Houston Real Estate News

Houston

U.S. Office Market Experiences Historic Conversion Shift

In a landmark shift for the U.S. office real estate market, more office space is set to be removed from inventory than added for the first time since at least 2018, according to a new report from global real estate services firm CBRE. The trend marks a critical turning point in the sector's path toward stabilization and early signs of recovery.

International Buyer Demand for U.S. Homes Upticks in Early 2025

A new report from Realtor.com reveals a modest uptick in international interest in U.S. real estate, with 1.9% of the platform's traffic in the first quarter of 2025 coming from global home shoppers -- up slightly from the same period in 2024.

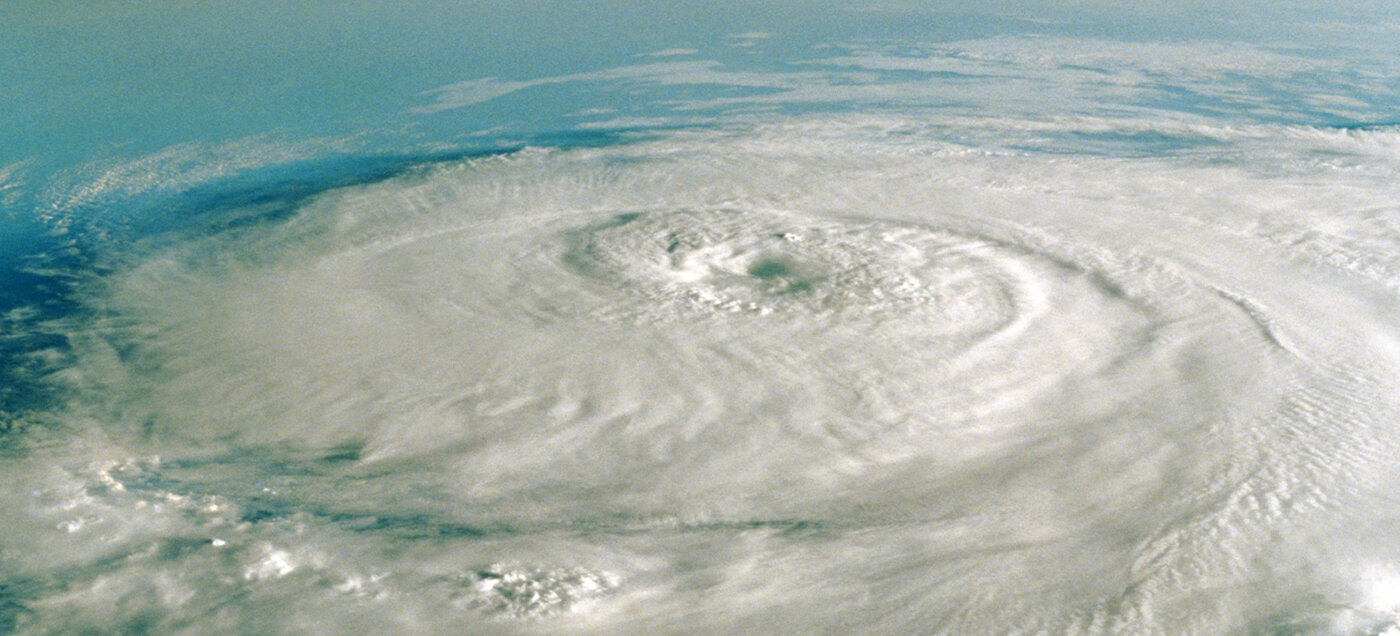

2025 Hurricane Season Puts 6.4 Million U.S. Homes at Risk of Storm Surge

Now that the 2025 hurricane season has officially begun, according to NOAA, a new and growing concern is emerging for homeowners along the U.S. coast -- especially in an already tight housing market with historically low inventory.

Investor Condo Purchases in U.S. Fall to 10 Year Low in 2025

After years of volatile swings in real estate activity during and after the pandemic, U.S. property investors appear to be returning to more measured behavior. According to new data released by Redfin, investors purchased 46,726 homes in the first quarter of 2025--a modest 2% increase from a year ago--signaling a stabilization of investor activity in the residential market.

Developer Spotlight

Houston Property News

More Results: 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 | 35 | 36 | 37 | 38 | 39 | 40 | 41 | 42 | 43 | 44 | 45 | 46 | 47 | 48 | 49 | 50 | 51 | 52 | 53 | 54 | 55 | 56