The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Coming Integrated ASEAN Economic Zone to Boost Local Property Sectors

Commercial News » Singapore Edition | By Miho Favela | September 15, 2015 9:00 AM ET

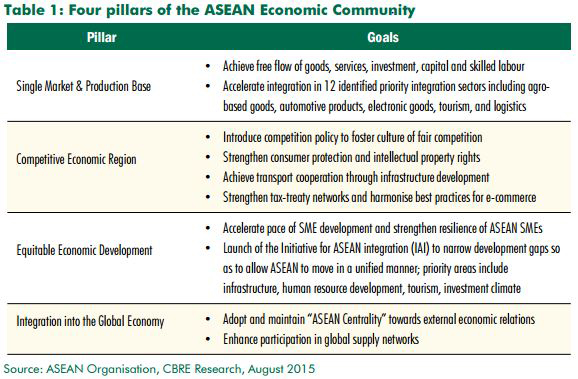

The establishment of the Association of South East Nations (ASEAN) as a single economic market by the end of 2015 will immediately benefit the industrial sectors of member countries, with some positive spill over for local office and retail property markets.

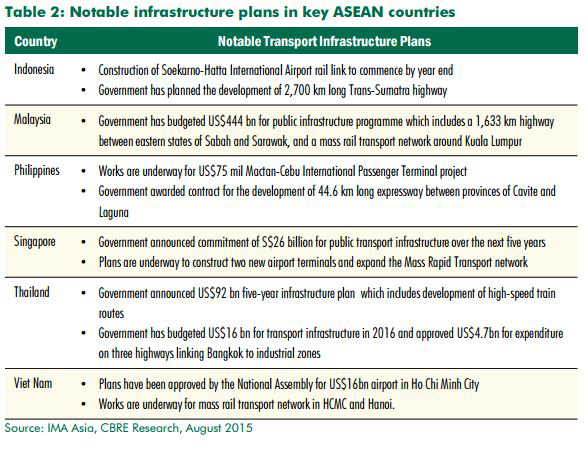

According to CBRE's new report - ASEAN Economic Community - A Boost to South East Asia's Real Estate Market - expects a ramp-up in the demand and supply of industrial and office space in most ASEAN markets in the short to medium term as more Small and Medium Enterprises (SMEs) and MNCs establish themselves in the region. In particular, the logistics market is expected to grow and develop in ASEAN given the strong emphasis under the AEC blueprint for infrastructure development and the gradual elimination of Non-Tariff Barriers across member countries.

The lift in the industrial market will in turn bolster the growth in office demand too as more MNCs enter the market and more regional SMEs expand. In particular, the financial and legal services sectors in emerging markets could grow on the back of rising infrastructure development and the proposed liberalization of the region's capital markets. More foreign retailers are also projected to venture into ASEAN, building on the momentum they have charted in the last few years. Tourism is a bright spot for ASEAN member countries as the AEC blueprint focuses on enhancing air and land transport infrastructure and regional cooperation to attract more visitors to the region.

ASEAN member countries include Singapore, Thailand, Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines and Vietnam

Desmond Sim, Head of CBRE Research, Singapore and South East Asia says, "while there exist hurdles and limitations that ASEAN needs to overcome, the region is still anticipated to remain an attractive proposition for businesses and commercial real estate with the implementation of the AEC serving to strengthen ASEAN's development".

The impediments to growth are varied. The report cites the possibility of an ill-managed institutional supply pipeline, which may result in volatility in retail rents. This could delay or even deter retailers from expanding. The undersupply of skilled labor also poses a challenge for the office and industrial sectors in the short to medium term, which might in turn hamper the expansion of high-value industrial manufacturers. The disparity in the skill sets between countries also limits the positive effects of the proposed free flow of skilled labour within ASEAN.

Another limiting factor would be the lack of complementary real estate investment policies to promote the liberalization of investment policies and free flow of capital. Often, real estate investors are deterred by restrictions on foreign land ownership and the short duration of leases. A pro-investment environment will be required to encourage further inflow of Foreign Direct Investments and improve the overall development process in ASEAN. Thus, a review of the individual country's land ownership policy for acquisition purposes may be necessary to allow more foreigners to participate in real estate development.

