The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

French Riviera Most Globally Desired Second Home Market

Residential News » Europe Residential News Edition | By Michael Gerrity | April 8, 2014 9:36 AM ET

While many housing markets around the world have been in recovery mode over the last five years, it is likely that getaway cities will deliver the best growth in the next five years, according to international real estate advisor Savills new report titled Spotlight on Prime Residential Retreats.

The widely invested and sought after hot spots of the Mediterranean, the Alps, South Africa and the Caribbean were hit hard in the global economic downturn, however, 2013 marked a turning point with renewed appetite for leisure property purchases. Savills anticipates that many residential retreats will continue to see price growth of up to 10% in some cases in 2014 with some returning to their former peaks by 2019. Recovery will be led by high quality, low supply prime hotspots in the Balearics, Tuscany and the Caribbean.

There are three main drivers behind this recovery. As many prime city markets are becoming more fully valued, buyers are actively looking for alternative real estate markets in which to invest. Prime second homes in the most sought after locations are an obvious choice.

Due to more liquidity in the market, investment is returning. Interest rates in Europe are low making overseas property loans more affordable (although lending requirements are more stringent than the pre-crunch era). Equity remains the main form of finance in the less established markets.

Thirdly, some jurisdictions such as Portugal, Cyprus and Antigua, are offering 'golden visa's to real estate purchasers buying above a certain value. This is acutely boosting demand for resorts and retreat properties.

Thirdly, some jurisdictions such as Portugal, Cyprus and Antigua, are offering 'golden visa's to real estate purchasers buying above a certain value. This is acutely boosting demand for resorts and retreat properties. Yolande Barnes, director, Savills World Research, says: "There are strong signs that the recovery which started in major world cities in 2009 is now rolling out to the hinterland and boltholes inhabited during weekends and vacations by equity rich homeowners."

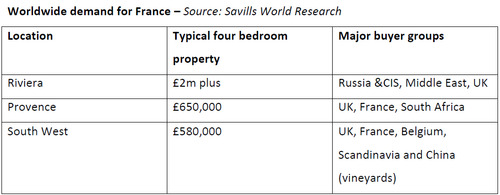

The French Riviera remains the most exclusive and desirable location for second homes and transaction volumes are starting to recover from a low base. An extremely limited pool of stock coupled with demand from buyers around the world means that the long term outlook for prices in this area are positive.

The more peripheral locations such as Valbonne and Mougins have started to see the return of the British buyer with Russian and Middle Eastern buyers demonstrating strong demand for rental properties. Inland, Provence attracts buyers from across Europe, particularly from the UK. Whilst in the South West, the market for renovation projects has largely disappeared.

The Chinese have been high profile investors in Bordeaux vineyards as business ventures and some early interest in hotels. Paul Tostevin, associate director, Savills World Research, adds: "Both trends echo the expansion of Chinese tourism in France. If these buyers were to embrace ski resorts and sunbelt destinations in the same way as Americans and Europeans, the potential from this market to expand would be substantial."

The Chinese have been high profile investors in Bordeaux vineyards as business ventures and some early interest in hotels. Paul Tostevin, associate director, Savills World Research, adds: "Both trends echo the expansion of Chinese tourism in France. If these buyers were to embrace ski resorts and sunbelt destinations in the same way as Americans and Europeans, the potential from this market to expand would be substantial."After a long recession, there are signs that the second home market is starting to look brighter. Prices for good quality second homes have fallen by between a quarter and a third from the peak of 2007 meaning that there are still some bargains to be had.

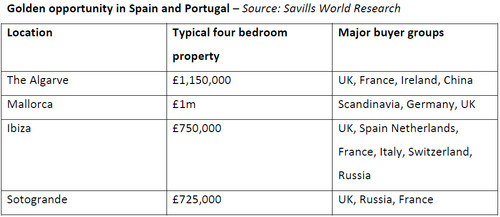

Portugal's golden visa scheme has seen significant uptake from the Chinese, who accounted for 78% of the 318 visas that were issued in 2013. In Quinta do Lago, British buyers accounted for 57% of all purchases in the area in 2013. Properties at the top end of the markets remain in demand with a resurgence in smaller townhouses and apartments.

In Spain, Ibiza has been the star performer where prices for the best villas in the best spots have recovered to their pre-peak levels. In neighbouring Mallorca, where supply is greater, the markets has remained repressed, although Scandinavians are particularly active.

In Sotogrande, on mainland Spain, British, Russian and French buyers are benefiting from heavily discounted prices, some 30-40% below their peak. Some purchasers are taking advantage of the low interest rates however the majority of buyers are equity-rich. Sales continue to be slow with high supply levels.

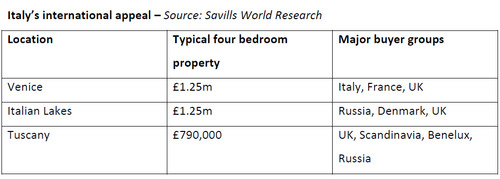

In Sotogrande, on mainland Spain, British, Russian and French buyers are benefiting from heavily discounted prices, some 30-40% below their peak. Some purchasers are taking advantage of the low interest rates however the majority of buyers are equity-rich. Sales continue to be slow with high supply levels. Italy has avoided the oversupply seen in Spain and Portugal, however its residential market has struggled. The domestic market has been subdued and mortgages are difficult to come by, especially for international buyers therefore cash buyers dominate.

