The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Industrial Sector Emerges as Oman's Top Commercial Market Performer

Commercial News » Oman Edition | By Michael Gerrity | April 30, 2015 9:18 AM ET

According to international real estate consultancy, Cluttons, Oman's continued investment in the development of infrastructure is aiding its transformation into a major logistics hub in the southern Gulf, and has been the main driver behind activity in the industrial property market during the first quarter of 2015.

Cluttons' Spring 2015 Muscat Commercial Property Outlook Report singles out the warehouse sector as being a stand out performer in the commercial market, with improved infrastructure and connectivity driving demand from occupiers, and catalyzing the development of modern warehouse estates.

Cluttons' Spring 2015 Muscat Commercial Property Outlook Report singles out the warehouse sector as being a stand out performer in the commercial market, with improved infrastructure and connectivity driving demand from occupiers, and catalyzing the development of modern warehouse estates. According to Philip Paul, head of Cluttons Oman, "We are recording an increase in warehouse developments coming to market to meet the current demand. In Rumais, which is located to the west of Muscat International Airport, First Logistic Services is developing warehousing units ranging in size from 500-1,000 sqm on an 81,000 sqm site. The first phase, comprising of 36 units is due to complete in May. The development is strategically positioned for occupants looking to service Muscat and interior markets in the wake of the closure of Port Sultan Qaboos.

"The developer is also offering "build to suit" opportunities within the second phase of the scheme in response to the success of the first phase, highlighting the depth of demand in the market."

The Cluttons report reveals that the country's various transport infrastructure project investments and upgrades are playing an important role in boosting connectivity across the country, which is subsequently improving Oman's attractiveness as a regional logistics and distribution centre.

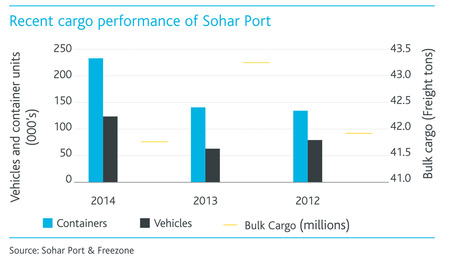

International research and business development manager at Cluttons, Faisal Durrani said, "Due to Oman's high scores for market connectedness and compatibility, the Sultanate has maintained its ranking of 13th in Agility's Emerging Markets Logistics Index for 2014 and this is reflected in the requirements we are currently receiving from shipping and logistics firms. At Sohar Port City for instance, these firms remain the most active group. The growing importance of Sohar Port is mirrored in the number of containers and vehicles handled by the port, which rose by 61% and 99% respectively during 2014."

Sohar's connectivity is also expected to be further bolstered by the Muscat to Barka section of the Batinah Expressway, which is due to open in June this year, while progress on Oman's rail network is gathering pace, with the construction contract expected to be awarded in mid-2015, covering the 207km stretch between Sohar and Buraimi.

Cluttons' report indicates that in the office market, rents across the main submarkets remained unchanged last year and during Q1 2015, marking the fifth consecutive quarter of rental stagnation.

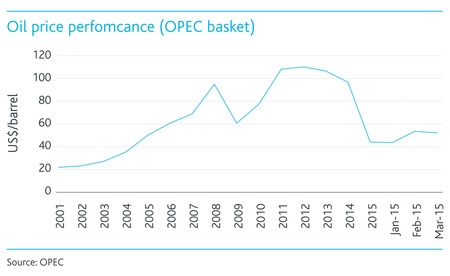

Durrani commented, "With the fall in oil prices, and hydrocarbon linked occupiers still forming the backbone of demand for office space, we are slowly starting to see this impact the rate of take up as global oil businesses assess their finances. We believe that take up activity may be subsequently impacted and is something we will be monitoring closely as the year progresses and the low oil price environment lingers."

Paul added, "Grade A rents however are still holding in the OMR 7-10 psm range across Muscat and occupiers remain focussed on this higher quality space, which is relatively limited. At Beach One for instance, we continue to record a high level of interest in the building, which has achieved over 85% occupancy.

