The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Case-Schiller Reports U.S. Home Prices Uptick Nationally in 2Q, But Still Below Last Year

Residential News » Residential Real Estate Edition | By Michael Gerrity | August 30, 2011 2:58 PM ET

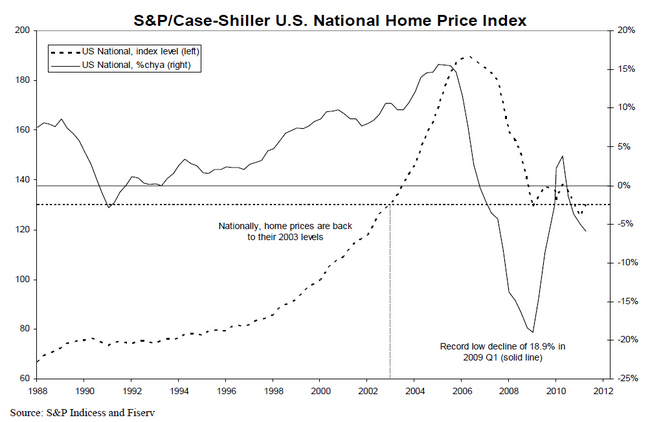

According to S&P Indices for its S&P/Case-Shiller Home Price Indices, U.S. National Home Price Index increased by 3.6% in the second quarter of 2011, after having fallen 4.1% in the first quarter of 2011.

With the second quarter's data, the National Index recovered from its first quarter low, but still posted an annual decline of 5.9% versus the second quarter of 2010. Nationally, home prices are back to their early 2003 levels.

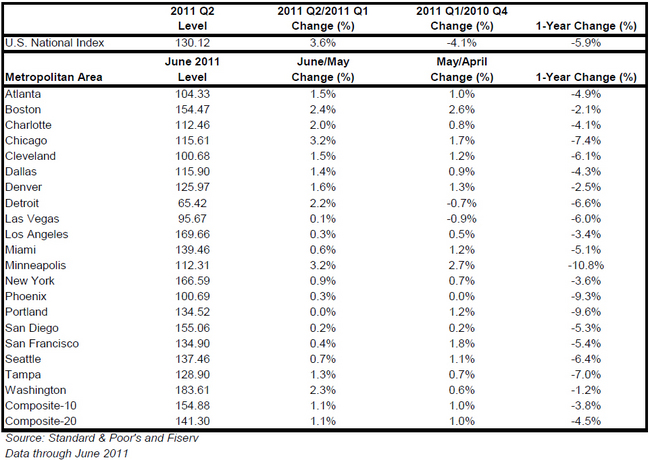

As of June 2011, 19 of the 20 MSAs covered by S&P/Case-Shiller Home Price Indices and both monthly composites were up versus May - Portland was flat. However, they were all down compared to June 2010. Twelve of the 20 MSAs and both Composites have now increased for three consecutive months, a sign of the seasonal strength in the housing market. None of the markets posted new lows with June's report. Minneapolis posted a double-digit 10.8% annual decline; Portland is not far behind at -9.6%.

Thirteen of the cities and both composites saw improvements in their annual rates; however; they all are in negative territory and have been so for three consecutive months.

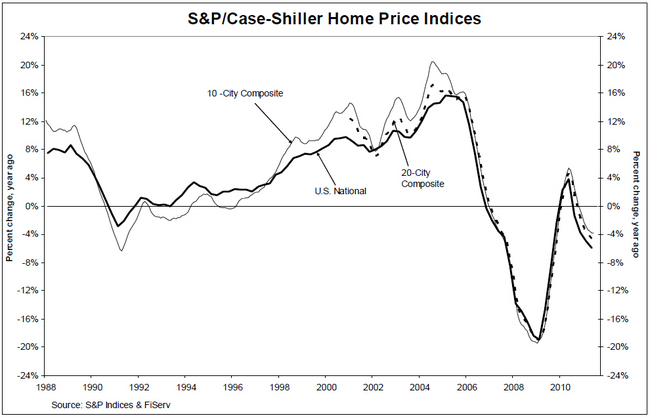

The chart on the previous page depicts the annual returns of the U.S. National, the 10-City Composite and the 20-City Composite Home Price Indices. The S&P/Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, recorded a 5.9% decline in the second quarter of 2011 over the second quarter of 2010. In June, the 10- and 20-City Composites posted annual rates of decline of 3.8% and 4.5%, respectively. Thirteen of the 20 MSAs and both monthly Composites saw their annual growth rates improve, although remaining in negative territory in June.

