The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

U.S. Home Sales Slide in Late 2018

Residential News » Washington D.C. Edition | By Monsef Rachid | January 23, 2019 8:45 AM ET

Nationwide, Home Sales Down 10.3 Percent Annually in December

According to a new report by the National Association of Realtors, after two consecutive months of increases, existing-home sales in the U.S. declined in the month of December 2018. None of the four major U.S. regions saw a gain in sales activity last month.

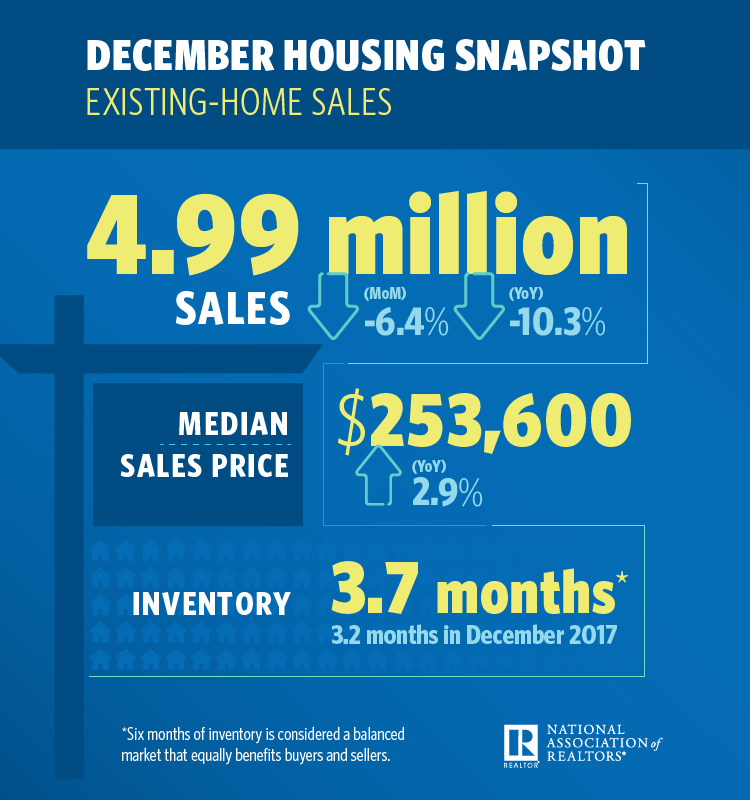

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, decreased 6.4 percent from November to a seasonally adjusted rate of 4.99 million in December 2018. Sales are now down 10.3 percent from a year ago (5.56 million in December 2017).

Lawrence Yun, NAR's chief economist, says current housing numbers are partly a result of higher interest rates during much of 2018. "The housing market is obviously very sensitive to mortgage rates. Softer sales in December reflected consumer search processes and contract signing activity in previous months when mortgage rates were higher than today. Now, with mortgage rates lower, some revival in home sales is expected going into spring."

The median existing-home price for all housing types in December was $253,600, up 2.9 percent from December 2017 ($246,500). December's price increase marks the 82nd straight month of year-over-year gains.

Total housing inventory at the end of December decreased to 1.55 million, down from 1.74 million existing homes available for sale in November, but represents an increase from 1.46 million a year ago. Unsold inventory is at a 3.7-month supply at the current sales pace, down from 3.9 last month and up from 3.2 months a year ago.

Properties typically stayed on the market for 46 days in December, up from 42 days in November and 40 days a year ago. Thirty-nine percent of homes sold in December were on the market for less than a month.

"Several consecutive months of rising inventory is a positive development for consumers and could lead to slower home price appreciation," says Yun. "But there is still a lack of adequate inventory on the lower-priced points and too many in upper-priced points."

Realtor.com's Market Hotness Index, measuring time-on-the-market data and listings views per property, revealed that the hottest metro areas in December were Chico, California; Midland, Texas; Odessa, Texas; Columbus, Ohio; and Fort Wayne, Ind.

According to Freddie Mac, the average commitment rate for a 30-year, conventional, fixed-rate mortgage decreased to 4.64 percent in December from 4.87 percent in November. The average commitment rate for all of 2017 was 3.99 percent.

"The partial shutdown of the federal government has not had a significant effect on December closings, but the uncertainty of a shutdown has the potential to harm the market," said NAR President John Smaby, a second-generation Realtor® from Edina, Minnesota and broker at Edina Realty. "Once the government is fully reopened, I am hopeful that housing transactions will increase."

