The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Housing Rents Continue to Rise in Most European Cities in Q4

| By Michael Gerrity | January 10, 2020 9:00 AM ET

Yet rents dip in expensive markets like London, Amsterdam and Munich

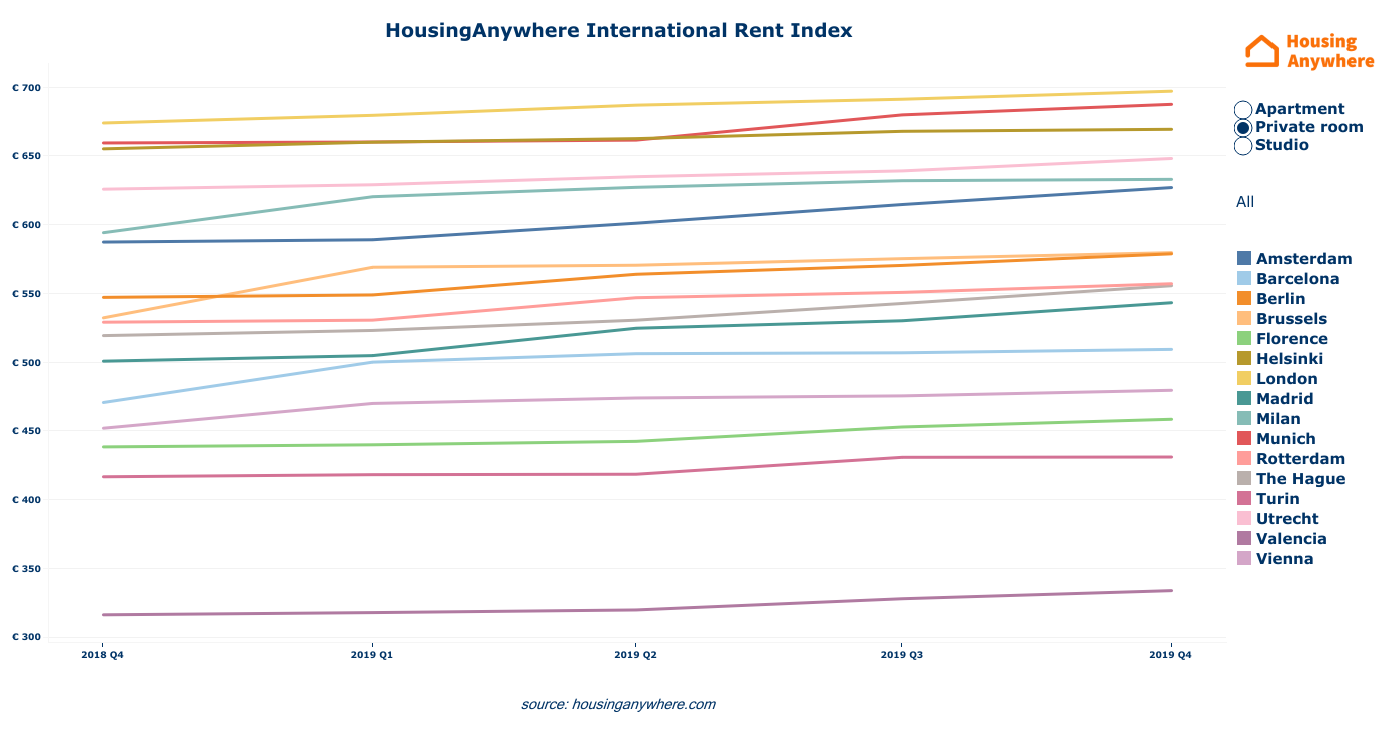

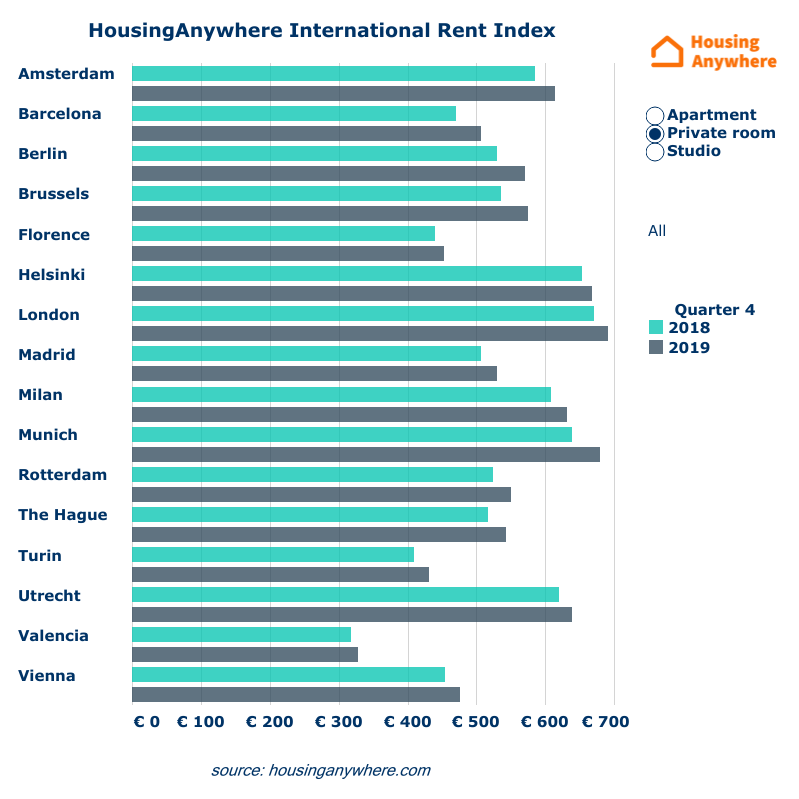

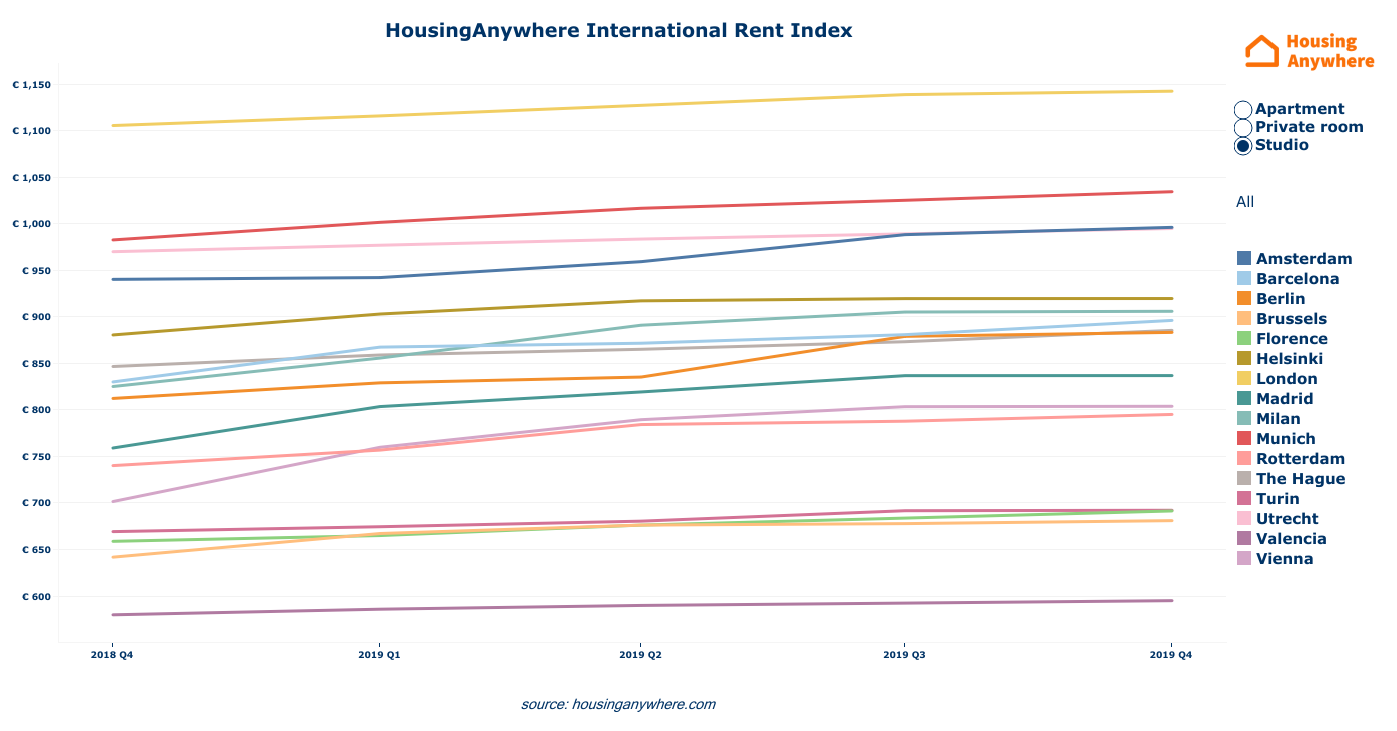

According to HousingAnywhere's latest International Rent Index, a rise in residential rents continued across Europe in Q4 of 2019, yet rents did decelerated in the more expensive cities such as London, Amsterdam and Munich.

This hasn't been the case for cities that are cheaper by comparison. These typically cheaper cities have seen a steep rental growth in the past year, most notably; Berlin, Barcelona, Madrid, Vienna, and Brussels. "The Q4 report reflects what we have been observing for a while now," says Djordy Seelmann, CEO of HousingAnywhere. "It will be interesting to see if a ceiling will be reached in 2020 for the most expensive European cities, and which lower-priced cities will catch up to the more expensive ones. The housing shortage certainly remains as pressing as it has been in past years."

Working towards effective solutions

