The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Moscow Office Rents on the Rise

Commercial News » Moscow Edition | By Michael Gerrity | February 4, 2019 8:16 AM ET

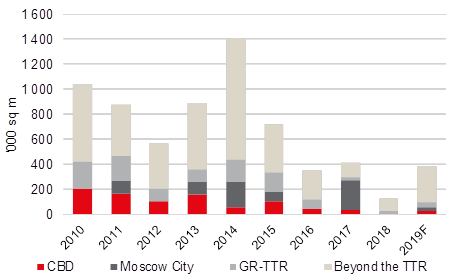

According to JLL, the overall office take-up in 2018 amounted to 1.39m sq. m, being flat year-over-year. Strong demand and low completions have led to growth of Class A and B+ rents, by 6.3% and 3.2% respectively over the course of last year.

In 2018, the decentralization of take-up continued due to the deficit of new supply in the Central business district (CBD). The share of non-central locations, beyond the TTR, in the take-up structure reached 46% in 2018 against 39% in 2017. The manufacturing and business service companies have taken the lead in the with 19% of take up each, after banks and finance organizations led the way a year ago. In 2018, companies of service industries were in second place, with 18%, and third were construction companies at 15% of take-up.

Take-up in the Moscow office market

The overall 2018 completions volume was a record low of 125,000 sq. m. The Class A share was 62% versus 63% in 2017. On the back of limited construction sites in the city centre, the development continues decentralizing further. As a result, the share of non-central completions was at 78% of overall volume. The largest projects delivered were Class A business centres, Amaltea at Skolkovo (30,900 sq. m), VTB Arena Park at Leningradsky Avenue (24,700 sq. m) and Novion near Olimpiysky Avenue (22,000 sq. m).

"In 2019, about 382,000 sq. m is announced to be completed. Despite the potential tripling of office completions, the supply stays limited," comments Elizaveta Golysheva, Head of Office Agency, JLL, Russia & CIS. - "About 2.1m sq. m of new office space is expected by 2022, with less than 7% of it expected in the CBD. Thus, the supply deficit will stay there in the future. Two office projects from AFI Development and second phase of Smolenskiy Passage by A.N.D. Corporation are among new projects in the CBD."

New supply in the Moscow office market

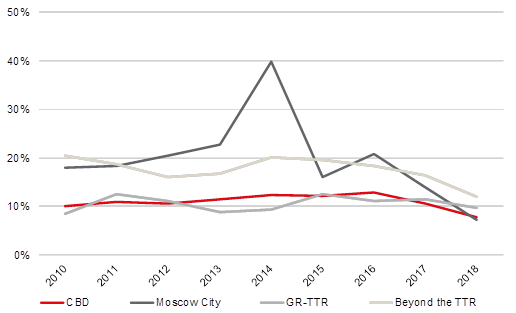

High take-up coupled with low completions stimulated the vacancy rate reduction in all classes and submarkets. The largest decrease was observed in Class A, by 5.6ppt YoY to 10.8%. Class B+ vacancy reduced by 2.7ppt YoY to 10.8%, Class B- indicator declined by 3.3ppt YoY to 8.8%. The lowest level of vacancy rate among submarkets was registered in Moscow City, a 7.3% (declined by 6.6ppt YoY). The second place has been taken by the CBD, where the vacancy was at 7.8%, 2.9ppt decrease YoY. The average vacancy reached ten-year lowest level of 10.3%, down 3.5ppt YoY.

Vacancy by submarkets

The shortage of large office blocks availability in the city centre and the Moscow City district has let some landlords to increase asking rents in their buildings, resulting in the market average rent increase. The Class A average rent increased by 6.3% YoY to RUB22,700/sq. m/year, the Class B+ by 3.2% to RUB17,000/sq. m/year (excluding operating expenses and VAT). Prime rent remained at USD750/sq. m/year. The highest Class A rent increase in 2018 was observed in the Moscow City (+16.4%). The CBD Class A rent increased by 4.4% YoY.

"The new supply growth and stable take-up at about 1.4m sq. m is expected in 2019," says Olesya Dzuba, Head of Research, JLL, Russia & CIS. - "Unlike 2017, when market saw huge lease and sale deals done by banks and government companies, there were almost no such transactions in 2018. This indicates the recovery of the take-up in the Moscow office market. At the same time, companies do not expand their offices but try to optimize office costs, as well as space utilization. Some companies already use new ways of working, like flexible space in their own offices or external locations."

In 2018, the decentralization of take-up continued due to the deficit of new supply in the Central business district (CBD). The share of non-central locations, beyond the TTR, in the take-up structure reached 46% in 2018 against 39% in 2017. The manufacturing and business service companies have taken the lead in the with 19% of take up each, after banks and finance organizations led the way a year ago. In 2018, companies of service industries were in second place, with 18%, and third were construction companies at 15% of take-up.

Take-up in the Moscow office market

The overall 2018 completions volume was a record low of 125,000 sq. m. The Class A share was 62% versus 63% in 2017. On the back of limited construction sites in the city centre, the development continues decentralizing further. As a result, the share of non-central completions was at 78% of overall volume. The largest projects delivered were Class A business centres, Amaltea at Skolkovo (30,900 sq. m), VTB Arena Park at Leningradsky Avenue (24,700 sq. m) and Novion near Olimpiysky Avenue (22,000 sq. m).