First-time buyers were responsible for 32 percent of sales in December, down from last month (33 percent), but the same as a year ago.

All-cash sales accounted for 22 percent of transactions in December, up from November and a year ago (21 and 20 percent, respectively). Individual investors, who account for many cash sales, purchased 13 percent of homes in December, the same as November but down from a year ago (16 percent).

Distressed sales- foreclosures and short sales - represented 2 percent of sales in December, unchanged from 2 percent last month and down from 5 percent a year ago.

Single-family and Condo/Co-op Sales

Single-family home sales sit at a seasonally adjusted annual rate of 4.45 million in December, down from 4.71 million in November, but is 10.1 percent below the 4.95 million sales pace from a year ago. The median existing single-family home price was $255,200 in December, up 2.9 percent from December 2017.

Existing condominium and co-op sales were recorded at a seasonally adjusted annual rate of 540,000 units in December, down 12.9 percent from last month and down 11.5 percent from a year ago. The median existing condo price was $240,600 in December, which is up 2.3 percent from a year ago.

Regional Breakdown

December existing-home sales in the Northeast decreased 6.8 percent to an annual rate of 690,000, 6.8 percent below a year ago. The median price in the Northeast was $283,400, which is up 8.2 percent from December 2017.

In the Midwest, existing-home sales fell 11.2 percent from last month to an annual rate of 1.19 million in December, down 10.5 percent overall from a year ago. The median price in the Midwest was $191,300, unchanged from last year.

Existing-home sales in the South dropped 5.4 percent to an annual rate of 2.09 million in December, down 8.7 percent from last year. The median price in the South was $224,300, up 2.5 percent from a year ago.

Existing-home sales in the West dipped 1.9 percent to an annual rate of 1.02 million in December, 15 percent below a year ago. The median price in the West was $374,400, up 0.2 percent from December 2017.

According to a new report by the National Association of Realtors, after two consecutive months of increases, existing-home sales in the U.S. declined in the month of December 2018. None of the four major U.S. regions saw a gain in sales activity last month.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, decreased 6.4 percent from November to a seasonally adjusted rate of 4.99 million in December 2018. Sales are now down 10.3 percent from a year ago (5.56 million in December 2017).

Lawrence Yun, NAR's chief economist, says current housing numbers are partly a result of higher interest rates during much of 2018. "The housing market is obviously very sensitive to mortgage rates. Softer sales in December reflected consumer search processes and contract signing activity in previous months when mortgage rates were higher than today. Now, with mortgage rates lower, some revival in home sales is expected going into spring."

The median existing-home price for all housing types in December was $253,600, up 2.9 percent from December 2017 ($246,500). December's price increase marks the 82nd straight month of year-over-year gains.

Total housing inventory at the end of December decreased to 1.55 million, down from 1.74 million existing homes available for sale in November, but represents an increase from 1.46 million a year ago. Unsold inventory is at a 3.7-month supply at the current sales pace, down from 3.9 last month and up from 3.2 months a year ago.

Properties typically stayed on the market for 46 days in December, up from 42 days in November and 40 days a year ago. Thirty-nine percent of homes sold in December were on the market for less than a month.

"Several consecutive months of rising inventory is a positive development for consumers and could lead to slower home price appreciation," says Yun. "But there is still a lack of adequate inventory on the lower-priced points and too many in upper-priced points."

Realtor.com's Market Hotness Index, measuring time-on-the-market data and listings views per property, revealed that the hottest metro areas in December were Chico, California; Midland, Texas; Odessa, Texas; Columbus, Ohio; and Fort Wayne, Ind.

According to Freddie Mac, the average commitment rate for a 30-year, conventional, fixed-rate mortgage decreased to 4.64 percent in December from 4.87 percent in November. The average commitment rate for all of 2017 was 3.99 percent.

"The partial shutdown of the federal government has not had a significant effect on December closings, but the uncertainty of a shutdown has the potential to harm the market," said NAR President John Smaby, a second-generation Realtor® from Edina, Minnesota and broker at Edina Realty. "Once the government is fully reopened, I am hopeful that housing transactions will increase."

First-time buyers were responsible for 32 percent of sales in December, down from last month (33 percent), but the same as a year ago.

