The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Vacancy Rates in Moscow's Office Market Enjoy 10-Year Low

Commercial News » Moscow Edition | By Michael Gerrity | August 1, 2018 8:15 AM ET

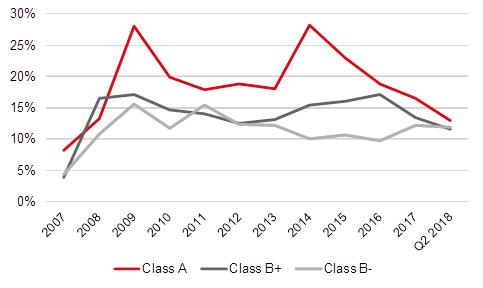

According to JLL, the vacancy rate of Moscow's office market continued to decline in Q2, 2018 amid low completions and rising take-up. The current vacancy, at 12.0%, is the lowest since Q3 2008. The decline began in Q3 2015 when it was 17%. A year ago, the vacancy rate was 16.3%, and 13.1% in Q1.

In Moscow, the vacancy rate was declining since Q3 2015 when the vacancy was 17%. A year ago, the vacancy rate was 16.3%, in Q1 it was 13.1% already.

Lower vacancy rate was recorded in all classes. In H1 2018, the Class A vacancy rate declined to 12.9%, Class B+ to 11.6%, Class B- to 11.9%.

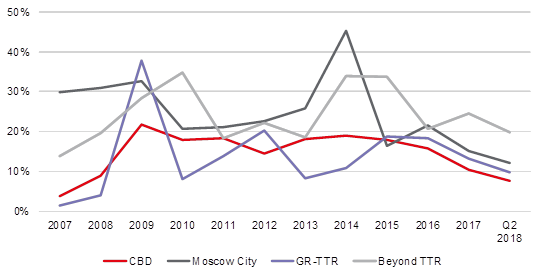

Geographically, the vacancy rate diminished strongly in key Moscow submarkets over the last year, by 6 ppt to 11.4% in the Moscow City and by 4.4 ppt to 8.9% in the Central Business District.

"The vacancy rate in the city centre reached the ten-year minimum, at 7.7% for both Class A and B+ premises there. The Central Business District net absorption was at 75,000 sq. meters in H1 2018, in H1 2017 it was negative," comments Elizaveta Golysheva, Head of Office Agency, JLL, Russia & CIS. "The key deal was Aeroflot in the Arbat 1 business centre. Moreover, vacancy rates in such centres like Legend or Paveletskaya Tower diminished strongly. Considering the high demand and the lack of completions in the Central Business District, the vacancy rate there will continue to decline. Therefore, we expect the CBD to transition into a landlord market in H2 2018."

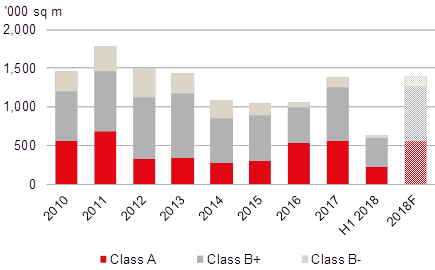

In Q2 2018, only 2,300 sq. meters were delivered to the market. The single business centre completed, Nikolin Park, a part of a residential complex, was located beyond MKAD on Kaluzhskoe Highway.

"In line with recent construction delays, a part of planned H1 completions was postponed to H2 or later," says Alexander Bazhenov, Office Market Analyst, JLL. "The overall H1 2018 completions were only 39,000 sq. meters, although 86% higher YoY. The delays resulted in the downgrade of overall 2018 expected completions to 217,000 sq. meters."

At the same time, the take-up has grown, reaching 633,00 sq m in H1 2018, up 41% YoY. The most significant increase, 48% YoY, was recorded in Class A, to 220,000 sq. meters. The bulk of leased and purchased space was beyond the Third Transport Ring, 46% versus 35% a year ago. Such dynamics shows the current trend of the Moscow market, when companies prefer to occupy quality buildings outside the Central Business District, which is primarily due to the shortage of large Class A premises in the CBD.

Prime office asking rents were USD600-750 sq. meter, Class A rental rates were RUB24,000-40,000 sq m/year. Class B+ rents were RUB12,000-25,000 sq. meter/year. JLL analysts expect rental growth in H2 2018.

In Moscow, the vacancy rate was declining since Q3 2015 when the vacancy was 17%. A year ago, the vacancy rate was 16.3%, in Q1 it was 13.1% already.

Lower vacancy rate was recorded in all classes. In H1 2018, the Class A vacancy rate declined to 12.9%, Class B+ to 11.6%, Class B- to 11.9%.

Geographically, the vacancy rate diminished strongly in key Moscow submarkets over the last year, by 6 ppt to 11.4% in the Moscow City and by 4.4 ppt to 8.9% in the Central Business District.

