The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Growing Demand for Commercial Space in Sharjah Continues

Commercial News » Sharjah Edition | By Michael Gerrity | November 24, 2014 8:27 AM ET

According to Cluttons, the ongoing diversification and growth of Sharjah's economy, as well as a limited supply pipeline of Grade A office space, is set to positively impact on rents in the emirate's commercial property market.

Cluttons' Sharjah Winter 2014 Commercial Market Outlook report, reveals that occupiers are focused on Grade A space, similar to other emirates in the UAE. Furthermore, with Sharjah's general economic restructuring now starting to bear fruit, the demand for top quality office space by occupiers continues to rise, and is focused on Grade A space.

The report also highlights that this trend is expected to drive Grade A space take up, against a backdrop of low levels of Grade A stock. In the short term, while supply levels play catch up to an extent, office rents at the top end of the market are expected to come under increased upwards pressure. This will leave incumbent occupiers with little choice, but to absorb the higher costs, or seek alternative options.

The report also highlights that this trend is expected to drive Grade A space take up, against a backdrop of low levels of Grade A stock. In the short term, while supply levels play catch up to an extent, office rents at the top end of the market are expected to come under increased upwards pressure. This will leave incumbent occupiers with little choice, but to absorb the higher costs, or seek alternative options.According to Cluttons' Chief Executive of the Middle East Steve Morgan, "The shortage of Grade A space and capital expenditure associated with any potential move, will mean that larger occupiers will be either unwilling, or unable to relocate and are likely to absorb any rent hikes. We anticipate that smaller occupiers will be more flexible due to their cost conscious behavior."

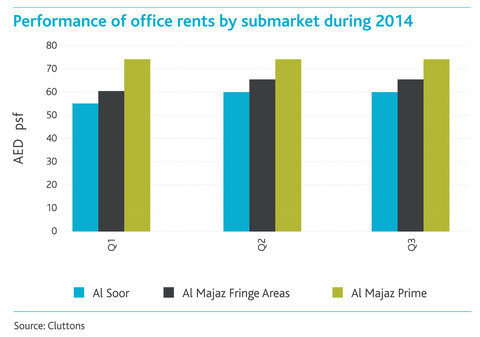

The report shows that, during Q3 2014, rents across Sharjah's main office markets held steady, with the prime areas of Al Majaz retaining their position as the city's most expensive area for office space, with rents remaining stable at AED 75 psf. These flat rents are attributed to the sudden drop in rental rates across some Grade A buildings in the area.

Morgan continued, "This drop in rental rates has been recorded in schemes where landlords, who were previously reluctant to lower rents, are now being forced to reassess their options due to prolonged void periods. This behavior has started to undermine rents in the prime areas of Al Majaz, which is being further exacerbated by landlords attempting to undercut one another in an attempt to drive take up."

Industrial

Elsewhere in the commercial sector, with both economic activity and the population continuing to expand, there has been an upturn in warehouse requirements from companies expanding operations in Sharjah, as well as those new to the emirate.

According to Cluttons, the rezoning of peripheral areas of several of Sharjah's Industrial Areas to "commercial use" has meant that there has been a steady flow of warehouse occupiers looking for alternative premises. The rezoning of these external parts of the Industrial Areas has translated into heightened interest for space in more internal areas, which have subsequently seen rents driven up.

Cluttons' international research and business development manager, Faisal Durrani commented, "Although there has been no official enforcement of the change of land use in the wider Industrial Areas yet, we have already begun to see a knock on impact on the limited number of vacant land plots in more central areas, with prices continuing to rise.

Durrani added, "Land prices in the Sharjah Industrial Areas currently stand at between AED 200 psf and AED 300 psf, depending on the size of the plot and the proximity to main roads. With the availability of larger plots dwindling, it is inevitable that values will continue to creep upwards, which is likely to catalyst the development of more peripheral and emerging industrial estates."

The report indicates that, away from the Sharjah Industrial Areas, the appetite to relocate to the emerging industrial areas around Sharjah International Airport and the existing Al Saja'a Industrial Area, is growing. The advantage of these areas is the widespread availability of larger land plots and better access to both the northern emirates and regional and international markets, due to the air-freight links available through Sharjah International Airport.

The report also points out that, with Sharjah Municipality's rent rules also extending to cover the commercial sector, industrial occupiers who have been in situ for a period of three years are being subjected to substantial uplifts at renewal, which is driving relocation to these more affordable areas.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Investment in Asia Pacific Multifamily Properties to Double by 2030

- Multi-story Warehouses Are 15 Percent of Sydney's New Industrial Stock

- Manhattan Office Leasing Activity Lags in Q3 as Sentiment Remains Cautious

- Nonresidential Construction Spending Increases in America

- Office Conversions on Pace to Double in U.S.

- Hong Kong Office Vacancy Rates Stabilize After 4 Months of Increases

- Commercial Mortgage Debt Outstanding in U.S. Jumps to $4.60 Trillion in Mid 2023

- Architecture Billings Index in U.S. Remains Flat in July

- Commercial Mortgage Delinquencies Rise in America

- U.S. Data Center Demand Explodes in U.S., Driven by AI Growth in 2023

- Demand for Electric Vehicle Manufacturing Space Jumps Across the U.S.

- Global Cross Border Commercial Property Capital Flows Implode 52 Percent Annually in 2023

- 2023 Financing Constraints Rapidly Drive Down Construction Starts in U.S.

- New York City Named as U.S. Leader in Climate Change Resilience

- Tokyo is the City of Choice for Global Retailers in 2023

- Despite VC Cooldown, Life Sciences Represents 33 Percent of New Office Construction in 2023

- Despite Reduced Credit, U.S. Multifamily Developer Confidence Remained Positive in Q2

- Brisbane Office Market Enjoying Strong Leasing Activity in 2023

- Commercial Lending Dampened in 2023 by U.S. Market Uncertainty

- Asia Pacific's Commercial Investment Market Continues to be Challenged in 2023

- Despite Global Economic Uncertainty, Commercial Investment in Japan Grew in Q2

- U.S. Commercial Lending to Dive 38 Percent to $504 Billion in 2023

- Apartment Markets Across America Continue to Stabilize in 2023

- Cap Rates for Prime Multifamily Assets in U.S. Stabilize in Q2

- Ireland Office Market Making a Comeback in 2023

- U.S. Office Sales Total $15 Billion Halfway Through 2023

- AI and Streaming Drive Global Data Center Growth Despite Power Constraints

- Asia Pacific Logistics Users Plan to Expand Warehouse Portfolio in 2023

- Manhattan Retail Rents Continue to Rise in Q2

- Manhattan Office Leasing Activity Down 29 Percent Annually in Q2

- Commercial Property Investment in Australia Dives 50 Percent in 2023

- U.S. Architecture Billings Uptick in May

- Employees Return to Office Trend Growing in Asia Pacific Markets

- Exponential AI Growth to Drive Asia Pacific's Data Center Market

- Large Opportunity to Transform Australia's Office Market in Play

- Australian Industrial Rent Growth to Continue in 2023

- Corporate Relocations in U.S. at Highest Rate Since 2017

- North American Ports Volume Drops 20 Percent Annually in 2023

- Office Investment in Asia Pacific Remains Strong Despite Weaker Sentiment

- Australia's Build-to-Rent Properties Uptick on Lender's Wish List in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More