All-cash sales accounted for 22 percent of transactions in December, up from November and a year ago (21 and 20 percent, respectively). Individual investors, who account for many cash sales, purchased 13 percent of homes in December, the same as November but down from a year ago (16 percent).

Distressed sales- foreclosures and short sales - represented 2 percent of sales in December, unchanged from 2 percent last month and down from 5 percent a year ago.

Single-family and Condo/Co-op Sales

Single-family home sales sit at a seasonally adjusted annual rate of 4.45 million in December, down from 4.71 million in November, but is 10.1 percent below the 4.95 million sales pace from a year ago. The median existing single-family home price was $255,200 in December, up 2.9 percent from December 2017.

Existing condominium and co-op sales were recorded at a seasonally adjusted annual rate of 540,000 units in December, down 12.9 percent from last month and down 11.5 percent from a year ago. The median existing condo price was $240,600 in December, which is up 2.3 percent from a year ago.

Regional Breakdown

December existing-home sales in the Northeast decreased 6.8 percent to an annual rate of 690,000, 6.8 percent below a year ago. The median price in the Northeast was $283,400, which is up 8.2 percent from December 2017.

In the Midwest, existing-home sales fell 11.2 percent from last month to an annual rate of 1.19 million in December, down 10.5 percent overall from a year ago. The median price in the Midwest was $191,300, unchanged from last year.

Existing-home sales in the South dropped 5.4 percent to an annual rate of 2.09 million in December, down 8.7 percent from last year. The median price in the South was $224,300, up 2.5 percent from a year ago.

Existing-home sales in the West dipped 1.9 percent to an annual rate of 1.02 million in December, 15 percent below a year ago. The median price in the West was $374,400, up 0.2 percent from December 2017.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Orlando's Housing Market Continues to Slow Down This Fall

- U.S. Mortgage Originations Predicted to Hit $1.95 Trillion in 2024

- Construction Input Costs in America Uptick in September

- Global Home Price Growth Further Slows in Mid-2023

- Home Values in U.S. Begin to Slip Late Summer

- Foreclosure Filings in U.S. Spike 34 Percent Annually in Q3

- U.S. Mortgage Credit Availability Upticks in September

- Retail Market is a Bright Spot for Manhattan Real Estate

- Residential Rents in U.S. Dip in September Amid Growing Apartment Supply

- U.S. Mortgage Rates Continue to Surge in October

- Greater Las Vegas Home Sales Down 10 Percent Annually in September

- Most U.S. Homebuyers Say Buying a Home is More Stressful Than Dating in 2023

- Mortgage Applications Dive 6 Percent Last Week in America

- Despite Peak Interest Rates, Global Housing Markets Improved in Q2

- U.S. Architecture Billings Index Reports Softening Business Conditions in August

- U.S. Home Price Growth Pace Upticks Again in August

- 10,000 Residential Properties Have Negative Equity in Hong Kong

- U.S. Pending Home Sales Dropped 7.1 Percent in August

- U.S. Mortgage Rates Reach Highest Level in 23 Years

- American Bankers See Weakening Credit Conditions Through End of 2024

- Palm Beach Area Residential Sales Uptick in August

- Driven by High Mortgage Rates, Pending Home Sales Drop 13% Annually in September

- Miami Area Residential Sales Slip 13 Percent Annually in August

- U.S. Home Sales Dip 15 Percent Annually in August

- Home Flipping Transactions Down in 2023, Profits Up

- U.S. Listings Inventory Rises 4 Percent in August

- The Fed Leaves Rates Alone for Now in September

- Mortgage Applications Uptick in U.S. Amid High Rates

- Single Family Rent Growth in U.S. Drops to 3-Year Low in July

- Greater Orlando Area Home Sales Down 16 Percent Annually in August

- Home Purchase Cancellations Accelerating in the U.S.

- U.S. Construction Input Costs Uptick in August

- U.S. Mortgage Credit Availability Upticks in August

- Monthly Property Foreclosure Activity Upticks in U.S.

- Greater Palm Beach Area Residential Sales Dip 5 Percent Annually in Mid-2023

- NAR Predicts Several U.S. Housing Market Outcomes

- Demand for U.S. Housing is Dropping as Prices Rise

- U.S. Homeowner Equity Decrease by $287 Billion Over the Last 12 Months

- 1 in 5 Millennials Think They'll Never Own a Home in America

- 1 in 8 San Francisco Home Sellers Is Losing Money at Closing in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More