The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

U.S. Luxury Home Prices Dip in Q3, First Time in Four Years

Residential News » Scottsdale Edition | By Michael Gerrity | December 15, 2015 9:00 AM ET

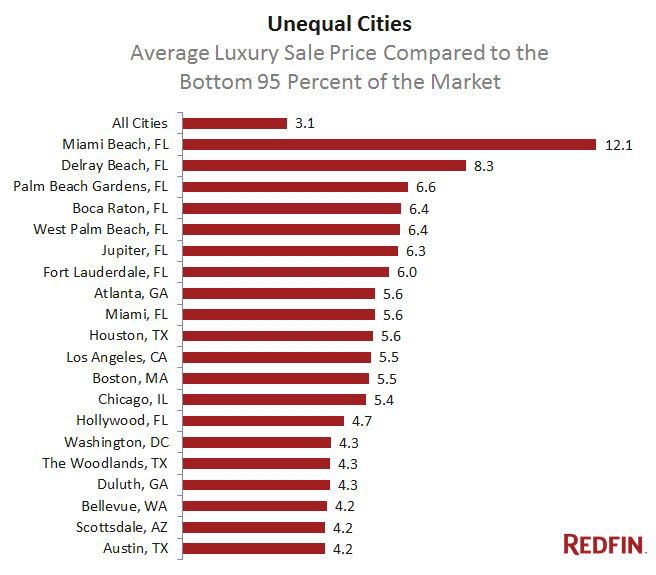

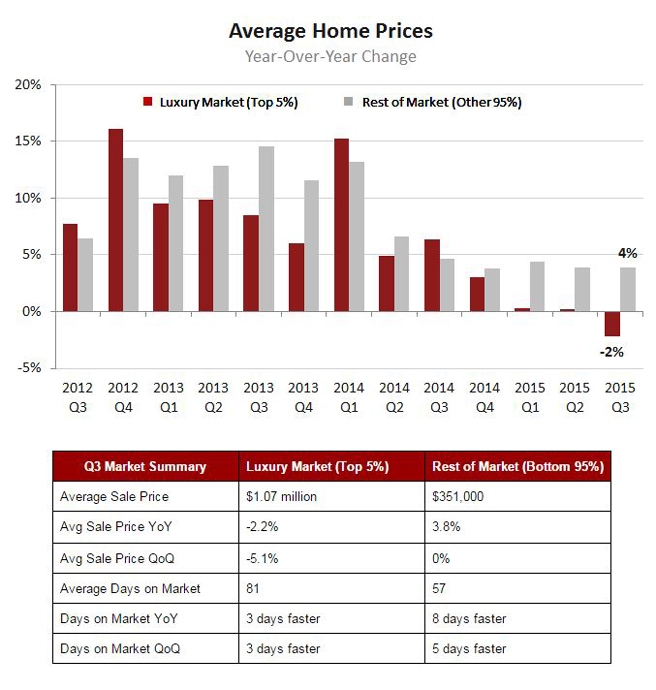

According to national real estate broker Redfin, U.S. home prices in the luxury market fell in the third quarter for the first time since 2012. Prices in the luxury market, which Redfin defines as the priciest 5 percent of home sales, fell 2.2 percent year over year, while prices in the rest of the market increased 3.8 percent.

The dip in luxury values might indicate that wealthy buyers and foreign investors are stepping out due to volatility in the global markets and fears that prices have climbed too high, too quickly. A bigger supply of luxury products might also be pushing prices down.

"High-end buyers are usually not weighed down by rates, mortgages or competition from other buyers, but they do look for deals," said Redfin chief economist Nela Richardson. "The luxury market was the first to recover from the housing downturn, and now it's a bellwether of slowing price growth for the rest of the market. Sales at the top end of the market continue to soar, but prices are downshifting."

The biggest luxury-market losers were Scottsdale, Ariz. and Boca Raton, Fla., where prices sunk 15 percent year over year. Fort Lauderdale, Fla. saw a 14 percent drop in values. Luxury prices in Boca Raton and Fort Lauderdale have now seen significant declines for two consecutive quarters, likely due to a wave of luxury condos hitting the market.

Not all markets had a slowdown. Washington, Denver, Delray Beach, Fla., and Bend, Ore., saw double-digit, year-over-year price gains in the third quarter. In California, the East Bay of San Francisco was also hot. In Oakland and Fremont, luxury home prices increased 9 percent and 8 percent respectively.

According to local Redfin agent Mia Simon, Oakland and Fremont are both popular because they are more affordable than San Francisco and Silicon Valley. Even well-heeled buyers who can afford a home in the top 5 percent of the market are concerned about the sky-high prices in San Francisco and San Jose. Simon expects Oakland and Fremont to continue to see above average appreciation in the years to come due to well-ranked schools, walkability and public transportation options.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

- Foreign Investment in U.S. Homes Surges to $56 Billion, Highest Growth Since 2017

- Tariffs, Weak Canadian Dollar Cool U.S. Real Estate Demand from Canadians

- U.S. Remodeling Market Sentiment Slips in Q2

- Monaco F1 Grand Prix Sparks Local Property Frenzy

- Canada Home Sales Climb for First Time in 6 Months as Market Stabilizes

- U.S. Real Estate Associations Applaud Senate Passage of Trump's Big Beautiful Bill

- Greater Fort Lauderdale Area Residential Sales Dive 18 Percent Annually in May

- Top 10 Things to Know About the U.S. Housing Market Mid-2025

- Global Luxury Housing Rents Stabilize as Post-Covid Surge Cools

- World Property Ventures to Reorganize as a Digital Investment Bank

- FHFA Signals to Count Crypto in U.S. Mortgage Underwriting

- Greater Miami Area Residential Sales Implode 20 Percent Annually in May

- U.S. Home Sales Remain Sluggish in May

- Ireland Home Prices Surge 12.3 Percent Annually in Q2

- Global Super-Prime Housing Markets Rally in 2025

- Home Flipping in U.S. Hits Lowest Level Since 2018

- World Property Markets to Launch Industry Wide Joint Venture Funding Round

- Greater Orlando Home Sales Down 12 Percent Annually as Inventory Hits 14-Year High

- Sluggish Fed Rate Cuts in 2025 Keep U.S. Home Sales on Ice

- World Property Ventures Bets Big on Real Estate's Digital Future

- Las Vegas Home Sales Dive 13 Percent Annually in May, Condos Down 19 Percent

- Annualized Bank Repossessions Rise Sharply in the U.S.

- International Buyer Demand for U.S. Homes Upticks in Early 2025

- Greater Palm Beach Area Residential Sales Drop 9 Percent Annually in April

- WORLD PROPERTY SEARCH: The Future 'Google of Real Estate' in the Making

- 2025 Hurricane Season Puts 6.4 Million U.S. Homes at Risk of Storm Surge

- Korea's Co-Living Market Heats Up in 2025

- U.S. Pending Home Sales Plunge 6.3 Percent in April

- Investor Condo Purchases in U.S. Fall to 10 Year Low in 2025

- U.S. Single-Family Rents Climb for Third Straight Month

- U.S. New Home Sales Unexpectedly Surge 11 Percent in April

- U.S. Home Sales Continue Slump in April Despite Growing Inventory

- Opportunity Zone Home Prices Surpass National Growth in Half of U.S. Markets

- Spring Home Sales Sputter in U.S. as High Costs Weigh on Buyers

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More