The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

U.S. Home Prices Rise 6% in May, Aided by Higher-end Sales

Residential News » North America Residential News Edition | By Michael Gerrity | June 24, 2014 8:10 AM ET

According to RealtyTrac's May 2014 Residential & Foreclosure Sales Report, U.S. residential properties, including single family homes, condominiums and townhomes, sold at an estimated annual pace of 5,147,550 in May, virtually unchanged from April and an increase of less than 1 percent from May 2013.

The median sales price of U.S. residential properties -- including both distressed and non-distressed sales -- was $180,000, up 6 percent from the previous month and up 13 percent from a year ago. The year-over-year increase in May was the second consecutive month with a double-digit annual increase in U.S. home prices, and the biggest annual increase since U.S. home prices bottomed out in March 2012.

The median price of distressed sales -- properties in the foreclosure process or bank-owned -- was $120,000, 37 percent below the median price of non-distressed properties: $190,000. Distressed sales and short sales combined accounted for 14.3 percent of all U.S. residential sales in May, down from 15.6 percent of sales in April and down from 15.9 percent of all sales in May 2013.

"Distressed sales continue to represent a smaller share of the overall sales pie nationwide, helping to boost median home prices higher given that distressed sales tend to be in lower price ranges," said Daren Blomquist, vice president at RealtyTrac. "When broken down by average price range, U.S. sales are clearly shifting away from the lower end. Properties selling below $200,000 represented 50 percent of all sales in May, but that was down from a 55 percent share a year ago. Meanwhile, the share of homes selling above $200,000 increased from a 45 percent a year ago to a 50 percent in May 2014."

Home sales in higher price ranges represent growing share of market

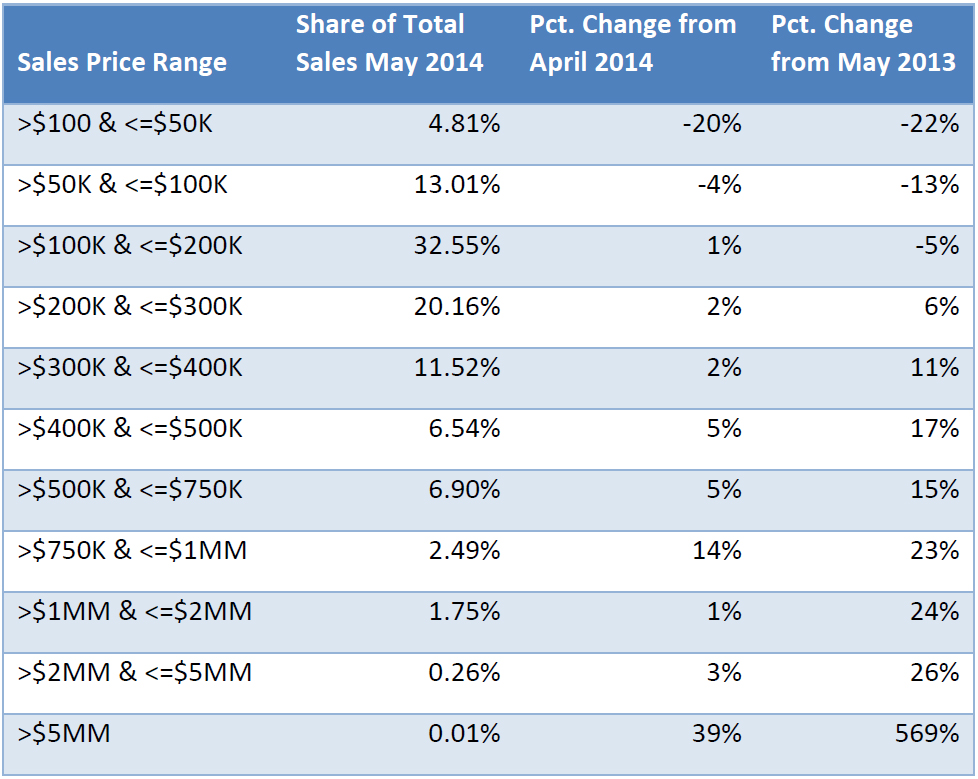

Sales prices in every price range above $200,000 analyzed in the report increased as a share of total sales, both from the previous month and from a year ago, with the increase generally higher in the higher price ranges (see table below).

The share of home sales in the $200,000 to $300,000 price range increased 2 percent from the previous month and were up 6 percent from a year ago, but the share of home sales in all price ranges above $750,000 was up more than 20 percent from a year ago.

