The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

U.S. Home Prices Rise 6.4 Percent Year Over Year in August

Residential News » United States Edition | By Miho Favela | October 7, 2014 9:55 AM ET

According to CoreLogic's August CoreLogic Home Price Index (HPI) report, U.S. home prices nationwide, including distressed sales, increased 6.4 percent in August 2014 compared to August 2013. This change represents 30 months of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, increased 0.3 percent in August 2014 compared to July 2014.

At the state level, including distressed sales, all states showed year-over-year home price appreciation in August. The HPI reached new highs in a total of nine states, plus the District of Columbia. These states are Alaska, Colorado, Iowa, Louisiana, Nebraska, North Dakota, Oklahoma, Texas and Wyoming.

At the state level, including distressed sales, all states showed year-over-year home price appreciation in August. The HPI reached new highs in a total of nine states, plus the District of Columbia. These states are Alaska, Colorado, Iowa, Louisiana, Nebraska, North Dakota, Oklahoma, Texas and Wyoming.Excluding distressed sales, home prices nationally increased 5.9 percent in August 2014 compared to August 2013 and 0.3 percent month over month compared to July 2014. Also excluding distressed sales, 49 states and the District of Columbia showed year-over-year home price appreciation in August, with Mississippi being the only state to experience a year-over-year decline (-1.7 percent). Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic HPI Forecast indicates that home prices, including distressed sales, are projected to increase 0.2 percent month over month from August 2014 to September 2014 and, on a year-over-year basis, by 5.2 percent** from August 2014 to August 2015. Excluding distressed sales, home prices are expected to rise 0.2 percent month over month from August 2014 to September 2014 and by 4.7 percent year over year from August 2014 to August 2015. The CoreLogic HPI Forecast is a monthly projection of home prices built using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

"The pace of year-over-year appreciation continues to slow down as real estate markets find more balance. Home price appreciation reached a peak of almost 12 percent year-over-year in October 2013 and has since subsided to the current pace of 6 percent," said Mark Fleming, chief economist at CoreLogic. "Continued moderation of home price appreciation is a welcomed sign of more balanced real estate markets and less pressure on affordability for potential home buyers in the near future."

"Home prices continue to rise, albeit more slowly, across most of the U.S.," said Anand Nallathambi, president and CEO of CoreLogic. "Major metropolitan areas such as Riverside and Los Angeles, California, and Houston continue to lead the way with strong price gains buoyed by tight supplies and a gradual rebound in economic activity."

Highlights as of August 2014:

-

Including distressed sales, the five states with the highest home price appreciation were: Michigan (+11.1 percent), California (+9.2 percent), Nevada (+9.2 percent), Maine (+9 percent) and West Virginia (+8.7 percent).

Including distressed sales, the five states with the highest home price appreciation were: Michigan (+11.1 percent), California (+9.2 percent), Nevada (+9.2 percent), Maine (+9 percent) and West Virginia (+8.7 percent).

- Excluding distressed sales, the five states with the highest home price appreciation were: Massachusetts (+9.4 percent), Maine (+9.3 percent), West Virginia (+8.9 percent), Hawaii (+8.7 percent) and South Carolina (+8.1 percent).

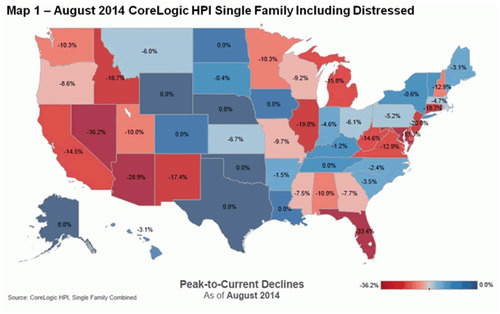

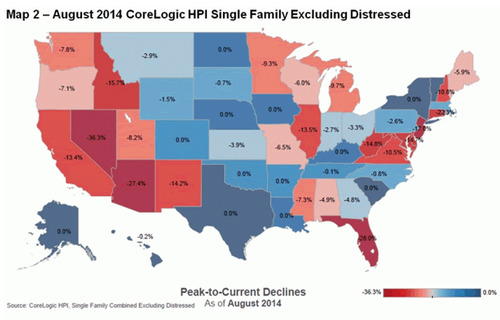

- Including distressed transactions, the peak-to-current change in the national HPI (from April 2006 to August 2014) was -12.1 percent. Excluding distressed transactions, the peak-to-current change in the HPI for the same period was -8.6 percent.

