The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Singapore Home Buyer Sentiment Affected by Government Cooling Measures

Residential News » Singapore Edition | By Michael Gerrity | December 5, 2018 9:12 AM ET

Overall sales volume improved due to frantic buying specifically on July 5th

According to Singapore-based real estate consulting firm Edmund Tie & Company, Singapore's private residential market was affected by the latest round of Government cooling measures, which was announced on July 5th, 2018 and took effect on July 6th.

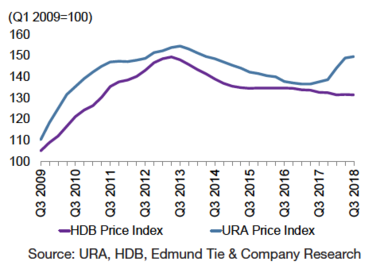

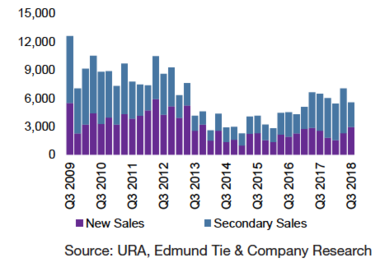

According to Singapore-based real estate consulting firm Edmund Tie & Company, Singapore's private residential market was affected by the latest round of Government cooling measures, which was announced on July 5th, 2018 and took effect on July 6th.Edmund Tie & Company further reports that after a surge in sales volume of private residential properties in Q2 2018, there was a quarter-over-quarter decline of 21.0 per cent to 5,569 units for the secondary sales in Q3. This can be attributed to the implementation of new cooling measures, resulting in buyers being more cautious.

Despite the decline in total sales volume, new sales increased from 2,302 units in Q2 to 2,960 units in Q3. This was mainly due to the frantic buying of homebuyers on the evening of 5 July, where developments such as Riverfront Residences, Stirling Residences and Park Colonial were launched.

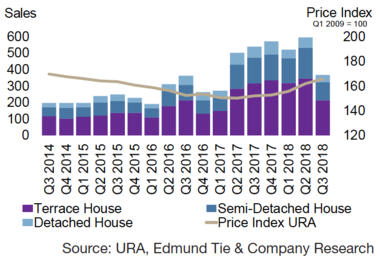

Effects of the cooling measures were felt for landed homes in the secondary market as well, as sales volume declined significantly by 38.4 per cent q-o-q and 31.9 per cent y-o-y to 368 units in Q3 2018. This may be due to the higher price quantum of landed properties, in comparison to non-landed homes, resulting in homebuyers being even more cautious. As such, price growth slowed down, with the URA landed price index increasing by 2.3 per cent q-o-q in Q3, compared to the 4.1 per cent in Q2. In the secondary market, newly completed developments were favored by buyers. Out of the top five selling projects in the resale market, three developments were completed after 2017. Additionally, due to price sensitive buyers, leasehold developments in the suburban areas were preferred for the irrelatively lower prices.

Effects of the cooling measures were felt for landed homes in the secondary market as well, as sales volume declined significantly by 38.4 per cent q-o-q and 31.9 per cent y-o-y to 368 units in Q3 2018. This may be due to the higher price quantum of landed properties, in comparison to non-landed homes, resulting in homebuyers being even more cautious. As such, price growth slowed down, with the URA landed price index increasing by 2.3 per cent q-o-q in Q3, compared to the 4.1 per cent in Q2. In the secondary market, newly completed developments were favored by buyers. Out of the top five selling projects in the resale market, three developments were completed after 2017. Additionally, due to price sensitive buyers, leasehold developments in the suburban areas were preferred for the irrelatively lower prices. The increase in Additional Buyer's Stamp Duties (ABSD) and tightening of loan-to-value (LTV) limits acted as a deterrent to Singapore Permanent Residents (SPRs) and Non-Permanent Residents (NPRs), as home purchases by them reduced by 26.4 per cent and 17.9 per cent q-o-q to 754 and 307 units respectively. In terms of housing preferences, projects that were popular among Singaporeans were also favored by SPRs. These projects include Riverfront Residences, Stirling Residences, Park Colonial and Jadescape, which were among the new launches in Q3. The NPRs favored developments that are either in prime areas or near to the Central Business District (CBD), with Marina One and Martin Modern being in the top five selling projects for NPRs.

