The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Jakarta, Dubai, Miami Post Big Price Increases

Residential News » Asia Pacific Residential News Edition | By Kevin Brass | March 11, 2013 9:08 AM ET

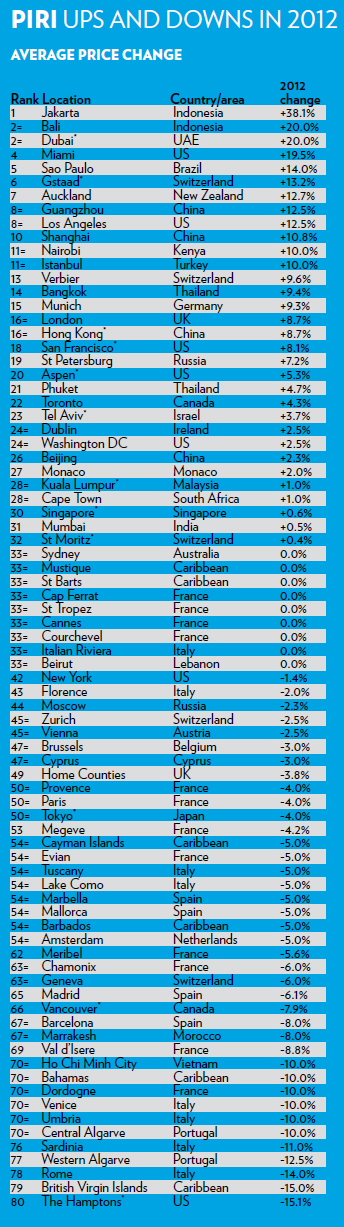

Some of the luxury property markets hardest hit by the economic collapse posted the largest price increases in the world in 2012, according to Knight Frank's annual wealth report.

Prices for Dubai luxury homes jumped 20 percent in 2012 compared to a year earlier, while Miami's high-end property prices increased 19.5 percent, the property company reports.

Jakarta posted the largest price gains in the world, with the price of a luxury home increasing by 38.1 percent in 2012, compared to 2011. Bali luxury home prices grew by 20 percent, Knight Frank reports.

"Jakarta benefited from continued strong GDP growth, which has stood at or above 6 percent for five out of the past six years and, in particular, from rapid growth in middle-class wealth," Knight Frank found.

But the return of the downtrodden markets was the report's most dramatic news.

Dubai was "the epitome of the global downturn," with prices falling 60 percent from 2006 to 2011, Knight Frank notes. The city's luxury home market has rebounded thanks to increased demand, lower prices and "its location as a strategic hub, able to attract wealth from the Middle East, North Africa, the Indian subcontinent and central Asia," according to the report.

Miami continued to benefit as a "safe haven" market, along with London and New York.

"Russians, long an important driver of the London market, became a growing force in both New York and Miami, alongside ever-rising demand from Latin America," Knight Frank found.

London and Hong Kong prices posted similar 8.7 percent increases, fueled by international buyers. New York luxury prices slid 1.4 percent, according to Knight Frank. The biggest drop recorded by the firm was in the Hamptons, the New York enclave, where prices dropped 15.1 percent.

Several key factors are shifting dynamics around the world, creating a "polarized" global market, Knight Frank research chief Liam Bailey says in the report:

"The search for safe haven investments has continued to propel prices higher in key global cities; some of the markets worst hit by the global financial crisis appear at long last to be recovering; and the impact of growing global wealth flows has kept governments busy in their attempts to limit price growth and deflate nascent real-estate bubbles before they explode"

Prices in several key Asian markets continued to grow, despite government efforts to dampen the market. Hong Kong's 8.7 percent increase in 2012, compared to a 4.6 percent increase in 2011.

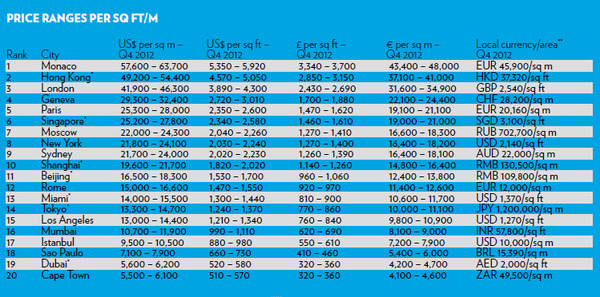

Monaco continued as the most expensive market in the world, with prices ranging between $5,350 and $5,920 a square foot. Hong Kong was second with prices between $4,570 and $5,050 a square foot, followed by London, Geneva and Paris.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More