Meanwhile the share of home sales decreased from a year ago in all price ranges below $200,000, with bigger decreases corresponding to lower price ranges. The share of homes priced between $100,000 and $200,000 decreased 5 percent from a year ago, while the share of homes between $50,000 and $100,000 decreased 13 percent and the share of homes priced below $50,000 -- often highly distressed homes -- decreased 22 percent.

Home sales in the $100,000 to $200,000 price range accounted for one-third of all home sales in May -- the largest percentage of any price range -- but homes priced between $200,000 and $400,000 were close, accounting for nearly 32 percent of all sales for the month. Sales of homes priced in the $200,000 to $400,000 range were at their highest percentage of U.S. home sales since September 2008 -- a 68-month high.

Sales volume decreases annually in 23 states, 31 of 50 largest metro areas

The 1 percent increase in U.S. annualized sales in May from a year ago was the smallest increase in any month so far this year, and the 0.19 increase from the previous month marked the eighth consecutive month with flat or declining home sales on a month-over-month basis.

Annualized sales volume in May decreased from a year ago in 23 states and the District of Columbia, along 31 of the nation's 50 largest metropolitan statistical areas.

States with decreasing sales volume from a year ago included California (down 15 percent), Arizona (down 10 percent), Nevada (down 7 percent), Michigan (down 3 percent), and Florida (down 3 percent).

Major metro areas with decreasing sales volume from a year ago included Boston (down 23 percent), Fresno, Calif., (down 22 percent), Orlando (down 18 percent), Los Angeles (down 16 percent), and Phoenix (down 13 percent).

"Sales continue to be down year over year, but inventory levels are beginning to climb giving prospective homeowners more choices to buy within the Southern California market," said Chris Pollinger, senior vice president of sales at First Team Real Estate, covering the Southern California market.

Highest share of distressed sales in Las Vegas, Lakeland and Modesto

Short sales and distressed sales -- in foreclosure or bank-owned -- accounted for 14.3 percent of all sales in May, down from 15.6 percent in April and down from 15.9 percent of all sales in May 2013.

Metro areas with the highest share of combined short sales and distressed sales were Las Vegas (36.6 percent), Lakeland, Fla., (33.3 percent), Modesto, Calif., (31.9 percent), Jacksonville, Fla., (31.7 percent), and Riverside-San Bernardino-Ontario in Southern California (29.3 percent).

Short sales nationwide accounted for 4.5 percent of all sales in May, down from 5.4 percent in April and down from 5.8 percent in May 2013. Metros with the five highest percentages of short sales in May were all in Florida: Lakeland (17.7 percent), Orlando (14.9 percent), Tampa-St. Petersburg-Clearwater (13.4 percent), Palm Bay-Melbourne-Titusville (12.9 percent), and Sarasota (11.6 percent).

Sales of bank-owned (REO) properties nationwide accounted for 8.6 percent of all sales in May, down from 9.1 percent of all sales in April and down from 9.3 percent of all sales in May 2013. Metros with the highest percentage of REO sales in May were Modesto, Calif., (26.7 percent), Riverside-San Bernardino-Ontario (23.3 percent), Las Vegas (23.1 percent), Stockton, Calif., (21.5 percent), and Bakersfield, Calif. (19.7 percent).

Sales at the public foreclosure auction accounted for 1.2 percent of all sales nationwide in May, up from 1.1 percent of all sales in April and up from 0.8 percent of all sales in May 2013. Metros with the highest percentage of foreclosure auction sales in May Orlando (3.8 percent), Tampa-St. Petersburg-Clearwater (3.8 percent), Miami (3.7 percent), Indianapolis (3.5 percent), and Lakeland, Fla., (3.4 percent).

Biggest distressed discounts on scheduled auctions, vacant with negative equity

As a supplement to the May U.S. Residential & Foreclosure Sales Report, RealtyTrac analyzed residential property sales transactions in the 12 months ending in March 2014 to pinpoint which types of distressed properties are selling at the biggest discounts based on foreclosure status, occupancy status, equity and year built range.

The analysis looked at 24 different distressed property profiles based on these four factors, comparing the sales price to the estimated full market value for each sale. The final discount was calculated by comparing the average discount (below market value) or premium (above market value) for each property profile to the control of properties not in foreclosure that sold during the same time period.

Based on this analysis, distressed properties with the biggest discount were those scheduled for public foreclosure auction that were vacant, had negative equity and were built between 1950 and 1990. Properties in this category sold for an average discount that was 28 percent below the control group of non-distressed sales.

