The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

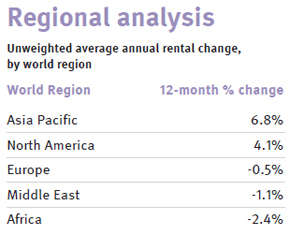

Global Prime Residential Rents Post Weakest Performance Gains in Two Years

Residential News » Europe Residential News Edition | By Michael Gerrity | April 10, 2012 12:11 PM ET

According to London-based Knight Frank, a lot has changed on the global economic stage in the last three months that negatively impacts prime residential rental markets across the globe.

According to London-based Knight Frank, a lot has changed on the global economic stage in the last three months that negatively impacts prime residential rental markets across the globe.In Q4 2011 Greece's debt restructuring plans hung in the balance, its southern European neighbors were revising already pitiful economic forecasts downwards and any tangible signs of a recovery in the US seemed a long way off. It is against this backdrop that prime rents across key global cities struggled in the last three months of 2011.

With the world's economy in a fragile state at the end of 2011, corporate demand declined as relocation budgets shrank reducing rental volumes in many markets. This helps to explain why the financial centers of London, Zurich and Hong Kong saw quarterly growth drop from 0.9%, 3.3% and 1.8% in the third quarter to -0.4%, -3.2% and -1.0% in the final quarter respectively.

In Asia the fluctuations in expatriate demand are proving influential. Thomas Lam, Knight Frank's Head of Research in Greater China tells World Property Channel, "Shanghai and Beijing's rental markets remained strong in 2011 thanks to sustained demand from expatriate workers and limited supply. By comparison rents in Hong Kong softened as demand from expatriates declined and the city felt the effects of corporate cost-cutting and the downsizing of operations."

Nairobi's stellar performance, which placed it at the top of the rankings in 2011, is largely attributable to Kenya's recent economic growth and its expanding middle class, many of whom are unable to access housing loans. There are only 14,000 home loans in Kenya, a country with a population of almost 39 million.

Nairobi's stellar performance, which placed it at the top of the rankings in 2011, is largely attributable to Kenya's recent economic growth and its expanding middle class, many of whom are unable to access housing loans. There are only 14,000 home loans in Kenya, a country with a population of almost 39 million.Moscow and New York's performances were polarized in 2011. Rents in Moscow fell by almost 10% compared to a near 3% rise in New York. Moscow's downturn was largely due to a frenetic period in late 2010 which saw rents rise by more than 7% in one quarter. This correction in the market has now been fully played out and we expect rents to stabilize by the end of 2012.

New York recorded the strongest quarterly growth with rents rising 2.6%. As well as improving employment figures, landlords have the banks to thank.

Jonathan Miller, president of Manhattan-based Miller Samuel says, "Rental growth has been underpinned by an irrationally tight mortgage market, unchanged from a year ago, which is pushing potential purchasers into the rental market."

Assuming the eurozone crisis plays out as the European Central Bank hopes and the global economy starts to gain some meaningful traction; we expect prime rents particularly in mainland China and North America to see continued growth. Europe's outlook is less clear-cut. Here, future growth, particularly in the key financial centers of London and Zurich, will be heavily dependent on the health of their employment markets.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Orlando's Housing Market Continues to Slow Down This Fall

- U.S. Mortgage Originations Predicted to Hit $1.95 Trillion in 2024

- Construction Input Costs in America Uptick in September

- Global Home Price Growth Further Slows in Mid-2023

- Home Values in U.S. Begin to Slip Late Summer

- Foreclosure Filings in U.S. Spike 34 Percent Annually in Q3

- U.S. Mortgage Credit Availability Upticks in September

- Retail Market is a Bright Spot for Manhattan Real Estate

- Residential Rents in U.S. Dip in September Amid Growing Apartment Supply

- U.S. Mortgage Rates Continue to Surge in October

- Greater Las Vegas Home Sales Down 10 Percent Annually in September

- Most U.S. Homebuyers Say Buying a Home is More Stressful Than Dating in 2023

- Mortgage Applications Dive 6 Percent Last Week in America

- Despite Peak Interest Rates, Global Housing Markets Improved in Q2

- U.S. Architecture Billings Index Reports Softening Business Conditions in August

- U.S. Home Price Growth Pace Upticks Again in August

- 10,000 Residential Properties Have Negative Equity in Hong Kong

- U.S. Pending Home Sales Dropped 7.1 Percent in August

- U.S. Mortgage Rates Reach Highest Level in 23 Years

- American Bankers See Weakening Credit Conditions Through End of 2024

- Palm Beach Area Residential Sales Uptick in August

- Driven by High Mortgage Rates, Pending Home Sales Drop 13% Annually in September

- Miami Area Residential Sales Slip 13 Percent Annually in August

- U.S. Home Sales Dip 15 Percent Annually in August

- Home Flipping Transactions Down in 2023, Profits Up

- U.S. Listings Inventory Rises 4 Percent in August

- The Fed Leaves Rates Alone for Now in September

- Mortgage Applications Uptick in U.S. Amid High Rates

- Single Family Rent Growth in U.S. Drops to 3-Year Low in July

- Greater Orlando Area Home Sales Down 16 Percent Annually in August

- Home Purchase Cancellations Accelerating in the U.S.

- U.S. Construction Input Costs Uptick in August

- U.S. Mortgage Credit Availability Upticks in August

- Monthly Property Foreclosure Activity Upticks in U.S.

- Greater Palm Beach Area Residential Sales Dip 5 Percent Annually in Mid-2023

- NAR Predicts Several U.S. Housing Market Outcomes

- Demand for U.S. Housing is Dropping as Prices Rise

- U.S. Homeowner Equity Decrease by $287 Billion Over the Last 12 Months

- 1 in 5 Millennials Think They'll Never Own a Home in America

- 1 in 8 San Francisco Home Sellers Is Losing Money at Closing in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More