The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

ECB's Quantitative Easing to Boost Eurozone Property Markets

Commercial News » London Edition | By Michael Gerrity | January 23, 2015 8:34 AM ET

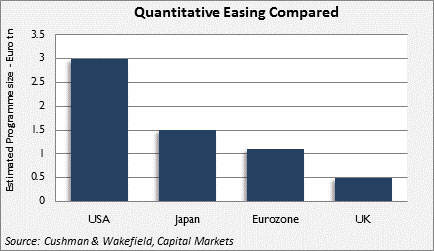

This week the ECB has taken markets somewhat by surprise with the scale of its quantitative easing (QE) program and this should help to consolidate recent bond yield and currency falls and hopefully pave the way for higher inflation expectations and also better GDP growth.

Maintaining market confidence will be crucial to making this happen in the short term of course but to deliver real and sustainable changes going forward, the QE program needs to encourage governments to get on with deeper structural reforms. In our opinion it will be the committed reformers like Spain who will be most rewarded with increased activity and inward investment.

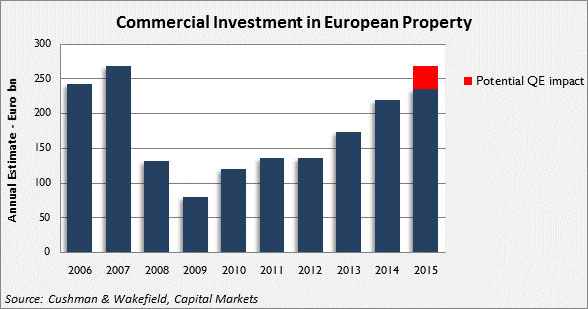

David Hutchings, Head of EMEA Investment Strategy at Cushman & Wakefield said, "If the QE program is successful, the impact on property markets in general could be substantial as even more demand will now be diverted into the market. As a result, yields are set to fall more than expected and volumes will be pushed further back towards record levels."

Cushman & Wakefield predicts that without QE, the market would be expecting a 5-10% increase in European investment volumes this year alongside a 20-30 basis points prime yield fall. With a successful QE package delivering lower for longer borrowing costs, more growth and some reform, that forecast is increased to a 40-70 basis point yield fall and a 20% plus jump in property trading.

Cushman & Wakefield further points outs that this assumes investors can find the stock to buy, which relies on bank sales and deleveraging as well as profit taking and stock recycling. Also however according to Hutchings, "We can expect increased interest in a range of global markets as Europeans export capital in search of opportunities, and also a move back into development, helped by recent falls in commodity prices softening build costs. In addition, we are now anticipating more corporate activity - including asset sales by corporates, joint ventures and takeovers."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More