Commercial Real Estate News

U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

Commercial News » New York City Edition | By Michael Gerrity | May 15, 2025 8:30 AM ET

Commercial lending surge led by banks and CMBS

Based on CBRE's latest research, U.S. commercial real estate lending posted a strong comeback in the first quarter of 2025, buoyed by a surge in bank activity, tighter loan spreads, and increased financing demand. Despite lingering caution around federal policy and economic uncertainty, the market showed notable resilience.

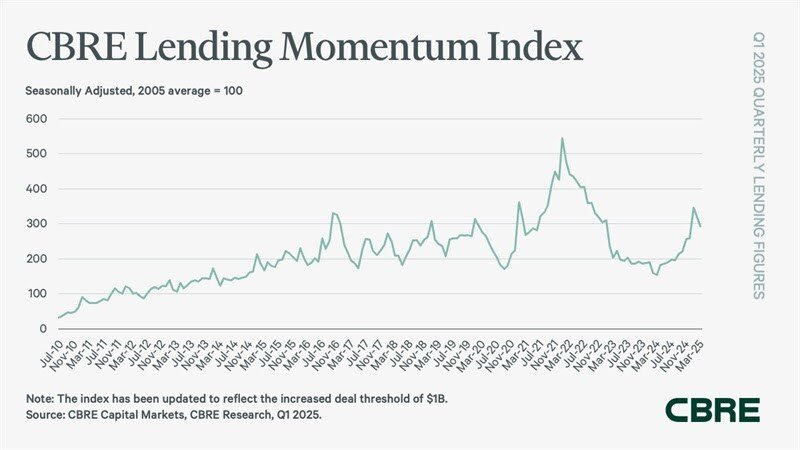

CBRE's Lending Momentum Index--tracking commercial loan closings by the firm--jumped 13% quarter-over-quarter and soared 90% year-over-year. The index surpassed 300 in early 2025 for the first time since Q1 2023, before ending the quarter at 292 due to a slight slowdown in March tied to broader market volatility.

"Despite persistent and volatile Treasury rates, credit spreads continued to compress, enabling sponsors to pursue early refinancings and accretive debt for acquisitions," said James Millon, U.S. President of Debt & Structured Finance at CBRE. "The uptick in investment sales created fresh financing opportunities and helped establish pricing benchmarks for less liquid asset types."

Banks and CMBS Drive Growth

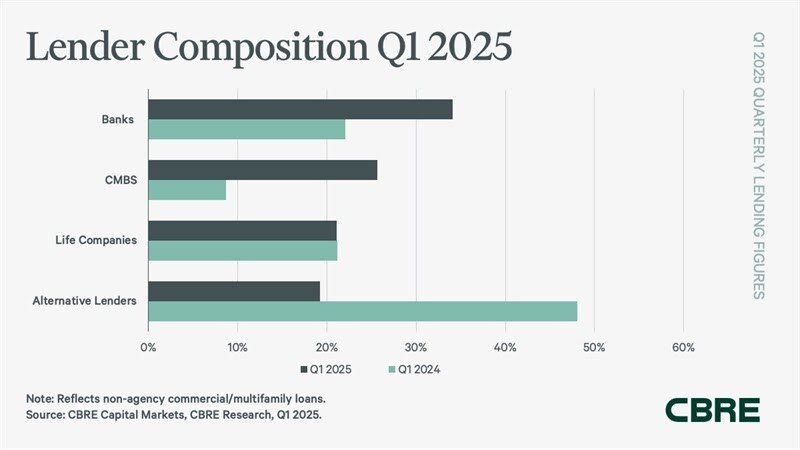

Banks led the non-agency lending segment in Q1, capturing a 34% market share--up from 22% in the previous quarter--helped by favorable regulations and stronger balance sheets. CMBS conduits followed closely with a 26% share, tripling their stake from 9% a year earlier. Industrywide, private-label CMBS issuance was up 132% year-to-date compared to Q1 2024.

Life insurance companies held steady at 21% of non-agency originations, while alternative lenders, including debt funds and mortgage REITs, saw their share drop to 19%, down from 48% a year ago. The pullback among debt funds reflected a more cautious stance and rising competition, leading to a 17% annual decline in origination activity.

Loan Spreads and Metrics Show Optimism With Restraint

Loan pricing grew more competitive in early 2025. The average commercial mortgage loan spread narrowed to 183 basis points--down 29 bps year-over-year. Multifamily loan spreads dropped to 149 bps, their lowest level since Q1 2022, fueled by tighter agency execution.

Office financing made a surprising rebound, with many single-asset, single-borrower (SASB) transactions reaching the finish line. Data center construction loans also remained in high demand, driven by diversified tenant needs beyond traditional tech anchors.

Meanwhile, underwritten cap rates climbed by 24 bps to 6.1%, while debt yields increased 90 bps to 10.3%--a sign of lenders adjusting risk expectations. The average loan-to-value (LTV) ratio dipped to 62.2%, indicating more conservative underwriting standards.

Agency Lending Sees Mixed Results

Multifamily agency lending totaled $22 billion in Q1, marking a 15% year-over-year increase despite a 58% drop from Q4 2024. CBRE's Agency Pricing Index, which tracks fixed mortgage rates for 7-10-year multifamily loans, rose to 5.8%, up 40 bps quarter-over-quarter.

"While agency activity remained a steady force, non-agency multifamily deals--particularly those backed by floating-rate bridge or bank financing--gained traction, offering borrowers more flexibility in a still-evolving rate environment," Millon added.

Overall, the first quarter's data paints a picture of a commercial real estate lending market that is not only recovering, but also adapting to a complex and shifting macroeconomic landscape.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Commercial Property Investors Poised to Increase Allocations in 2026

- U.S. Commercial Mortgage Debt Climbs Toward $5 Trillion

- AI Sparks a Global $3 Trillion Data Center Supercycle

- AI Rewrites Playbook for Global Property Dealmakers, Says PwC

- Hong Kong's Central Office Market Enjoys First Rent Increase Since 2022

- U.S. Commercial Real Estate Lending Spikes in Q3

- Commercial Lending Surges in America

- North America Real Estate Enters a Tech-Driven, Boomers-Fueled Era in 2026

- U.S. Commercial Mortgage Delinquencies Ease in Q3

- Rents Hit 18-Year High in Tokyo as Japan's Office Market Defies Gravity

- Hong Kong Office Market Rebounds, IPO Activity Spurs Leasing Demand

- Poland's Commercial Markets Enjoy Rising Property Investment Activity

- Asia-Pacific Property Markets Show Signs of Revival as Investment Rises

- World Property Ventures Raising Capital to Digitize the Global Real Estate Economy

- U.S. Data Center Boom Tests Power Grid as AI Demand Outpaces Supply

- Commercial, Multifamily Mortgage Debt Climbs to Record $4.88 Trillion in U.S.

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs