The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Thirteen Percent of U.S. Homes with a Mortgage Have Negative Equity in Q2

Residential News » United States Edition | By Miho Favela | July 31, 2015 9:00 AM ET

According to Irvine, California based RealtyTrac's Q2 2015 U.S. Home Equity & Underwater Report, as of the end of the second quarter of 2015 there were 7,443,580 U.S. residential properties that were seriously underwater -- where the combined loan amount secured by the property is at least 25 percent higher than the property's estimated market value -- representing 13.3 percent of all properties with a mortgage.

The second quarter underwater numbers were up from 7,341,922 seriously underwater homes representing 13.2 percent of all homes with a mortgage in the previous quarter -- making Q2 the second consecutive quarter with a slight increase in both the number and share of seriously underwater properties -- but were down from 9,074,449 seriously underwater properties representing 17.2 percent of all homes with a mortgage in the second quarter of 2015. The number and share of seriously underwater homes peaked in the second quarter of 2012 at 12,824,729 seriously homes representing 28.6 percent of all homes with a mortgage.

"Slowing home price appreciation in 2015 has resulted in the share of seriously underwater properties plateauing at about 13 percent of all properties with a mortgage," said Daren Blomquist, vice president at RealtyTrac. "However, the share of homeowners with the double-whammy of seriously underwater properties that are also in foreclosure is continuing to decrease and is now at the lowest level we've seen since we began tracking that metric in the first quarter of 2012."

The share of distressed properties -- those in some stage of the foreclosure process -- that were seriously underwater at the end of the second quarter was 34.4 percent, down from 35.1 percent in the first quarter of 2015 and down from 43.6 percent in the second quarter of 2014 to the lowest level since tracking began in the first quarter of 2012. Conversely, the share of foreclosures with positive equity increased to 42.4 percent in the second quarter, up slightly from 42.1 percent in the first quarter and up from 34.1 percent in the second quarter of 2014.

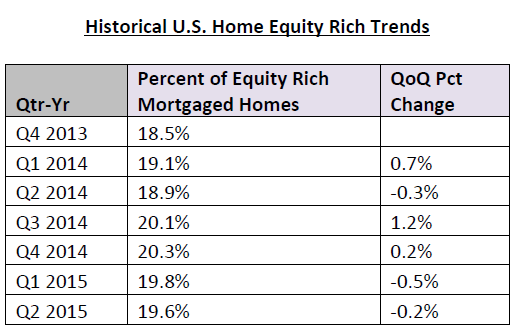

Share of equity rich mortgaged properties up 1 million from year ago, down 300K YTD

The universe of equity-rich mortgaged properties -- those with at least 50 percent equity -- decreased on a quarter-over-quarter basis for the second straight quarter, down to 10.9 million representing 19.6 percent of all properties with a mortgage at the end of the second quarter. That was down from 11.1 million representing 19.8 percent at the end of the first quarter and down from 11.3 million representing 20.3 percent at the end of the fourth quarter, but still up from 9.9 million representing 18.9 percent at the end of the second quarter of 2014.

"Although the number of equity rich homeowners with a mortgage has increased by 1 million compared to a year ago, that number dropped by nearly 300,000 between the end of 2014 and the middle of 2015," Blomquist added. "The number of homeowners with a mortgage who have at least 20 percent equity has dropped by more than 900,000 during the past six months, indicating that homeowners who have gained substantial equity thanks to the housing price recovery over the past three years are taking advantage of that newfound equity. Some are leveraging that equity into a higher LTV refinance or a move-up purchase, some may be downsizing into an all-cash purchase and some may be cashing out of homeownership altogether. Those homeowners cashing out of homeownership altogether would explain why the nation's overall homeownership rate continued to decline in the second quarter even as homeownership rates among millennials increased."

Major metro areas with the highest percentage of equity rich properties reflect areas of continued growth in home prices: San Jose, California (43.8 percent), San Francisco, California (38.3 percent), Honolulu, Hawaii (36.7 percent), Los Angeles, California (32 percent), New York (30.7 percent), Pittsburgh, Pennsylvania (29.4 percent), Poughkeepsie, New York (28.0 percent), Oxnard, California (27.5 percent) and San Diego, California (26.9 percent).

"Over the past two years, the Seattle region has seen the percentage of homeowners who are seriously underwater drop by over 56 percent, one of the fastest and most impressive drops in the country ," said Matthew Gardner, chief economist at Windermere Real Estate, covering the Seattle market. "Usually a decline of this magnitude would suggest an uptick in the number of homes for sale, but unfortunately for Seattle, I don't see this taking place. Many of these homeowners are simply too apprehensive or don't have the financial capacity to move. But what we lose in new listings, we gain in overall market stability."

Markets with the most seriously underwater properties

Markets with a population greater than 500,000 with the highest percentage of seriously underwater properties in Q2 2015 were Lakeland, Florida, (28.5 percent), Cleveland, Ohio (28.2 percent), Las Vegas, Nevada (27.9 percent), Akron, Ohio (27.3 percent), Orlando, Florida (26.1 percent), Tampa, Florida (24.8 percent), Chicago, Illinois (24.8 percent), Palm Bay, Florida (24.4 percent) and Toledo, Ohio (24.3 percent).