There are some second home locations that have, against the odds, avoided severe price falls, and still attract high end international buyers, such as Venice, Lake Como and Tuscany.

Venice real estate remains highly prized with buyers choosing to occupy the property themselves as well as renting it out. Rentals are underpinned by solid tourist demand and yields of 5% are achievable. Further south, Tuscany has seen price falls of between 15-30% from their former high. The more expensive Chianti region has seen some market movement due to some high profile vineyard sales to Russian buyers.

The Lunigiana area, closer to Milan, has seen the most activity as buyers look for lower priced properties. Russians, South Africans and French buyers are present here.

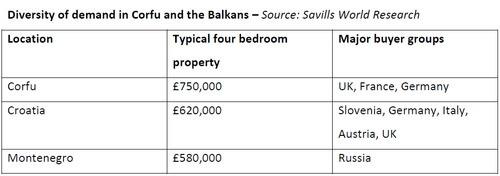

The Lunigiana area, closer to Milan, has seen the most activity as buyers look for lower priced properties. Russians, South Africans and French buyers are present here. Tourism is a major factor of economic prosperity in Corfu and the Balkans, attracting visitors from across Europe, and has been tipped to lead the economic recovery in the region.

Corfu has remained relatively resilient when set against the markets of mainland Greece. Prices on the island are down by around 30%, compared to price falls in excess of 50% in the mainland cities. There are deals to be found on Corfu, however demand is selective with turnkey properties favored whilst the market for building plots has all but disappeared.

In Montenegro, Russians are the biggest non-domestic buyer group. Volumes are down 40% from their former highs, however the area has enjoyed strong economic growth and inward investment and its favorable tax climate and pro-business environment will hold it in good stead.

In Croatia, property prices fell significantly during the downturn, but have stabilized in the last year. Apartments on the coast have now risen slightly in value, by 1% in the year to January 2014.

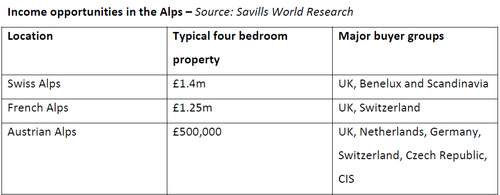

In Croatia, property prices fell significantly during the downturn, but have stabilized in the last year. Apartments on the coast have now risen slightly in value, by 1% in the year to January 2014.The Alpine property market saw prices stabilize in 2013, following falls in 2012 and 2011. Both viewings and transactions increased in 2013, while both where up again - by 200% - in January and February of 2014.

Switzerland's status as a safe haven is an attraction from buyers around the world. Apartments are popular, particularly new build properties with a range of attractive offers such as proximity to the lifts, parking, 'wellness centres' and concierge services.

In Austria, lower capital values have meant that buyers can find good income producing investments. New developments are underway in many resorts so supply is not as constrained as in some other alpine locations.

The French Alps have seen a mixed picture in terms of pricing. Courchevel has seen prices stabilize at 30% below 2008 values, limited supply has helped Megeve and Val d'Isere see sustained price growth of the last five years to 2013.

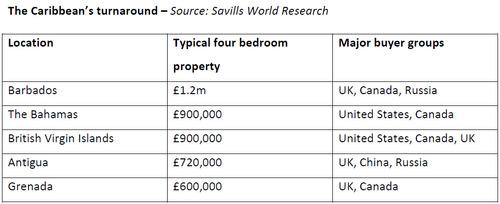

The French Alps have seen a mixed picture in terms of pricing. Courchevel has seen prices stabilize at 30% below 2008 values, limited supply has helped Megeve and Val d'Isere see sustained price growth of the last five years to 2013.Residential values fell by around 30% across the Caribbean during the North Atlantic debt crisis, but 2013 saw a return of buyer interest in the region's second home market. Prices seem now to have bottomed out and transactions are beginning to pick up again.

Buyer interest has grown in the most well-known and prominent islands. A dearth of new development during the downturn means that there is little or new supply and so off-plan sales have resumed in the most established markets. Even the sale of individual development land plots is showing early signs of a come-back. Reasons for buying in the Caribbean are becoming more diverse: tax, lifestyle, investment, family ties, even flexible working arrangements, are part of the real estate story.

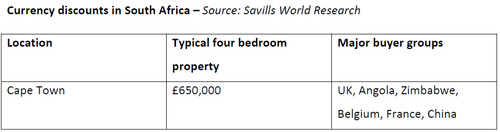

Buyer interest has grown in the most well-known and prominent islands. A dearth of new development during the downturn means that there is little or new supply and so off-plan sales have resumed in the most established markets. Even the sale of individual development land plots is showing early signs of a come-back. Reasons for buying in the Caribbean are becoming more diverse: tax, lifestyle, investment, family ties, even flexible working arrangements, are part of the real estate story.The Western Cape stands out of as one of South Africa's most in demand locations for owning residential property. A week rand puts international buyers in a strong position, having fallen 30% in euro terms, 23% to the US dollar and 24% on sterling since 2011.

Properties on the Atlantic Seaboard are the most sought after due to their beach access and Atlantic Ocean views. Stellenbosch in the Cape Winelands is also popular, appealing to families thanks to its quality schools and university.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More