Gainesville Real Estate News

Gainesville

America's Industrial Market Experiences Sharp User Demand Declines in Early 2023

According to new research by national commercial property broker Lee and Associates, there was a sharp first-quarter decline in U.S. tenant demand for industrial space as wholesalers and retailers reconsider their inventory levels out of caution over the economic outlook.

$8.1 Billion of Florida Mortgage Transactions at Risk Post Hurricane Ian

Based on new research by CoreLogic, more than 22,282 pending mortgage transactions currently in progress in Florida's 20 affected counties are in jeopardy from storm surge and flooding caused by the recent hurricane, Ian. Nearly 14,000 are purchase transactions where the state's average home sales price is $452,000 (as of June 2022).

Property Damage from Hurricane Ian Now Estimated Between $41 Billion to $70 Billion

According to new data analysis by CoreLogic, total flood and wind losses are between $41 billion and $70 billion. This estimate includes wind loss, re-evaluated insured and uninsured storm surge loss and newly calculated inland flood loss for residential and commercial properties.

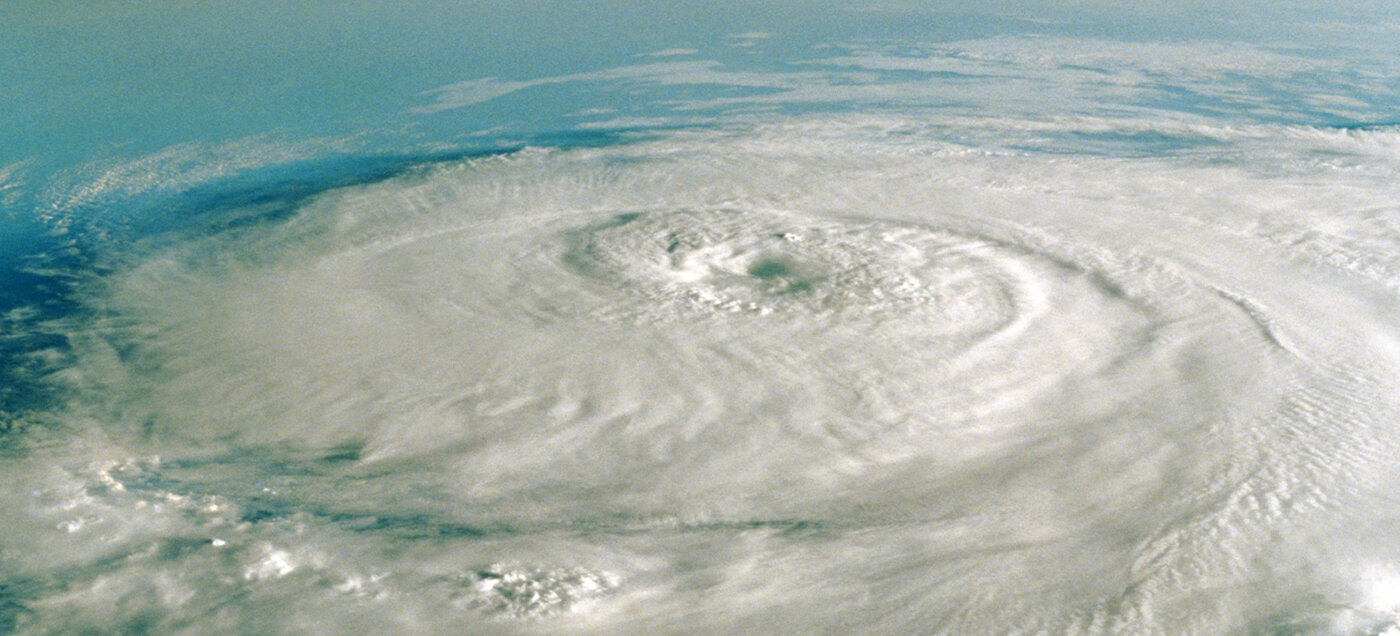

Historic Hurricane Ian Brings High Flash Flood Risk to 7.2 Million Florida Homes

As Hurricane Ian makes landfall in Southwest Florida today, property data company CoreLogic now estimates that 7,201,572 single- and multifamily residences (SFRs and MFRs) with a combined total reconstruction value (RCV) of $1.6 trillion are within the "moderate" and "high" flash flood risk bands, as forecasted by NHC.

Developer Spotlight

Gainesville Property News

U.S. Tenants Gravitating to Higher Quality Offices in Response to Hybrid Work

Posted on July 27, 2022

More Results: 1 | 2