The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Institutional Investment in Asia-Pacific Property Markets Spike 40 Percent

Commercial News » Hong Kong Edition | By Michael Gerrity | November 10, 2014 9:30 AM ET

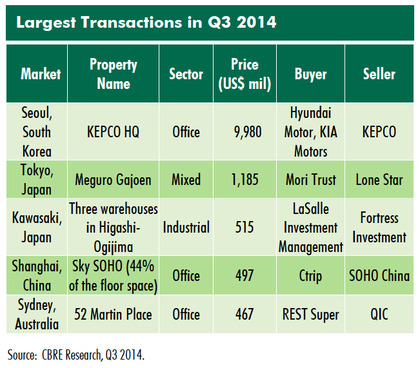

According to global real estate consultant CBRE, the third quarter of 2014 saw the completion of four large transactions worth over $500 million each, pushing up total real estate investment volume in Asia Pacific to $35 billion, an increase of 40% quarter-on-quarter. Particularly strong activity was recorded in South Korea, Japan and Australia. Cross-border investment activity in the region has remained lively and totaled $16 billion for the first nine months of 2014, an increase of 20% year-on-year.

CBRE's Managing Director of Capital Markets, Greg Penn commented, "Looking ahead, we expect to see an active market during the remainder of the year, with Japan and Australia showing a strong flow of deals. Investor sentiment is also increasing in emerging markets in Southeast Asia and India, particularly in Vietnam as their economy recovers and prices display growth. With India, we see that more foreign investors are taking an interest in the form of joint ventures with local groups. Business confidence has improved in India following the new election of a new government in May.

CBRE's Managing Director of Capital Markets, Greg Penn commented, "Looking ahead, we expect to see an active market during the remainder of the year, with Japan and Australia showing a strong flow of deals. Investor sentiment is also increasing in emerging markets in Southeast Asia and India, particularly in Vietnam as their economy recovers and prices display growth. With India, we see that more foreign investors are taking an interest in the form of joint ventures with local groups. Business confidence has improved in India following the new election of a new government in May.Meanwhile, Q3 saw newly formed private equity real estate funds turn more active in expanding their portfolio, with additional funds expected to complete their fund raising activity by year end. Several major deals are expected to be completed as international institutional investors continue to display a strong appetite for core assets."

Other key highlights include:

-

In Q3, South Korea saw the largest ever commercial real estate transaction in Asia Pacific--a $10 billion acquisition of the KEPCO headquarters in Seoul by Hyundai Motor Company and KIA Motors--pushing up the quarterly turnover to the highest level recorded since 2005. Excluding this deal, transaction volume was similar to that which was recorded in Q2.

In Q3, South Korea saw the largest ever commercial real estate transaction in Asia Pacific--a $10 billion acquisition of the KEPCO headquarters in Seoul by Hyundai Motor Company and KIA Motors--pushing up the quarterly turnover to the highest level recorded since 2005. Excluding this deal, transaction volume was similar to that which was recorded in Q2.

- Strong investment activity continued in Japan, where transaction volume rose significantly due to the large yield spread over the lending rate and fluid lending environment. Elsewhere, China's activity was driven by acquisitions by owner-occupiers and dispositions by property companies.

- Office leasing momentum is generally improving but occupiers remain cost conscious and core location demand is supported by flight-to-quality activity. The improving occupier market supported further growth in office prices this quarter. The CBRE Asia Pacific Office Capital Value Index increased by 1.7% quarter-on-quarter in Q3 2014, compared to a rise of 0.6% in Q2 2014. Price growth was led by Tokyo--up by 8.1% quarter-on-quarter--as well as growth being recorded in Australia and New Zealand.

- Australia and Japan recorded strong investment demand for retail assets, as both markets continued to see robust expansionary activity from international retailers. In Japan, investors are seeking opportunities in regional cities as retailers expand outside Tokyo. This pushed up the CBRE Asia Pacific Retail Capital Value Index by 1.9% quarter-on-quarter, a rise driven exclusively by Tokyo, Sydney and Melbourne. On the other hand, investor sentiment in Greater China and Singapore remains weak.

