The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Abu Dhabi Residential Rents on the Rise

Residential News » U.A.E. (Abu Dhabi) Edition | By Miho Favela | December 8, 2014 10:55 AM ET

According to Cluttons, Abu Dhabi's drive for economic diversification continues to directly impact tenant demand, and is helping to deliver long term sustainability to the emirate's residential property market.

Cluttons Abu Dhabi Winter 2014 Residential Market Outlook Report, points to the emirate's strong economy, which is showing significant signs of change with rapid expansion in the education, healthcare and aviation sectors, as a key driver for residential demand. The Cleveland Clinic, for example, is set to open in 2015 and has recruited 3,000 healthcare professionals over the course of 2014, the majority of which are new to the capital and have directly contributed to the scarcity of lettings stock across the city.

Cluttons' Abu Dhabi Report Highlights:

- Rents across freehold areas rose by just 2.7% during first nine months of 2014

- Mid-range apartments on Al Reem Island were the strongest performing in Q3, with rents rising by almost 6%.

- House prices rise by 1.6% during Q3, taking total growth during first nine months of 2014 to almost 19%

- During Q3, apartment prices increased by just over 4%, against a marginal drop for villas

The hydrocarbon sector continues to contribute to Abu Dhabi's population growth and has fuelled the creation of additional new jobs. With the UAE pledging to boost its oil production capacity by approximately 25% to 3.5 million barrels per day by 2017, a significant amount of investment is expected to take place in Abu Dhabi, which will no doubt further bolster the rate of job creation in the capital.

Steve Morgan, Chief Executive Cluttons Middle East said, "In addition to the hydrocarbon sector, the education sector continues to expand in order to keep pace with the rising demand for school places.

"A shortage of sites in central Abu Dhabi has meant that new schools have begun to mushroom in more fringe locations on the mainland, which is driving the creation of new residential communities in areas previously considered to be too remote, offering more options in a supply starved market."

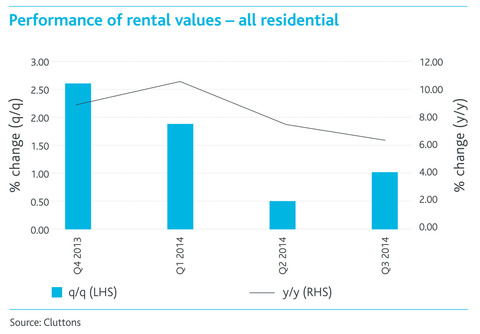

According to the report, during the first nine months of 2014, rents across Abu Dhabi's freehold areas rose by just 2.7%, which compares to the near 9% growth recorded in 2013. With average household incomes failing to keep up with the growth in rents, the cost of living is likely to be impacted and is already being factored into rental values.

"Landlords have been sensitive to the threat of affordability emerging as a core issue for tenants, with many containing rent increases in order to avert an increase in vacancy levels. This behavior is occurring despite the removal of the government enforced Rent Cap earlier this year", said Morgan.

"Landlords have been sensitive to the threat of affordability emerging as a core issue for tenants, with many containing rent increases in order to avert an increase in vacancy levels. This behavior is occurring despite the removal of the government enforced Rent Cap earlier this year", said Morgan.Cluttons' international research and business development manager, Faisal Durrani added, "Most mature markets around the world operate freely without government intervention and Abu Dhabi's rental market is now subject to the usual economic influences, along with the fundamental demand-supply equation. That said, the market could benefit from some sort of guidance in the form of a Rent Index barometer; a light touch version of the rental index enforced by RERA in Dubai would probably suit the market best."

Cluttons' report highlights that the rate of rent increases did recover to an extent during Q3 (1.0%), after rising by a marginal 0.5% in the second quarter. This is however not reflective of tenant demand, which remains stable but strong. Overall, apartments continued to record a higher rate of rental value growth when compared to villas during the third quarter.

The demand for new apartment schemes has continued to increase across the capital during Q3. Abu Dhabi's Aldar properties, recently leased over 200 residential units in the city's tallest tower - Burj Mohammed Bin Rashid, within a week of its launch.

The demand for new apartment schemes has continued to increase across the capital during Q3. Abu Dhabi's Aldar properties, recently leased over 200 residential units in the city's tallest tower - Burj Mohammed Bin Rashid, within a week of its launch.Mid-range apartments on Al Reem Island were the strongest performing in Q3, with rents rising by almost 6%. Despite this, rental value growth on Al Reem Island is almost unchanged on this time last year. With an emerging sense of community living, the desirability of Reem Island is expected to rise, which will in turn help to nudge rents upwards gradually in the coming months, particularly as the overall supply pipeline remains thin."

