying Strong Leasing Activity in 2023

- Commercial Lending Dampened in 2023 by U.S. Market Uncertainty

- Asia Pacific's Commercial Investment Market Continues to be Challenged in 2023

- Despite Global Economic Uncertainty, Commercial Investment in Japan Grew in Q2

- U.S. Commercial Lending to Dive 38 Percent to $504 Billion in 2023

- Apartment Markets Across America Continue to Stabilize in 2023

- Cap Rates for Prime Multifamily Assets in U.S. Stabilize in Q2

- Ireland Office Market Making a Comeback in 2023

- U.S. Office Sales Total $15 Billion Halfway Through 2023

- AI and Streaming Drive Global Data Center Growth Despite Power Constraints

- Asia Pacific Logistics Users Plan to Expand Warehouse Portfolio in 2023

- Manhattan Retail Rents Continue to Rise in Q2

- Manhattan Office Leasing Activity Down 29 Percent Annually in Q2

- Commercial Property Investment in Australia Dives 50 Percent in 2023

- U.S. Architecture Billings Uptick in May

- Employees Return to Office Trend Growing in Asia Pacific Markets

- Exponential AI Growth to Drive Asia Pacific's Data Center Market

- Large Opportunity to Transform Australia's Office Market in Play

- Australian Industrial Rent Growth to Continue in 2023

- Corporate Relocations in U.S. at Highest Rate Since 2017

- North American Ports Volume Drops 20 Percent Annually in 2023

- Office Investment in Asia Pacific Remains Strong Despite Weaker Sentiment

- Australia's Build-to-Rent Properties Uptick on Lender's Wish List in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More