- The five states with the largest peak-to-current declines, including distressed transactions, were: Nevada (-36.2 percent), Florida (-33.4 percent), Arizona (-28.9 percent), Rhode Island (-26.8 percent) and Maryland (-20.2 percent).

- Including distressed sales, the U.S. has experienced 30 consecutive months of year-over-year increases; however, the national average is no longer posting double-digit increases.

- Ninety-eight of the top 100 Core Based Statistical Areas (CBSAs) measured by population showed year-over-year increases in August 2014. The two CBSAs that did not show an increase were Rochester, N.Y. and Little Rock-North Little Rock-Conway, Ark.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Orlando's Housing Market Continues to Slow Down This Fall

- U.S. Mortgage Originations Predicted to Hit $1.95 Trillion in 2024

- Construction Input Costs in America Uptick in September

- Global Home Price Growth Further Slows in Mid-2023

- Home Values in U.S. Begin to Slip Late Summer

- Foreclosure Filings in U.S. Spike 34 Percent Annually in Q3

- U.S. Mortgage Credit Availability Upticks in September

- Retail Market is a Bright Spot for Manhattan Real Estate

- Residential Rents in U.S. Dip in September Amid Growing Apartment Supply

- U.S. Mortgage Rates Continue to Surge in October

- Greater Las Vegas Home Sales Down 10 Percent Annually in September

- Most U.S. Homebuyers Say Buying a Home is More Stressful Than Dating in 2023

- Mortgage Applications Dive 6 Percent Last Week in America

- Despite Peak Interest Rates, Global Housing Markets Improved in Q2

- U.S. Architecture Billings Index Reports Softening Business Conditions in August

- U.S. Home Price Growth Pace Upticks Again in August

- 10,000 Residential Properties Have Negative Equity in Hong Kong

- U.S. Pending Home Sales Dropped 7.1 Percent in August

- U.S. Mortgage Rates Reach Highest Level in 23 Years

- American Bankers See Weakening Credit Conditions Through End of 2024

- Palm Beach Area Residential Sales Uptick in August

- Driven by High Mortgage Rates, Pending Home Sales Drop 13% Annually in September

- Miami Area Residential Sales Slip 13 Percent Annually in August

- U.S. Home Sales Dip 15 Percent Annually in August

- Home Flipping Transactions Down in 2023, Profits Up

- U.S. Listings Inventory Rises 4 Percent in August

- The Fed Leaves Rates Alone for Now in September

- Mortgage Applications Uptick in U.S. Amid High Rates

- Single Family Rent Growth in U.S. Drops to 3-Year Low in July

- Greater Orlando Area Home Sales Down 16 Percent Annually in August

- Home Purchase Cancellations Accelerating in the U.S.

- U.S. Construction Input Costs Uptick in August

- U.S. Mortgage Credit Availability Upticks in August

- Monthly Property Foreclosure Activity Upticks in U.S.

- Greater Palm Beach Area Residential Sales Dip 5 Percent Annually in Mid-2023

- NAR Predicts Several U.S. Housing Market Outcomes

- Demand for U.S. Housing is Dropping as Prices Rise

- U.S. Homeowner Equity Decrease by $287 Billion Over the Last 12 Months

- 1 in 5 Millennials Think They'll Never Own a Home in America

- 1 in 8 San Francisco Home Sellers Is Losing Money at Closing in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More