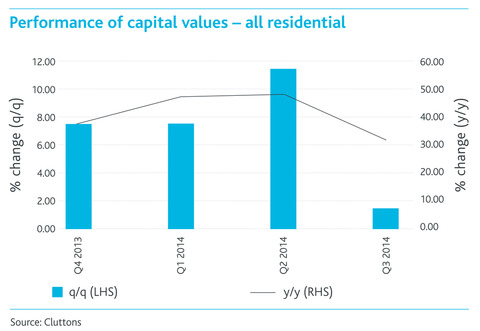

The report shows, that in the sales market, like Dubai, the pace of residential value appreciation has slowed in Abu Dhabi, with house prices rising by just 1.6% during the third quarter, taking total growth during the first nine months of 2014 to almost 19%. The latest rise comes in addition to the 39% rise registered last year.

Durrani commented, "In a similar pattern to the lettings market, apartment values grew at a faster rate than villas during Q3, rising by just over 4%, against a marginal drop for villas. Clearly the top end of the villa market, in excess of AED 5 million, is feeling the strain of the Federal Mortgage Cap."

Rates for high end villas on Sa'adiyat Island slipped by nearly 2% between Q2 and Q3. Despite the apparent plateauing of villa values in recent months, this segment of the residential market has recorded a 24% rise in prices between January and December.

Durrani concluded, "In contrast, apartment values on Sa'adiyat Island grew by 2.4% in Q3, as demand for property on the exclusive island continues to gather momentum now that its iconic schemes such as the Louvre and Guggenheim are edging closer to completion."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Orlando's Housing Market Continues to Slow Down This Fall

- U.S. Mortgage Originations Predicted to Hit $1.95 Trillion in 2024

- Construction Input Costs in America Uptick in September

- Global Home Price Growth Further Slows in Mid-2023

- Home Values in U.S. Begin to Slip Late Summer

- Foreclosure Filings in U.S. Spike 34 Percent Annually in Q3

- U.S. Mortgage Credit Availability Upticks in September

- Retail Market is a Bright Spot for Manhattan Real Estate

- Residential Rents in U.S. Dip in September Amid Growing Apartment Supply

- U.S. Mortgage Rates Continue to Surge in October

- Greater Las Vegas Home Sales Down 10 Percent Annually in September

- Most U.S. Homebuyers Say Buying a Home is More Stressful Than Dating in 2023

- Mortgage Applications Dive 6 Percent Last Week in America

- Despite Peak Interest Rates, Global Housing Markets Improved in Q2

- U.S. Architecture Billings Index Reports Softening Business Conditions in August

- U.S. Home Price Growth Pace Upticks Again in August

- 10,000 Residential Properties Have Negative Equity in Hong Kong

- U.S. Pending Home Sales Dropped 7.1 Percent in August

- U.S. Mortgage Rates Reach Highest Level in 23 Years

- American Bankers See Weakening Credit Conditions Through End of 2024

- Palm Beach Area Residential Sales Uptick in August

- Driven by High Mortgage Rates, Pending Home Sales Drop 13% Annually in September

- Miami Area Residential Sales Slip 13 Percent Annually in August

- U.S. Home Sales Dip 15 Percent Annually in August

- Home Flipping Transactions Down in 2023, Profits Up

- U.S. Listings Inventory Rises 4 Percent in August

- The Fed Leaves Rates Alone for Now in September

- Mortgage Applications Uptick in U.S. Amid High Rates

- Single Family Rent Growth in U.S. Drops to 3-Year Low in July

- Greater Orlando Area Home Sales Down 16 Percent Annually in August

- Home Purchase Cancellations Accelerating in the U.S.

- U.S. Construction Input Costs Uptick in August

- U.S. Mortgage Credit Availability Upticks in August

- Monthly Property Foreclosure Activity Upticks in U.S.

- Greater Palm Beach Area Residential Sales Dip 5 Percent Annually in Mid-2023

- NAR Predicts Several U.S. Housing Market Outcomes

- Demand for U.S. Housing is Dropping as Prices Rise

- U.S. Homeowner Equity Decrease by $287 Billion Over the Last 12 Months

- 1 in 5 Millennials Think They'll Never Own a Home in America

- 1 in 8 San Francisco Home Sellers Is Losing Money at Closing in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More