The European political landscape is quite unstable at present, with political issues weighing down the performance of the real estate industry. Seelmann: "Current governmental initiatives are focused on applying stricter control of the domestic real estate sector, instead of encouraging the much-needed development of new accommodation. Rent controls, as seen in Berlin and the Netherlands, are a way of dealing with housing affordability in the short term. They are, however, counterproductive, and add risk to residential investment while failing to add more accommodation."

There are both short-term and long-term strategies that will have the desired effect, according to Seelmann, "For the short term, we urge governments and municipalities to take a more constructive attitude towards allowing the development of new sites. Land prices have increased, in part due to the fiscal policies of governments that aim to boost local authority funding. Much to the discouragement of property investors. At the same time, we see opportunities for transforming existing commercial properties into residential properties. This not only results in more accommodation but also reduces vacancy. In the long term, cities need to be forward-looking when considering infrastructure: communities that are currently less accessible could flourish if city centers and regional public transportation links are generally improved. Young professionals and students are looking for housing in areas where sufficient mobility is available. Additionally, there must be enough available accommodation for homeseekers in all categories. This would allow families and seniors to move more easily within the rental market, freeing up cheaper accommodation for young professionals and students. The cities that achieve this will succeed in attracting the workforce of the future."

According to HousingAnywhere's latest International Rent Index, a rise in residential rents continued across Europe in Q4 of 2019, yet rents did decelerated in the more expensive cities such as London, Amsterdam and Munich.

This hasn't been the case for cities that are cheaper by comparison. These typically cheaper cities have seen a steep rental growth in the past year, most notably; Berlin, Barcelona, Madrid, Vienna, and Brussels. "The Q4 report reflects what we have been observing for a while now," says Djordy Seelmann, CEO of HousingAnywhere. "It will be interesting to see if a ceiling will be reached in 2020 for the most expensive European cities, and which lower-priced cities will catch up to the more expensive ones. The housing shortage certainly remains as pressing as it has been in past years."

