The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Market Report: Singapore Residential Property

Residential News » Asia Pacific Residential News Edition | By Alex Frew McMillan | August 7, 2013 10:06 AM ET

After seven rounds of measures aimed at cooling the residential property market, Singapore's housing market is slowing and will likely have further to fall this year, market watchers say. The latest round of curbs expanded the restrictions to nonresidential real estate for the first time, and many in the city expect an eighth round of restrictions later this year.

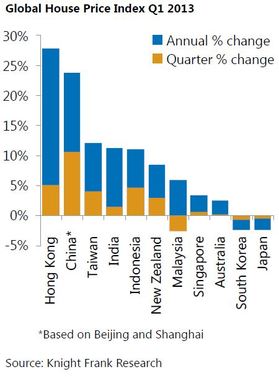

The government has been responding to criticism that house values have risen too fast in a short period of time, with plenty of Singaporeans blaming mainland Chinese for the price hikes. Home prices are 52 percent above their troughs during the worst of the financial crisis, according to the brokerage Knight Frank.

The government has been responding to criticism that house values have risen too fast in a short period of time, with plenty of Singaporeans blaming mainland Chinese for the price hikes. Home prices are 52 percent above their troughs during the worst of the financial crisis, according to the brokerage Knight Frank.With China's growth slowing, most Asian economies are likely to face a challenging couple of years. According to the investment bank Nomura, a slower Chinese economy will likely shave 1.3 percentage points off Singapore's growth rate in 2014, to 2.2 percent rather than 3.5 percent.

Tourism from China, in particular, would be affected, hurting hotel operators. Some of Singapore's largest developers would also take a hit such as CapitaLand and Keppel Land, because they have diversified extensively into China, as is the case with the bank DBS.

After the latest round of curbs, people who are not permanent residents in Singapore must now pay an extra 15 percent on the top of any purchase price of residential property. The measure has been widely viewed as an attempt to curb the number of purchases by mainlanders. Singapore has also increased the amount that home buyers must put down to 25 percent of the purchase for any second loan.

The heavier freight on overseas buyers has had a remarkable effect. The number of foreign buyers, whether local permanent residents or not, fell 24 percent in 2012, compared with the previous year, according to Jones Lang LaSalle.

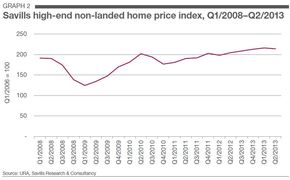

The heavier freight on overseas buyers has had a remarkable effect. The number of foreign buyers, whether local permanent residents or not, fell 24 percent in 2012, compared with the previous year, according to Jones Lang LaSalle. The average price of high-end homes fell 1 percent in the second quarter, the first decline in a year, according to Savills. "As the latest rules weigh down on market sentiment, activity in the residential market is expected to moderate over the next few months and developers are likely to adopt a more cautious stance when bidding for new sites," the consultancy said.

The property brokerage Knight Frank anticipates that home prices will fall 5 percent in Singapore this year, while Savills predicts a fall of 3 to 5 percent. Analysts say only deep-pocketed investors are still searching for property in Singapore, with many international buyers having shifted away from protectionist markets like Singapore and Hong Kong to the United States, where it's increasingly clear a housing rally is under way.

Rents are currently running at around S$521 (US$412) per square meter per year, according to Jones Lang LaSalle, but are likely to fall given the decreasing interest in property. The brokerage noted that 15-year Singapore government bonds are now yielding more than luxury property, meaning very long term investors will start preferring government debt.

Rents are currently running at around S$521 (US$412) per square meter per year, according to Jones Lang LaSalle, but are likely to fall given the decreasing interest in property. The brokerage noted that 15-year Singapore government bonds are now yielding more than luxury property, meaning very long term investors will start preferring government debt. Home-buying habits are also shifting. "In our conversation with our business lines and clients, there is a growing interest in fixed-rate mortgages as buyers look to hedge against any unexpected rise in interest rates," JLL said in a report.

Singapore's real estate investment trusts were down 5.7 percent in June, bringing their year to date performance to a fall of 8.0 percent, according to the Asia Pacific Real Estate Association. That follows a 19 percent gain in the last year.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More