The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Hong Kong, Beijing Claim Four of Five Most Expensive Global Office Markets

Commercial News » Hong Kong Edition | By Michael Gerrity | December 28, 2015 9:31 AM ET

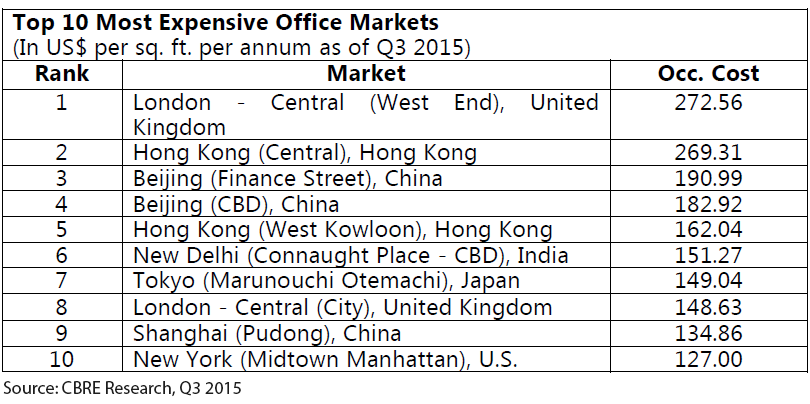

According to CBRE Research's semi-annual Global Prime Office Occupancy Costs Survey, London's West End was the world's highest-priced office market for the second straight year. Hong Kong and Beijing took four of the top five slots in the rankings with Hong Kong's Central, Beijing's Finance Street, Beijing's Central Business District (CBD), and Hong Kong's West Kowloon, rounding out the top four.

London's West End topped the 'most expensive' list, with overall prime occupancy costs of US$273 per sq. ft. per year. Hong Kong (Central) followed, with prime occupancy costs of US$269 per sq. ft. per year, Beijing (Finance Street) at US$191 per sq. ft. per year, Beijing (CBD) at US$183 per sq. ft. per year, and Hong Kong (West Kowloon) at US$162 per sq. ft. per year, rounded out the top five. In total, Asia Pacific was home to seven of the top ten most expensive markets globally.

Prime occupancy costs--which reflect rent, plus local taxes and service charges--increased at a 2.4% annual pace globally, as the world economy continued to gradually improve and the service sector, a key bellwether for prime office space, entered its fourth year of expansion, driving healthy demand for space in top-quality properties.

Prime occupancy costs in Asia Pacific increased by 1.9% year-over-year--from 1.4% in Q1 2015--compared to 3.1% growth in the Americas and 2.2% growth in EMEA.

"The global services sector has grown steadily for four years now, which helps to explain the general uplift in office rents and costs we are seeing worldwide," said Dr. Richard Barkham, Global Chief Economist, CBRE. "Despite the fact that some markets have been hit by the China oil and commodities slowdowns, we expect that most advanced economies will keep growing in 2016 and 2017, which combined with limited availability and relatively muted development levels, will result in moderate 2-3% cost increases."

Dr. Henry Chin, Head of Research, CBRE Asia Pacific, comments, "the TMT sector continues to drive office leasing demand in Asia Pacific, with healthy appetite for prime quality space in search for talents across the region. Domestic financial services companies will also remain the main drivers of leasing activity, although demand will likely moderate after several years of strong growth. Cost saving remains at the top of the occupier agenda with renewals being one of the main themes."

CBRE tracks occupancy costs for prime office space in 126 markets around the globe. Of the top 50 'most expensive' markets, Asia Pacific had the most number of markets featured, with 20 markets ranked.

Shanghai (Pudong) moved into the top ten, rising two places to the ninth spot. Despite the Chinese economic slowdown, demand from financial services firms for prime space in Pudong remains strong and supply remains limited.

"China, where the service sector is still expanding, looked relatively stable, with little change in prime costs in most Chinese markets. One of the goals of China's current economic policy is to expand the service sector--and there is evidence that this is already happening--a secular trend that should support office demand over the long term," adds Dr. Chin.

Hong Kong (Central) remained the only market in the world--other than London's West End--with a prime occupancy cost exceeding US$200 per sq. ft. per annum However, there is some evidence that overseas financial services companies are resistant to continued high costs and may be seeking alternatives to a Hong Kong location.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Investment in Asia Pacific Multifamily Properties to Double by 2030

- Multi-story Warehouses Are 15 Percent of Sydney's New Industrial Stock

- Manhattan Office Leasing Activity Lags in Q3 as Sentiment Remains Cautious

- Nonresidential Construction Spending Increases in America

- Office Conversions on Pace to Double in U.S.

- Hong Kong Office Vacancy Rates Stabilize After 4 Months of Increases

- Commercial Mortgage Debt Outstanding in U.S. Jumps to $4.60 Trillion in Mid 2023

- Architecture Billings Index in U.S. Remains Flat in July

- Commercial Mortgage Delinquencies Rise in America

- U.S. Data Center Demand Explodes in U.S., Driven by AI Growth in 2023

- Demand for Electric Vehicle Manufacturing Space Jumps Across the U.S.

- Global Cross Border Commercial Property Capital Flows Implode 52 Percent Annually in 2023

- 2023 Financing Constraints Rapidly Drive Down Construction Starts in U.S.

- New York City Named as U.S. Leader in Climate Change Resilience

- Tokyo is the City of Choice for Global Retailers in 2023

- Despite VC Cooldown, Life Sciences Represents 33 Percent of New Office Construction in 2023

- Despite Reduced Credit, U.S. Multifamily Developer Confidence Remained Positive in Q2

- Brisbane Office Market Enjoying Strong Leasing Activity in 2023

- Commercial Lending Dampened in 2023 by U.S. Market Uncertainty

- Asia Pacific's Commercial Investment Market Continues to be Challenged in 2023

- Despite Global Economic Uncertainty, Commercial Investment in Japan Grew in Q2

- U.S. Commercial Lending to Dive 38 Percent to $504 Billion in 2023

- Apartment Markets Across America Continue to Stabilize in 2023

- Cap Rates for Prime Multifamily Assets in U.S. Stabilize in Q2

- Ireland Office Market Making a Comeback in 2023

- U.S. Office Sales Total $15 Billion Halfway Through 2023

- AI and Streaming Drive Global Data Center Growth Despite Power Constraints

- Asia Pacific Logistics Users Plan to Expand Warehouse Portfolio in 2023

- Manhattan Retail Rents Continue to Rise in Q2

- Manhattan Office Leasing Activity Down 29 Percent Annually in Q2

- Commercial Property Investment in Australia Dives 50 Percent in 2023

- U.S. Architecture Billings Uptick in May

- Employees Return to Office Trend Growing in Asia Pacific Markets

- Exponential AI Growth to Drive Asia Pacific's Data Center Market

- Large Opportunity to Transform Australia's Office Market in Play

- Australian Industrial Rent Growth to Continue in 2023

- Corporate Relocations in U.S. at Highest Rate Since 2017

- North American Ports Volume Drops 20 Percent Annually in 2023

- Office Investment in Asia Pacific Remains Strong Despite Weaker Sentiment

- Australia's Build-to-Rent Properties Uptick on Lender's Wish List in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More