Working towards effective solutions

The European political landscape is quite unstable at present, with political issues weighing down the performance of the real estate industry. Seelmann: "Current governmental initiatives are focused on applying stricter control of the domestic real estate sector, instead of encouraging the much-needed development of new accommodation. Rent controls, as seen in Berlin and the Netherlands, are a way of dealing with housing affordability in the short term. They are, however, counterproductive, and add risk to residential investment while failing to add more accommodation."

There are both short-term and long-term strategies that will have the desired effect, according to Seelmann, "For the short term, we urge governments and municipalities to take a more constructive attitude towards allowing the development of new sites. Land prices have increased, in part due to the fiscal policies of governments that aim to boost local authority funding. Much to the discouragement of property investors. At the same time, we see opportunities for transforming existing commercial properties into residential properties. This not only results in more accommodation but also reduces vacancy. In the long term, cities need to be forward-looking when considering infrastructure: communities that are currently less accessible could flourish if city centers and regional public transportation links are generally improved. Young professionals and students are looking for housing in areas where sufficient mobility is available. Additionally, there must be enough available accommodation for homeseekers in all categories. This would allow families and seniors to move more easily within the rental market, freeing up cheaper accommodation for young professionals and students. The cities that achieve this will succeed in attracting the workforce of the future."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Real Estate Headlines

- Investment in Asia Pacific Multifamily Properties to Double by 2030

- Orlando's Housing Market Continues to Slow Down This Fall

- U.S. Mortgage Originations Predicted to Hit $1.95 Trillion in 2024

- Construction Input Costs in America Uptick in September

- Introducing Homebourse - The First Digital Real Estate Marketplace for Online Property Acquisition

- Global Home Price Growth Further Slows in Mid-2023

- Home Values in U.S. Begin to Slip Late Summer

- Foreclosure Filings in U.S. Spike 34 Percent Annually in Q3

- U.S. Mortgage Credit Availability Upticks in September

- Retail Market is a Bright Spot for Manhattan Real Estate

- Residential Rents in U.S. Dip in September Amid Growing Apartment Supply

- Asia Pacific Hotel Revenues to Rise in 2024 Despite Economic Volatility

- Multi-story Warehouses Are 15 Percent of Sydney's New Industrial Stock

- Manhattan Office Leasing Activity Lags in Q3 as Sentiment Remains Cautious

- U.S. Mortgage Rates Continue to Surge in October

- Tourist Bookings to Hawaii Down 50 Percent Since Maui Wildfires

- Greater Las Vegas Home Sales Down 10 Percent Annually in September

- Most U.S. Homebuyers Say Buying a Home is More Stressful Than Dating in 2023

- Mortgage Applications Dive 6 Percent Last Week in America

- Despite Peak Interest Rates, Global Housing Markets Improved in Q2

- U.S. Architecture Billings Index Reports Softening Business Conditions in August

- U.S. Home Price Growth Pace Upticks Again in August

- Nonresidential Construction Spending Increases in America

- Measurabl Appoints MetaProp Partner as Chief Growth Officer to Drive Globalization of its Market-Leading ESG Data Platform

- 10,000 Residential Properties Have Negative Equity in Hong Kong

- U.S. Pending Home Sales Dropped 7.1 Percent in August

- U.S. Mortgage Rates Reach Highest Level in 23 Years

- Office Conversions on Pace to Double in U.S.

- American Bankers See Weakening Credit Conditions Through End of 2024

- Hong Kong Office Vacancy Rates Stabilize After 4 Months of Increases

- Palm Beach Area Residential Sales Uptick in August

- Driven by High Mortgage Rates, Pending Home Sales Drop 13% Annually in September

- Miami Area Residential Sales Slip 13 Percent Annually in August

- U.S. Home Sales Dip 15 Percent Annually in August

- Home Flipping Transactions Down in 2023, Profits Up

- North Shore Systems Launches their iOS App, North Shore Mobile, in the Apple App Store

- U.S. Listings Inventory Rises 4 Percent in August

- The Fed Leaves Rates Alone for Now in September

- Blue Roc Premier Properties Earns CEO of the Year Award

- Commercial Mortgage Debt Outstanding in U.S. Jumps to $4.60 Trillion in Mid 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More