Other distressed property profiles with discounts among the top five nationwide were the following:

- Properties in default with positive equity (26 percent discount)

- Properties in default with negative equity, vacant and built in 1950 or before (26 percent discount)

- Properties scheduled for foreclosure auction with negative equity and vacant (25 percent discount)

- Properties scheduled for foreclosure auction and vacant (25 percent).

Distressed properties selling at a premium

The analysis found that not all distressed properties sold at a big discount, and in some cases even sold at a premium above non-distressed properties. Bank-owned properties overall sold at a 3 percent premium, while bank-owned properties built in 1950 or before sold at a 7 percent premium.

Some sub-categories of bank-owned homes sold at a discount. Bank-owned properties that were confirmed vacant -- without the former homeowner or tenant still living there -- sold at an 18 percent discount below the non-distressed control, and bank-owned properties that sold after 1990 and between 1950 and 1990 also sold at slight discounts.

Properties with negative equity that were not in foreclosure or bank owned sold at a substantial premium of 19 percent above the control of all properties with no foreclosure status.

Best distressed discounts vary by state

The analysis also found the property profiles with the biggest discounts -- and the discounts available -- varied significantly by state. Below are the distressed property profiles with the biggest available discounts for select states.

- California: scheduled for foreclosure auction with positive equity (17 percent discount)

- Florida: scheduled for foreclosure auction with negative equity, vacant and built between 1950 and 1990 (29 percent discount)

- Ohio: in default, negative equity, vacant and built between 1950 and 1990 (34 percent discount)

- Michigan: in default and vacant (34 percent discount)

- New York: scheduled for foreclosure auction with negative equity and vacant (38 percent discount)

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Orlando's Housing Market Continues to Slow Down This Fall

- U.S. Mortgage Originations Predicted to Hit $1.95 Trillion in 2024

- Construction Input Costs in America Uptick in September

- Global Home Price Growth Further Slows in Mid-2023

- Home Values in U.S. Begin to Slip Late Summer

- Foreclosure Filings in U.S. Spike 34 Percent Annually in Q3

- U.S. Mortgage Credit Availability Upticks in September

- Retail Market is a Bright Spot for Manhattan Real Estate

- Residential Rents in U.S. Dip in September Amid Growing Apartment Supply

- U.S. Mortgage Rates Continue to Surge in October

- Greater Las Vegas Home Sales Down 10 Percent Annually in September

- Most U.S. Homebuyers Say Buying a Home is More Stressful Than Dating in 2023

- Mortgage Applications Dive 6 Percent Last Week in America

- Despite Peak Interest Rates, Global Housing Markets Improved in Q2

- U.S. Architecture Billings Index Reports Softening Business Conditions in August

- U.S. Home Price Growth Pace Upticks Again in August

- 10,000 Residential Properties Have Negative Equity in Hong Kong

- U.S. Pending Home Sales Dropped 7.1 Percent in August

- U.S. Mortgage Rates Reach Highest Level in 23 Years

- American Bankers See Weakening Credit Conditions Through End of 2024

- Palm Beach Area Residential Sales Uptick in August

- Driven by High Mortgage Rates, Pending Home Sales Drop 13% Annually in September

- Miami Area Residential Sales Slip 13 Percent Annually in August

- U.S. Home Sales Dip 15 Percent Annually in August

- Home Flipping Transactions Down in 2023, Profits Up

- U.S. Listings Inventory Rises 4 Percent in August

- The Fed Leaves Rates Alone for Now in September

- Mortgage Applications Uptick in U.S. Amid High Rates

- Single Family Rent Growth in U.S. Drops to 3-Year Low in July

- Greater Orlando Area Home Sales Down 16 Percent Annually in August

- Home Purchase Cancellations Accelerating in the U.S.

- U.S. Construction Input Costs Uptick in August

- U.S. Mortgage Credit Availability Upticks in August

- Monthly Property Foreclosure Activity Upticks in U.S.

- Greater Palm Beach Area Residential Sales Dip 5 Percent Annually in Mid-2023

- NAR Predicts Several U.S. Housing Market Outcomes

- Demand for U.S. Housing is Dropping as Prices Rise

- U.S. Homeowner Equity Decrease by $287 Billion Over the Last 12 Months

- 1 in 5 Millennials Think They'll Never Own a Home in America

- 1 in 8 San Francisco Home Sellers Is Losing Money at Closing in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More