- Meanwhile, logistics remains a hot sector; transaction volume in this sector surged by 53% quarter-on-quarter to $4.8 billion in Q3 2014, which was mainly led by industrial-focused J-REITs expanding their portfolios through acquisitions in Japan.

Senior Director of CBRE Research, Ada Choi also commented, "Overall, investment activity will be supported by high liquidity, particularly in mature markets benefiting from low interest rates and increased leveraging. However, the current pricing is barely supported by the weak recovery in rental growth in some parts of the region.

Investors are now being more patient in searching for more viable investment opportunities. Besides core assets, investors are also looking more closely at secondary assets and value-added strategies, such as asset enhancement in order to capture upgrading occupier demand and higher expected return."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Investment in Asia Pacific Multifamily Properties to Double by 2030

- Multi-story Warehouses Are 15 Percent of Sydney's New Industrial Stock

- Manhattan Office Leasing Activity Lags in Q3 as Sentiment Remains Cautious

- Nonresidential Construction Spending Increases in America

- Office Conversions on Pace to Double in U.S.

- Hong Kong Office Vacancy Rates Stabilize After 4 Months of Increases

- Commercial Mortgage Debt Outstanding in U.S. Jumps to $4.60 Trillion in Mid 2023

- Architecture Billings Index in U.S. Remains Flat in July

- Commercial Mortgage Delinquencies Rise in America

- U.S. Data Center Demand Explodes in U.S., Driven by AI Growth in 2023

- Demand for Electric Vehicle Manufacturing Space Jumps Across the U.S.

- Global Cross Border Commercial Property Capital Flows Implode 52 Percent Annually in 2023

- 2023 Financing Constraints Rapidly Drive Down Construction Starts in U.S.

- New York City Named as U.S. Leader in Climate Change Resilience

- Tokyo is the City of Choice for Global Retailers in 2023

- Despite VC Cooldown, Life Sciences Represents 33 Percent of New Office Construction in 2023

- Despite Reduced Credit, U.S. Multifamily Developer Confidence Remained Positive in Q2

- Brisbane Office Market Enjoying Strong Leasing Activity in 2023

- Commercial Lending Dampened in 2023 by U.S. Market Uncertainty

- Asia Pacific's Commercial Investment Market Continues to be Challenged in 2023

- Despite Global Economic Uncertainty, Commercial Investment in Japan Grew in Q2

- U.S. Commercial Lending to Dive 38 Percent to $504 Billion in 2023

- Apartment Markets Across America Continue to Stabilize in 2023

- Cap Rates for Prime Multifamily Assets in U.S. Stabilize in Q2

- Ireland Office Market Making a Comeback in 2023

- U.S. Office Sales Total $15 Billion Halfway Through 2023

- AI and Streaming Drive Global Data Center Growth Despite Power Constraints

- Asia Pacific Logistics Users Plan to Expand Warehouse Portfolio in 2023

- Manhattan Retail Rents Continue to Rise in Q2

- Manhattan Office Leasing Activity Down 29 Percent Annually in Q2

- Commercial Property Investment in Australia Dives 50 Percent in 2023

- U.S. Architecture Billings Uptick in May

- Employees Return to Office Trend Growing in Asia Pacific Markets

- Exponential AI Growth to Drive Asia Pacific's Data Center Market

- Large Opportunity to Transform Australia's Office Market in Play

- Australian Industrial Rent Growth to Continue in 2023

- Corporate Relocations in U.S. at Highest Rate Since 2017

- North American Ports Volume Drops 20 Percent Annually in 2023

- Office Investment in Asia Pacific Remains Strong Despite Weaker Sentiment

- Australia's Build-to-Rent Properties Uptick on Lender's Wish List in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More