San Diego Real Estate News

San Diego

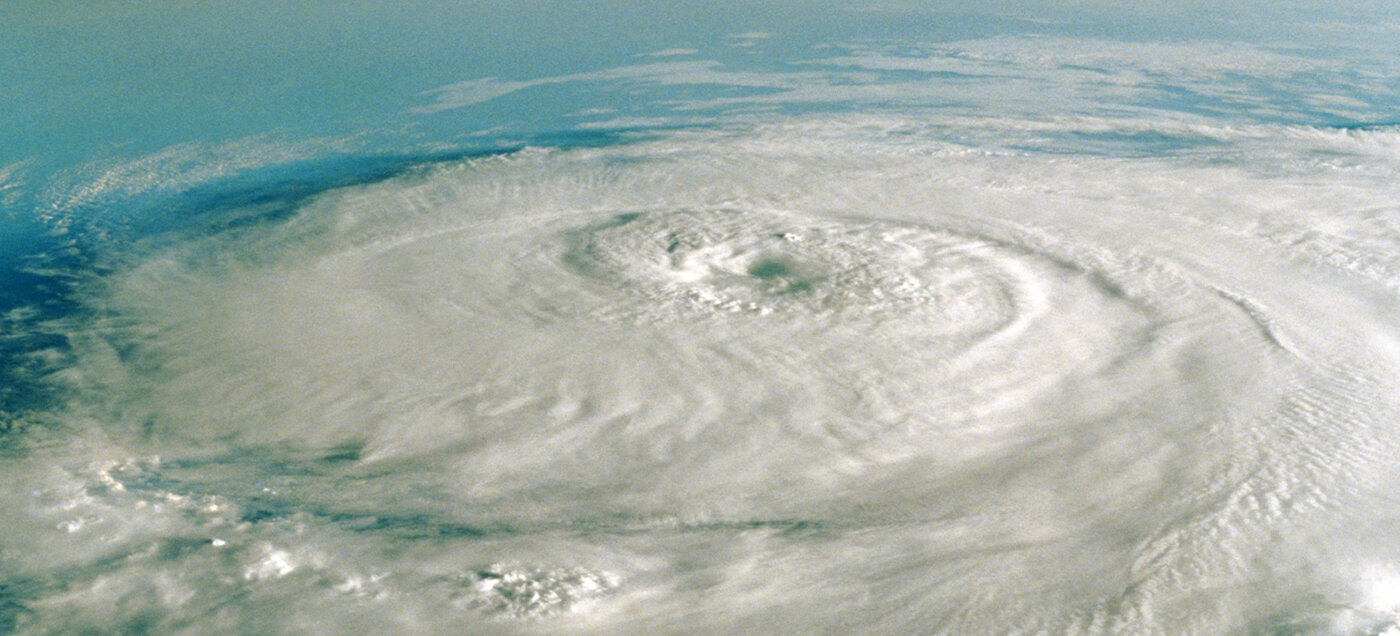

2025 Hurricane Season Puts 6.4 Million U.S. Homes at Risk of Storm Surge

Now that the 2025 hurricane season has officially begun, according to NOAA, a new and growing concern is emerging for homeowners along the U.S. coast -- especially in an already tight housing market with historically low inventory.

U.S. Home Sales Continue Slump in April Despite Growing Inventory

According to new data released by the National Association of Realtors, existing-home sales dipped again in April 2025, reflecting ongoing challenges in the U.S. housing market despite growing inventory and continued buyer interest.

Spring Home Sales Sputter in U.S. as High Costs Weigh on Buyers

Sales of existing U.S. homes dropped to a seasonally adjusted annual rate of 4.2 million in April 2025, hitting their lowest level since October 2024, according to new data released by Redfin. The figure marks a 0.2% decline from March 2025, and a 1.1% drop year-over-year--breaking a seven-month streak of annual gains.

California Home Sales Dip in March Amid Rising Economic Concerns

California home sales took a step back in March 2025 as growing economic uncertainty and consumer anxiety weighed on the state's housing market, according to the latest report from the California Association of Realtors (C.A.R.).

Developer Spotlight

San Diego Property News

Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

Posted on February 21, 2025

More Results: 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 | 35 | 36 | 37 | 38 | 39 | 40 | 41 | 42 | 43 | 44 | 45 | 46 | 47 | 48 | 49 | 50 | 51 | 52 | 53 | 54 | 55 | 56