U.A.E. (Dubai) Real Estate News

U.A.E. (Dubai)

Global Home Price Growth Further Slows in Mid-2023

Based on Knight Frank's latest Global House Price Index, average annual price growth slowed across a cohort of world cities in Q2 2023, falling to 1.7% from 3.2% in Q1 of 2023.

Global Cross Border Commercial Property Capital Flows Implode 52 Percent Annually in 2023

According to a new report by CBRE, global cross-regional capital flows totaled $30.5 billion in H1 2023, down by 52% from H1 2022 and the second consecutive half-year period with an approximate 50% decrease in volume.

Global Residential Rents Surge 300 Percent Their Prepandemic Growth Rates in 2023

Based on the 10 cities covered by Knight Frank's Prime Global Rental Index, global rental values rise 7.5% in the year to June. While this rate was down from the 8.2% seen in Q1, and lower still than the 12.2% growth reached in the first quarter of 2022.

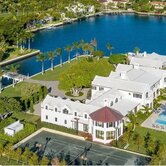

Dubai Leads the World for Residential Property Price Growth in 2023

Based on new data by global property consultant Knight Frank, surging inflation and constant mortgage rate hikes in 2023 have hobbled many mainstream property markets, worldwide. While many property markets have borne the brunt of this pain, property sales volumes, not home prices, have been the greatest casualty to date.