The increase in Additional Buyer's Stamp Duties (ABSD) and tightening of loan-to-value (LTV) limits acted as a deterrent to Singapore Permanent Residents (SPRs) and Non-Permanent Residents (NPRs), as home purchases by them reduced by 26.4 per cent and 17.9 per cent q-o-q to 754 and 307 units respectively. In terms of housing preferences, projects that were popular among Singaporeans were also favored by SPRs. These projects include Riverfront Residences, Stirling Residences, Park Colonial and Jadescape, which were among the new launches in Q3. The NPRs favored developments that are either in prime areas or near to the Central Business District (CBD), with Marina One and Martin Modern being in the top five selling projects for NPRs.Out of the four major foreign nationalities of non-landed homebuyers, the cooling measures deterred Indian nationals the most. Their purchases declined by 49.2 per cent q-o-q to 61 units in Q3. Acquisitions by Mainland Chinese nationals fell by 37.6 per cent q-o-q to 291 units while that of Malaysian buyers decreased by 28.1 per cent q-o-q to 197 units. Due to the cooling measures, foreign buyers have become even more price-conscious in their purchases.

Chief Executive Officer, Ong Choon Fah tells The World Property Journal, "Despite the recent measures, the residential market remains attractive as Singapore continues to be a gateway to the fast developing ASEAN region and Asia. While sales momentum has slowed in the secondary market, developer sales continue to be encouraging. The measures have signaled to stakeholders that the residential market will continue to be supported by fundamentals, attracting buyers taking a longer-term perspective.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Orlando's Housing Market Continues to Slow Down This Fall

- U.S. Mortgage Originations Predicted to Hit $1.95 Trillion in 2024

- Construction Input Costs in America Uptick in September

- Global Home Price Growth Further Slows in Mid-2023

- Home Values in U.S. Begin to Slip Late Summer

- Foreclosure Filings in U.S. Spike 34 Percent Annually in Q3

- U.S. Mortgage Credit Availability Upticks in September

- Retail Market is a Bright Spot for Manhattan Real Estate

- Residential Rents in U.S. Dip in September Amid Growing Apartment Supply

- U.S. Mortgage Rates Continue to Surge in October

- Greater Las Vegas Home Sales Down 10 Percent Annually in September

- Most U.S. Homebuyers Say Buying a Home is More Stressful Than Dating in 2023

- Mortgage Applications Dive 6 Percent Last Week in America

- Despite Peak Interest Rates, Global Housing Markets Improved in Q2

- U.S. Architecture Billings Index Reports Softening Business Conditions in August

- U.S. Home Price Growth Pace Upticks Again in August

- 10,000 Residential Properties Have Negative Equity in Hong Kong

- U.S. Pending Home Sales Dropped 7.1 Percent in August

- U.S. Mortgage Rates Reach Highest Level in 23 Years

- American Bankers See Weakening Credit Conditions Through End of 2024

- Palm Beach Area Residential Sales Uptick in August

- Driven by High Mortgage Rates, Pending Home Sales Drop 13% Annually in September

- Miami Area Residential Sales Slip 13 Percent Annually in August

- U.S. Home Sales Dip 15 Percent Annually in August

- Home Flipping Transactions Down in 2023, Profits Up

- U.S. Listings Inventory Rises 4 Percent in August

- The Fed Leaves Rates Alone for Now in September

- Mortgage Applications Uptick in U.S. Amid High Rates

- Single Family Rent Growth in U.S. Drops to 3-Year Low in July

- Greater Orlando Area Home Sales Down 16 Percent Annually in August

- Home Purchase Cancellations Accelerating in the U.S.

- U.S. Construction Input Costs Uptick in August

- U.S. Mortgage Credit Availability Upticks in August

- Monthly Property Foreclosure Activity Upticks in U.S.

- Greater Palm Beach Area Residential Sales Dip 5 Percent Annually in Mid-2023

- NAR Predicts Several U.S. Housing Market Outcomes

- Demand for U.S. Housing is Dropping as Prices Rise

- U.S. Homeowner Equity Decrease by $287 Billion Over the Last 12 Months

- 1 in 5 Millennials Think They'll Never Own a Home in America

- 1 in 8 San Francisco Home Sellers Is Losing Money at Closing in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More