Paul added, "Grade A rents however are still holding in the OMR 7-10 psm range across Muscat and occupiers remain focussed on this higher quality space, which is relatively limited. At Beach One for instance, we continue to record a high level of interest in the building, which has achieved over 85% occupancy."With the government's infrastructure investment program progressing to schedule, for this year at least, a number of construction and engineering firms continue to expand operations and enquire about space. We are also seeing landlords who adapt their properties to suit the demand of these occupiers, benefit across Muscat."

The prolonged strong demand for Grade A space has translated into the development of schemes designed to tap into this, with several high quality office buildings now on the verge of completion. These include the new Omnivest Building (OMR 12 psm) in Shatti Al Qurm, the Panorama Building (OMR 9 psm) in central Muscat and the Public Authority for Social Insurance (PASI) Building (OMR 9.5 psm). All of these schemes are due to complete shortly and have already attracted inquiries from technology-media-telecoms (TMT), financial services, construction and engineering firms.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Investment in Asia Pacific Multifamily Properties to Double by 2030

- Multi-story Warehouses Are 15 Percent of Sydney's New Industrial Stock

- Manhattan Office Leasing Activity Lags in Q3 as Sentiment Remains Cautious

- Nonresidential Construction Spending Increases in America

- Office Conversions on Pace to Double in U.S.

- Hong Kong Office Vacancy Rates Stabilize After 4 Months of Increases

- Commercial Mortgage Debt Outstanding in U.S. Jumps to $4.60 Trillion in Mid 2023

- Architecture Billings Index in U.S. Remains Flat in July

- Commercial Mortgage Delinquencies Rise in America

- U.S. Data Center Demand Explodes in U.S., Driven by AI Growth in 2023

- Demand for Electric Vehicle Manufacturing Space Jumps Across the U.S.

- Global Cross Border Commercial Property Capital Flows Implode 52 Percent Annually in 2023

- 2023 Financing Constraints Rapidly Drive Down Construction Starts in U.S.

- New York City Named as U.S. Leader in Climate Change Resilience

- Tokyo is the City of Choice for Global Retailers in 2023

- Despite VC Cooldown, Life Sciences Represents 33 Percent of New Office Construction in 2023

- Despite Reduced Credit, U.S. Multifamily Developer Confidence Remained Positive in Q2

- Brisbane Office Market Enjoying Strong Leasing Activity in 2023

- Commercial Lending Dampened in 2023 by U.S. Market Uncertainty

- Asia Pacific's Commercial Investment Market Continues to be Challenged in 2023

- Despite Global Economic Uncertainty, Commercial Investment in Japan Grew in Q2

- U.S. Commercial Lending to Dive 38 Percent to $504 Billion in 2023

- Apartment Markets Across America Continue to Stabilize in 2023

- Cap Rates for Prime Multifamily Assets in U.S. Stabilize in Q2

- Ireland Office Market Making a Comeback in 2023

- U.S. Office Sales Total $15 Billion Halfway Through 2023

- AI and Streaming Drive Global Data Center Growth Despite Power Constraints

- Asia Pacific Logistics Users Plan to Expand Warehouse Portfolio in 2023

- Manhattan Retail Rents Continue to Rise in Q2

- Manhattan Office Leasing Activity Down 29 Percent Annually in Q2

- Commercial Property Investment in Australia Dives 50 Percent in 2023

- U.S. Architecture Billings Uptick in May

- Employees Return to Office Trend Growing in Asia Pacific Markets

- Exponential AI Growth to Drive Asia Pacific's Data Center Market

- Large Opportunity to Transform Australia's Office Market in Play

- Australian Industrial Rent Growth to Continue in 2023

- Corporate Relocations in U.S. at Highest Rate Since 2017

- North American Ports Volume Drops 20 Percent Annually in 2023

- Office Investment in Asia Pacific Remains Strong Despite Weaker Sentiment

- Australia's Build-to-Rent Properties Uptick on Lender's Wish List in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More