"In 2019, about 382,000 sq. m is announced to be completed. Despite the potential tripling of office completions, the supply stays limited," comments Elizaveta Golysheva, Head of Office Agency, JLL, Russia & CIS. - "About 2.1m sq. m of new office space is expected by 2022, with less than 7% of it expected in the CBD. Thus, the supply deficit will stay there in the future. Two office projects from AFI Development and second phase of Smolenskiy Passage by A.N.D. Corporation are among new projects in the CBD."

New supply in the Moscow office market

High take-up coupled with low completions stimulated the vacancy rate reduction in all classes and submarkets. The largest decrease was observed in Class A, by 5.6ppt YoY to 10.8%. Class B+ vacancy reduced by 2.7ppt YoY to 10.8%, Class B- indicator declined by 3.3ppt YoY to 8.8%. The lowest level of vacancy rate among submarkets was registered in Moscow City, a 7.3% (declined by 6.6ppt YoY). The second place has been taken by the CBD, where the vacancy was at 7.8%, 2.9ppt decrease YoY. The average vacancy reached ten-year lowest level of 10.3%, down 3.5ppt YoY.

Vacancy by submarkets

The shortage of large office blocks availability in the city centre and the Moscow City district has let some landlords to increase asking rents in their buildings, resulting in the market average rent increase. The Class A average rent increased by 6.3% YoY to RUB22,700/sq. m/year, the Class B+ by 3.2% to RUB17,000/sq. m/year (excluding operating expenses and VAT). Prime rent remained at USD750/sq. m/year. The highest Class A rent increase in 2018 was observed in the Moscow City (+16.4%). The CBD Class A rent increased by 4.4% YoY.

"The new supply growth and stable take-up at about 1.4m sq. m is expected in 2019," says Olesya Dzuba, Head of Research, JLL, Russia & CIS. - "Unlike 2017, when market saw huge lease and sale deals done by banks and government companies, there were almost no such transactions in 2018. This indicates the recovery of the take-up in the Moscow office market. At the same time, companies do not expand their offices but try to optimize office costs, as well as space utilization. Some companies already use new ways of working, like flexible space in their own offices or external locations."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Investment in Asia Pacific Multifamily Properties to Double by 2030

- Multi-story Warehouses Are 15 Percent of Sydney's New Industrial Stock

- Manhattan Office Leasing Activity Lags in Q3 as Sentiment Remains Cautious

- Nonresidential Construction Spending Increases in America

- Office Conversions on Pace to Double in U.S.

- Hong Kong Office Vacancy Rates Stabilize After 4 Months of Increases

- Commercial Mortgage Debt Outstanding in U.S. Jumps to $4.60 Trillion in Mid 2023

- Architecture Billings Index in U.S. Remains Flat in July

- Commercial Mortgage Delinquencies Rise in America

- U.S. Data Center Demand Explodes in U.S., Driven by AI Growth in 2023

- Demand for Electric Vehicle Manufacturing Space Jumps Across the U.S.

- Global Cross Border Commercial Property Capital Flows Implode 52 Percent Annually in 2023

- 2023 Financing Constraints Rapidly Drive Down Construction Starts in U.S.

- New York City Named as U.S. Leader in Climate Change Resilience

- Tokyo is the City of Choice for Global Retailers in 2023

- Despite VC Cooldown, Life Sciences Represents 33 Percent of New Office Construction in 2023

- Despite Reduced Credit, U.S. Multifamily Developer Confidence Remained Positive in Q2

- Brisbane Office Market Enjoying Strong Leasing Activity in 2023

- Commercial Lending Dampened in 2023 by U.S. Market Uncertainty

- Asia Pacific's Commercial Investment Market Continues to be Challenged in 2023

- Despite Global Economic Uncertainty, Commercial Investment in Japan Grew in Q2

- U.S. Commercial Lending to Dive 38 Percent to $504 Billion in 2023

- Apartment Markets Across America Continue to Stabilize in 2023

- Cap Rates for Prime Multifamily Assets in U.S. Stabilize in Q2

- Ireland Office Market Making a Comeback in 2023

- U.S. Office Sales Total $15 Billion Halfway Through 2023

- AI and Streaming Drive Global Data Center Growth Despite Power Constraints

- Asia Pacific Logistics Users Plan to Expand Warehouse Portfolio in 2023

- Manhattan Retail Rents Continue to Rise in Q2

- Manhattan Office Leasing Activity Down 29 Percent Annually in Q2

- Commercial Property Investment in Australia Dives 50 Percent in 2023

- U.S. Architecture Billings Uptick in May

- Employees Return to Office Trend Growing in Asia Pacific Markets

- Exponential AI Growth to Drive Asia Pacific's Data Center Market

- Large Opportunity to Transform Australia's Office Market in Play

- Australian Industrial Rent Growth to Continue in 2023

- Corporate Relocations in U.S. at Highest Rate Since 2017

- North American Ports Volume Drops 20 Percent Annually in 2023

- Office Investment in Asia Pacific Remains Strong Despite Weaker Sentiment

- Australia's Build-to-Rent Properties Uptick on Lender's Wish List in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More

-thumb-483x288-29559.png)