The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Vacation Real Estate News

Brazil Hotels' RevPAR Dips as FIFA World Cup Soccer Begins

Vacation News » Latin America Vacation News Edition | By Michael Gerrity | June 13, 2014 9:10 AM ET

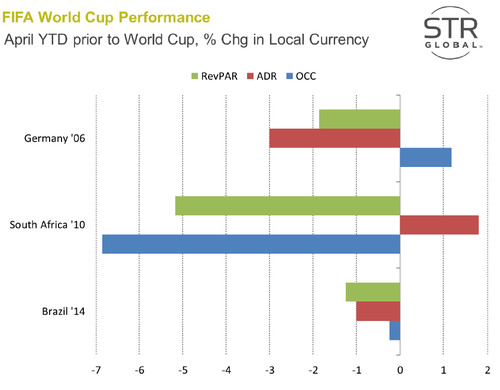

STR Global is reporting hotels in Brazil have experienced declines in revenue per available room as they prepared to host the FIFA World Cup, which began this week. The country's performance is following a similar trend observed by other host countries, including Germany and South Africa.

South Africa saw sharp declines in occupancy before the start of the World Cup, which was mainly driven by an increase in room supply and average-daily-rate growth. Brazil's year-to-date performance has declined due to lower occupancy levels during March and April. After experiencing low rates at the start of the year, Brazil has increased ADR, partly as a positive result of the Carnival.

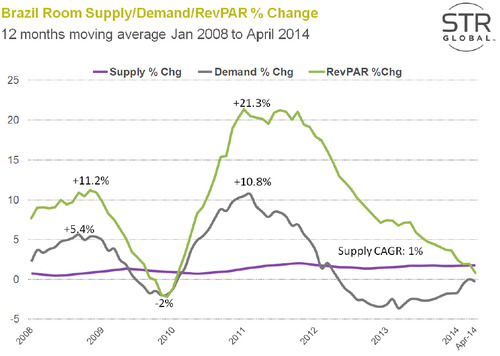

South Africa saw sharp declines in occupancy before the start of the World Cup, which was mainly driven by an increase in room supply and average-daily-rate growth. Brazil's year-to-date performance has declined due to lower occupancy levels during March and April. After experiencing low rates at the start of the year, Brazil has increased ADR, partly as a positive result of the Carnival. The overall supply trend for Brazil shows a countrywide supply compound annual growth rate (CAGR) of 1.0 percent since 2008. The supply growth has been flat since 2008, and the country has not seen any sharp rises leading up to the World Cup or the Olympics. Since 2012, Brazil has seen a decline in demand following a positive trend of growth for more than two years.

During the previous years, Brazil was able to consistently increase ADR without significantly impacting occupancy rates. Brazil's previous increase in ADR is driven primarily by increasing inflation rates seen throughout the previous years, which is currently at 6.4 percent.

During the previous years, Brazil was able to consistently increase ADR without significantly impacting occupancy rates. Brazil's previous increase in ADR is driven primarily by increasing inflation rates seen throughout the previous years, which is currently at 6.4 percent.Despite the historical supply growth, the Under Contract Pipeline of the country recorded an additional 21 percent supply on top of existing supply, of which 23,600 rooms are projected to open by the end of 2015. Sixty-nine percent of this growth is allocated amongst the Economy, Midscale and Upper Midscale classes. International hotel brands are increasing their portfolios in Brazil, with projects not restricted to main tourism destinations or large cities, but also converging smaller city destinations that have significant growth potential.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Vacation Real Estate Headlines

- Asia Pacific Hotel Revenues to Rise in 2024 Despite Economic Volatility

- Tourist Bookings to Hawaii Down 50 Percent Since Maui Wildfires

- Demand for Vacation Homes in U.S. Hit 7-Year Low in August

- International Travel for Americans Jumps Over 200 Percent in 2023

- U.S. Labor Day Weekend Travel To Uptick in 2023

- Asia Pacific Hotel Investment Collapses 51 Percent in 2023

- As Summer Travel Season Winds Down, U.S. Gas Prices Rise Again

- Record Setting 50.7 Million Americans to Travel This July Fourth Holiday

- Israel Hotels Poised for Growth as International Visitors Set to Return

- Over 42 Million Americans to Travel This Memorial Holiday Weekend

- European Hotel Transactions Decline 18 Percent in 2022 as Interest Rates Surge

- U.S. Vacation Home Demand Dives 50 Percent from Pre-Pandemic Levels

- European Hotel Values Upticked 3 Percent in 2022

- U.S. Vacation Rental Bookings Rise 27 Percent Annually in January

- Third-Party Hotel Operators Set to Increase Across Europe in 2023

- 113 Million People Traveling in the U.S. During the 2022 Holiday Season

- London Hotels Set to Weather High Inflation in 2022

- Almost 55 Million People to Travel This Thanksgiving Holiday in America

- Düsseldorf Hotels Enjoy Growing Corporate Demand in 2022

- Global Hotel Investment Activity in Asia Pacific to Rise 80 Percent in 2022

- Japan Lifts Foreign Inbound Covid Travel Restrictions in October

- Demand for Second Vacation Homes in the U.S. Decline

- Amsterdam Hotels Enjoy Comeback Post Covid Travel Restrictions

- 47.9 Million Americans Will Travel This July 4th Weekend

- High Prices, Rising Rates, Economic Uncertainty Ends Vacation Home Boom in America

- My Top 3 July Fourth Vacation Getaways in America Revealed for 2022

- Post Covid, New York City Hotel Market on the Road to Recovery

- Fast Rising Gas Prices to Impede U.S. Vacation Travel in H2 of 2022

- Post-Covid, Paris Hotel Sector Set for Strong Recovery as Demand Grows

- Singapore Hotel Demand to Accelerate in Late 2022

- 39.2 Million Americans to Travel Memorial Weekend, Says AAA

- Covid Driven Vacation Home Boom in America Now Ending in 2022

- Turks and Caicos Vacation Home Sales Enjoy Record-Breaking 2021

- Asia Pacific Hotel Sector Enjoys $8.5 Billion of Investment in 2021

- London Hotels Enjoying a Flight to Quality

- Demand for Vacation Homes Up 77 Percent From Pre-Pandemic Levels

- Even With Omicron, 109 Million Americans Traveling for the Holidays in 2021

- U.S. Vacation Home Demand Still Strong in Late 2021

- Top 5 Christmas Getaways in America Revealed

- Vacation Home Markets in the U.S. Remain Strong

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More