Markets where the share of distressed properties -- those in some stage of foreclosure -- that were seriously underwater exceeded 50 percent in the first quarter of 2015 included Las Vegas, Nevada (57.7 percent), Lakeland, Florida (54.8 percent), Cleveland, Ohio (52.9 percent), Chicago, Illinois (52.5 percent), Tampa, Florida (51.7 percent ), Palm Bay, Florida (51.5 percent), and Orlando, Florida (51.2 percent).

"Many consumers in foreclosure don't understand the positive effects of the increased equity we are seeing across the Ohio markets, and the opportunities that this might bring in assisting them to avoid foreclosure," said Michael Mahon, president at HER Realtors, covering the Cincinnati, Dayton and Columbus markets in Ohio. "Across much of Ohio, housing demand is driving increased prices and lower days on the market, contributing to positive equity growth. For homeowners facing troubled financial circumstances due to job loss, divorce, death in the family, or health concerns, the best advice would be to consult with a real estate agent early in the process."

Markets with the highest share of positive equity foreclosures

Those states with the highest percent of distressed properties with positive equity included Colorado (72.0 percent), Alaska (69.8 percent), Texas (66.4 percent), Oklahoma (65.2 percent), and Nebraska (64.4 percent).

Major markets where the share of distressed properties with positive equity exceeded 60 percent included Denver, Colorado (83.7 percent), Austin, Texas (83.1percent), Honolulu, Hawaii (77.5 percent), San Jose, California (77 percent), Pittsburgh, Pennsylvania (75.9 percent), Jackson Mississippi (75 percent), Nashville, Tennessee (69.3 percent) and Houston, Texas (69 percent).

"The strong South Florida price increases over the past few years have moved many homeowners from negative to positive equity. We would encourage the remaining distressed homeowners to ask for a Broker Price Opinion (BPO) regarding the value of their property -- many may be surprised at their improving value," said Mike Pappas, CEO and president of Keyes Company, covering the South Florida market.

"Many homeowners that found themselves upside down in their homes just a few years ago are finding that they are now in a much better position with equity to spare, based on the strong appreciation we have experienced over the last few years," said Greg Smith, owner/broker at RE/MAX Alliance, covering the Denver market in Colorado. "When we look at other areas, such as Las Vegas, where homes seriously underwater have dropped by close to 50 percent, we see the strengthening of the economy as a whole provided by housing."

Homes owned seven to 11 years account for 38 percent of all seriously underwater homes

Residential properties owned between seven years and 11 years accounted for 38 percent of all seriously underwater homes as of the end of the second quarter. The highest seriously underwater rate is for homes owned for nine years, 21.6 percent of which are seriously underwater, followed by those owned for 10 years, 19.8 percent of which are seriously underwater, and those owned for eight years, 19.0 percent of which are seriously underwater.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Orlando's Housing Market Continues to Slow Down This Fall

- U.S. Mortgage Originations Predicted to Hit $1.95 Trillion in 2024

- Construction Input Costs in America Uptick in September

- Global Home Price Growth Further Slows in Mid-2023

- Home Values in U.S. Begin to Slip Late Summer

- Foreclosure Filings in U.S. Spike 34 Percent Annually in Q3

- U.S. Mortgage Credit Availability Upticks in September

- Retail Market is a Bright Spot for Manhattan Real Estate

- Residential Rents in U.S. Dip in September Amid Growing Apartment Supply

- U.S. Mortgage Rates Continue to Surge in October

- Greater Las Vegas Home Sales Down 10 Percent Annually in September

- Most U.S. Homebuyers Say Buying a Home is More Stressful Than Dating in 2023

- Mortgage Applications Dive 6 Percent Last Week in America

- Despite Peak Interest Rates, Global Housing Markets Improved in Q2

- U.S. Architecture Billings Index Reports Softening Business Conditions in August

- U.S. Home Price Growth Pace Upticks Again in August

- 10,000 Residential Properties Have Negative Equity in Hong Kong

- U.S. Pending Home Sales Dropped 7.1 Percent in August

- U.S. Mortgage Rates Reach Highest Level in 23 Years

- American Bankers See Weakening Credit Conditions Through End of 2024

- Palm Beach Area Residential Sales Uptick in August

- Driven by High Mortgage Rates, Pending Home Sales Drop 13% Annually in September

- Miami Area Residential Sales Slip 13 Percent Annually in August

- U.S. Home Sales Dip 15 Percent Annually in August

- Home Flipping Transactions Down in 2023, Profits Up

- U.S. Listings Inventory Rises 4 Percent in August

- The Fed Leaves Rates Alone for Now in September

- Mortgage Applications Uptick in U.S. Amid High Rates

- Single Family Rent Growth in U.S. Drops to 3-Year Low in July

- Greater Orlando Area Home Sales Down 16 Percent Annually in August

- Home Purchase Cancellations Accelerating in the U.S.

- U.S. Construction Input Costs Uptick in August

- U.S. Mortgage Credit Availability Upticks in August

- Monthly Property Foreclosure Activity Upticks in U.S.

- Greater Palm Beach Area Residential Sales Dip 5 Percent Annually in Mid-2023

- NAR Predicts Several U.S. Housing Market Outcomes

- Demand for U.S. Housing is Dropping as Prices Rise

- U.S. Homeowner Equity Decrease by $287 Billion Over the Last 12 Months

- 1 in 5 Millennials Think They'll Never Own a Home in America

- 1 in 8 San Francisco Home Sellers Is Losing Money at Closing in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More