"The vacancy rate in the city centre reached the ten-year minimum, at 7.7% for both Class A and B+ premises there. The Central Business District net absorption was at 75,000 sq. meters in H1 2018, in H1 2017 it was negative," comments Elizaveta Golysheva, Head of Office Agency, JLL, Russia & CIS. "The key deal was Aeroflot in the Arbat 1 business centre. Moreover, vacancy rates in such centres like Legend or Paveletskaya Tower diminished strongly. Considering the high demand and the lack of completions in the Central Business District, the vacancy rate there will continue to decline. Therefore, we expect the CBD to transition into a landlord market in H2 2018."

In Q2 2018, only 2,300 sq. meters were delivered to the market. The single business centre completed, Nikolin Park, a part of a residential complex, was located beyond MKAD on Kaluzhskoe Highway.

"In line with recent construction delays, a part of planned H1 completions was postponed to H2 or later," says Alexander Bazhenov, Office Market Analyst, JLL. "The overall H1 2018 completions were only 39,000 sq. meters, although 86% higher YoY. The delays resulted in the downgrade of overall 2018 expected completions to 217,000 sq. meters."

At the same time, the take-up has grown, reaching 633,00 sq m in H1 2018, up 41% YoY. The most significant increase, 48% YoY, was recorded in Class A, to 220,000 sq. meters. The bulk of leased and purchased space was beyond the Third Transport Ring, 46% versus 35% a year ago. Such dynamics shows the current trend of the Moscow market, when companies prefer to occupy quality buildings outside the Central Business District, which is primarily due to the shortage of large Class A premises in the CBD.

Prime office asking rents were USD600-750 sq. meter, Class A rental rates were RUB24,000-40,000 sq m/year. Class B+ rents were RUB12,000-25,000 sq. meter/year. JLL analysts expect rental growth in H2 2018.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Investment in Asia Pacific Multifamily Properties to Double by 2030

- Multi-story Warehouses Are 15 Percent of Sydney's New Industrial Stock

- Manhattan Office Leasing Activity Lags in Q3 as Sentiment Remains Cautious

- Nonresidential Construction Spending Increases in America

- Office Conversions on Pace to Double in U.S.

- Hong Kong Office Vacancy Rates Stabilize After 4 Months of Increases

- Commercial Mortgage Debt Outstanding in U.S. Jumps to $4.60 Trillion in Mid 2023

- Architecture Billings Index in U.S. Remains Flat in July

- Commercial Mortgage Delinquencies Rise in America

- U.S. Data Center Demand Explodes in U.S., Driven by AI Growth in 2023

- Demand for Electric Vehicle Manufacturing Space Jumps Across the U.S.

- Global Cross Border Commercial Property Capital Flows Implode 52 Percent Annually in 2023

- 2023 Financing Constraints Rapidly Drive Down Construction Starts in U.S.

- New York City Named as U.S. Leader in Climate Change Resilience

- Tokyo is the City of Choice for Global Retailers in 2023

- Despite VC Cooldown, Life Sciences Represents 33 Percent of New Office Construction in 2023

- Despite Reduced Credit, U.S. Multifamily Developer Confidence Remained Positive in Q2

- Brisbane Office Market Enjoying Strong Leasing Activity in 2023

- Commercial Lending Dampened in 2023 by U.S. Market Uncertainty

- Asia Pacific's Commercial Investment Market Continues to be Challenged in 2023

- Despite Global Economic Uncertainty, Commercial Investment in Japan Grew in Q2

- U.S. Commercial Lending to Dive 38 Percent to $504 Billion in 2023

- Apartment Markets Across America Continue to Stabilize in 2023

- Cap Rates for Prime Multifamily Assets in U.S. Stabilize in Q2

- Ireland Office Market Making a Comeback in 2023

- U.S. Office Sales Total $15 Billion Halfway Through 2023

- AI and Streaming Drive Global Data Center Growth Despite Power Constraints

- Asia Pacific Logistics Users Plan to Expand Warehouse Portfolio in 2023

- Manhattan Retail Rents Continue to Rise in Q2

- Manhattan Office Leasing Activity Down 29 Percent Annually in Q2

- Commercial Property Investment in Australia Dives 50 Percent in 2023

- U.S. Architecture Billings Uptick in May

- Employees Return to Office Trend Growing in Asia Pacific Markets

- Exponential AI Growth to Drive Asia Pacific's Data Center Market

- Large Opportunity to Transform Australia's Office Market in Play

- Australian Industrial Rent Growth to Continue in 2023

- Corporate Relocations in U.S. at Highest Rate Since 2017

- North American Ports Volume Drops 20 Percent Annually in 2023

- Office Investment in Asia Pacific Remains Strong Despite Weaker Sentiment

- Australia's Build-to-Rent Properties Uptick on Lender's Wish List in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More