Still, market observers remain optimistic about the real estate capital inflows, going by the strong track record the ASEAN community has charted in the last decade. Real estate investments in the ASEAN region recorded a total of $28.190 billion in capital inflow between 2005 and 2014. For the last five years from 2010 to 2014, China reigned as the top investor in the ASEAN market at 29% of total investment volume, which amounted to $4.423 billion of Chinese capital. This was followed closely by Singapore in second position, with a value of $4.268 billion, which made up 28% of total investment in that period. In tandem with the increase in cross-border investments into the ASEAN market, there is a prominent shift in global capital distribution across all ASEAN countries in recent years.

"The ASEAN Economic Community has played a key role to liberalize the investment markets in ASEAN to pave the way for foreign investments within individual member states. The diversity in the development of the real estate markets in ASEAN provides investors a broader investible universe for their investment strategies. More developed markets such as Singapore and Malaysia could offer investors a 'core' or 'value-added' investment profile while 'opportunistic' investments could be sourced from emerging markets such as Vietnam and Philippines. Investments into ASEAN real estate market is thus expected to grow as investors seek alternative markets for their real estate portfolios," Mr. Sim added.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Investment in Asia Pacific Multifamily Properties to Double by 2030

- Multi-story Warehouses Are 15 Percent of Sydney's New Industrial Stock

- Manhattan Office Leasing Activity Lags in Q3 as Sentiment Remains Cautious

- Nonresidential Construction Spending Increases in America

- Office Conversions on Pace to Double in U.S.

- Hong Kong Office Vacancy Rates Stabilize After 4 Months of Increases

- Commercial Mortgage Debt Outstanding in U.S. Jumps to $4.60 Trillion in Mid 2023

- Architecture Billings Index in U.S. Remains Flat in July

- Commercial Mortgage Delinquencies Rise in America

- U.S. Data Center Demand Explodes in U.S., Driven by AI Growth in 2023

- Demand for Electric Vehicle Manufacturing Space Jumps Across the U.S.

- Global Cross Border Commercial Property Capital Flows Implode 52 Percent Annually in 2023

- 2023 Financing Constraints Rapidly Drive Down Construction Starts in U.S.

- New York City Named as U.S. Leader in Climate Change Resilience

- Tokyo is the City of Choice for Global Retailers in 2023

- Despite VC Cooldown, Life Sciences Represents 33 Percent of New Office Construction in 2023

- Despite Reduced Credit, U.S. Multifamily Developer Confidence Remained Positive in Q2

- Brisbane Office Market Enjoying Strong Leasing Activity in 2023

- Commercial Lending Dampened in 2023 by U.S. Market Uncertainty

- Asia Pacific's Commercial Investment Market Continues to be Challenged in 2023

- Despite Global Economic Uncertainty, Commercial Investment in Japan Grew in Q2

- U.S. Commercial Lending to Dive 38 Percent to $504 Billion in 2023

- Apartment Markets Across America Continue to Stabilize in 2023

- Cap Rates for Prime Multifamily Assets in U.S. Stabilize in Q2

- Ireland Office Market Making a Comeback in 2023

- U.S. Office Sales Total $15 Billion Halfway Through 2023

- AI and Streaming Drive Global Data Center Growth Despite Power Constraints

- Asia Pacific Logistics Users Plan to Expand Warehouse Portfolio in 2023

- Manhattan Retail Rents Continue to Rise in Q2

- Manhattan Office Leasing Activity Down 29 Percent Annually in Q2

- Commercial Property Investment in Australia Dives 50 Percent in 2023

- U.S. Architecture Billings Uptick in May

- Employees Return to Office Trend Growing in Asia Pacific Markets

- Exponential AI Growth to Drive Asia Pacific's Data Center Market

- Large Opportunity to Transform Australia's Office Market in Play

- Australian Industrial Rent Growth to Continue in 2023

- Corporate Relocations in U.S. at Highest Rate Since 2017

- North American Ports Volume Drops 20 Percent Annually in 2023

- Office Investment in Asia Pacific Remains Strong Despite Weaker Sentiment

- Australia's Build-to-Rent Properties Uptick on Lender's Wish List in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More