"This month's report showed mixed signals for recovery in home prices. No cities made new lows in June 2011, and the majority of cities are seeing improved annual rates. The National Index was up 3.6% from the 2011 first quarter, but down 5.9% compared to a year-ago," says David M. Blitzer, Chairman of the Index Committee at S&P Indices. "Looking across the cities, eight bottomed in 2009 and have remained above their lows. These include all the California cities plus Dallas, Denver and Washington DC, all relatively strong markets. At the other extreme, those which set new lows in 2011 include the four Sunbelt cities - Las Vegas, Miami, Phoenix and Tampa - as well as the weakest of all, Detroit.

These shifts suggest that we are back to regional housing markets, rather than a national housing market where everything rose and fell together.

"As with May's report, June showed unusually large revisions across the same MSAs - Detroit, New York, Tampa and Washington DC. Our sales pairs data indicate that, once again, these markets reported a lot more sales closing in prior months, which caused the revisions. Since deed recording is usually county based, if the price trends across counties are very different, then delays from a subset of counties can lead to larger revisions. And data lag lengths tend to vary across the counties within a metro area. If counties with relatively stronger/weaker markets report sales with longer/shorter lags, this will result in larger revisions as we receive the lagged data. Revisions are also likely to be larger when sales volumes are low or the proportions of distressed/non-distressed sales are changing rapidly. Any and all of these factors are likely contributing to the revisions we have seen over the past few reports.

"Nineteen of the 20 MSAs and both Composites were up in June over May. Portland was flat. Cleveland has improved enough that average home prices in this market are back above its January 2000 levels. Only Detroit and Las Vegas remain below those levels."

The chart on the previous page shows the index levels for the U.S. National Home Price Index, as well as its annual returns. As of the second quarter of 2011, average home prices across the United States are back at their early 2003 levels. The National Index level had hit a new low in the first quarter of 2011; but recovered by +3.6% in the second quarter. It still remains 5.9% below its 2010Q2 level.

Twelve cities and both Composites have posted three consecutive months of positive month-over-month returns. Eleven of the 20 cities were up 1% or more.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Orlando's Housing Market Continues to Slow Down This Fall

- U.S. Mortgage Originations Predicted to Hit $1.95 Trillion in 2024

- Construction Input Costs in America Uptick in September

- Global Home Price Growth Further Slows in Mid-2023

- Home Values in U.S. Begin to Slip Late Summer

- Foreclosure Filings in U.S. Spike 34 Percent Annually in Q3

- U.S. Mortgage Credit Availability Upticks in September

- Retail Market is a Bright Spot for Manhattan Real Estate

- Residential Rents in U.S. Dip in September Amid Growing Apartment Supply

- U.S. Mortgage Rates Continue to Surge in October

- Greater Las Vegas Home Sales Down 10 Percent Annually in September

- Most U.S. Homebuyers Say Buying a Home is More Stressful Than Dating in 2023

- Mortgage Applications Dive 6 Percent Last Week in America

- Despite Peak Interest Rates, Global Housing Markets Improved in Q2

- U.S. Architecture Billings Index Reports Softening Business Conditions in August

- U.S. Home Price Growth Pace Upticks Again in August

- 10,000 Residential Properties Have Negative Equity in Hong Kong

- U.S. Pending Home Sales Dropped 7.1 Percent in August

- U.S. Mortgage Rates Reach Highest Level in 23 Years

- American Bankers See Weakening Credit Conditions Through End of 2024

- Palm Beach Area Residential Sales Uptick in August

- Driven by High Mortgage Rates, Pending Home Sales Drop 13% Annually in September

- Miami Area Residential Sales Slip 13 Percent Annually in August

- U.S. Home Sales Dip 15 Percent Annually in August

- Home Flipping Transactions Down in 2023, Profits Up

- U.S. Listings Inventory Rises 4 Percent in August

- The Fed Leaves Rates Alone for Now in September

- Mortgage Applications Uptick in U.S. Amid High Rates

- Single Family Rent Growth in U.S. Drops to 3-Year Low in July

- Greater Orlando Area Home Sales Down 16 Percent Annually in August

- Home Purchase Cancellations Accelerating in the U.S.

- U.S. Construction Input Costs Uptick in August

- U.S. Mortgage Credit Availability Upticks in August

- Monthly Property Foreclosure Activity Upticks in U.S.

- Greater Palm Beach Area Residential Sales Dip 5 Percent Annually in Mid-2023

- NAR Predicts Several U.S. Housing Market Outcomes

- Demand for U.S. Housing is Dropping as Prices Rise

- U.S. Homeowner Equity Decrease by $287 Billion Over the Last 12 Months

- 1 in 5 Millennials Think They'll Never Own a Home in America

- 1 in 8 San Francisco Home Sellers Is Losing Money at Closing in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More