Residential Real Estate News

Dubai Leads the World for Residential Property Price Growth in 2023

Residential News » U.A.E. (Dubai) Edition | By Michael Gerrity | August 17, 2023 7:45 AM ET

Based on new data by global property consultant Knight Frank, surging inflation and constant mortgage rate hikes in 2023 have hobbled many mainstream property markets, worldwide. While many property markets have borne the brunt of this pain, property sales volumes, not home prices, have been the greatest casualty to date.

Knight Frank also states that while prime residential markets are better insulated to the changing monetary policy environment given the sector's higher proportion of cash purchasers (46 percent), they're not immune.

Knight Frank last took the pulse of prime city markets in December 2022. Much has changed since then. New Zealand has seen four additional rate rises taking their tally to 12 hikes, Canada has introduced a ban on foreign buyers, Los Angeles's Mansion Tax is up and running and Singapore has ramped up stamp duty for non-residents from 30% to 60%.

It seemed an opportune time therefore to ask our global research teams to dust off their crystal balls and provide us with their take on the risks and opportunities facing their luxury housing markets and crucially, where they think prices are headed.

Which cities lead the forecast for 2023?

Of the 26 cities tracked, Dubai still leads the rankings for 2023, although annual growth is expected to cool to a less frothy 14%, down from 44% last year.

Surprisingly, 20 of the 26 cities still expect to see flat or positive price growth in 2023.

Tokyo, Paris, Madrid and Miami, all forecast to see 4% growth in 2023, completing the top five.

In Tokyo, persistently low interest rates and strengthening overseas interest explain the positivity, in Miami, low taxes, relative value and Latin demand are the key factors. Whilst for Paris and Madrid a lack of prime stock is cushioning prices.

Cooled Optimism

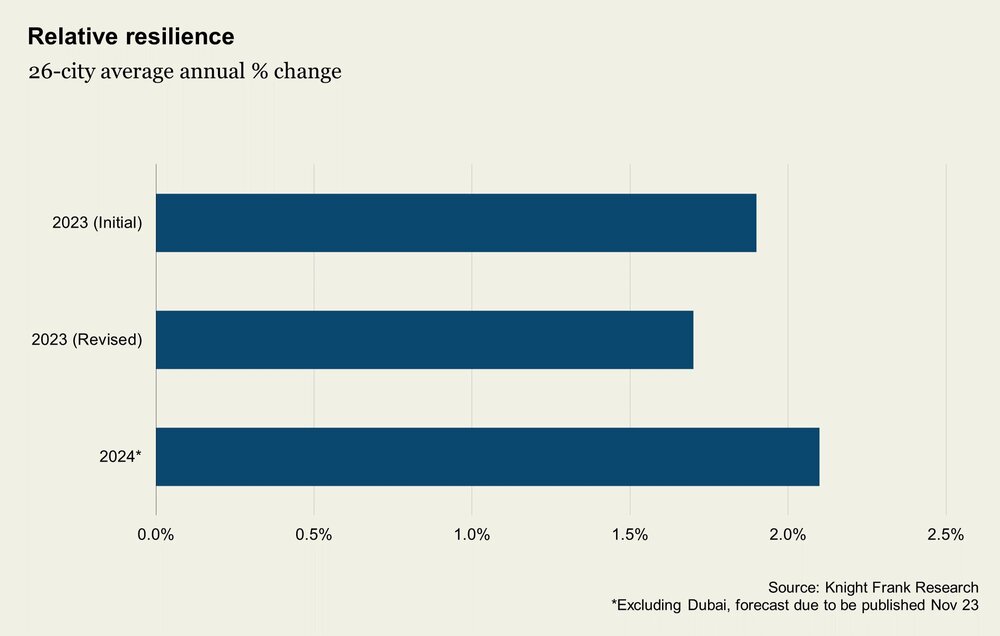

Despite an end to the era of cheap finance, a surging cost of living and the IMF's downbeat forecast that "advanced economies will struggle to exceed GDP growth of 1.4% by the end of 2024", the overall forecast has dipped only marginally, from 1.9% to 1.7%, between December 2022 and July 2023.

Christine Li, Knight Frank's Head of Research in Asia-Pacific says, "Firstly, real estate assets appeal in times of uncertainty and high inflation given they allow for diversification and act as an inflation hedge. Secondly, in some parts of the region, such as in New Zealand, there is a growing perception that policymakers are about to pivot, and sales volumes are strengthening given the market still offers firm fundamentals."

How has the prime price forecast changed?

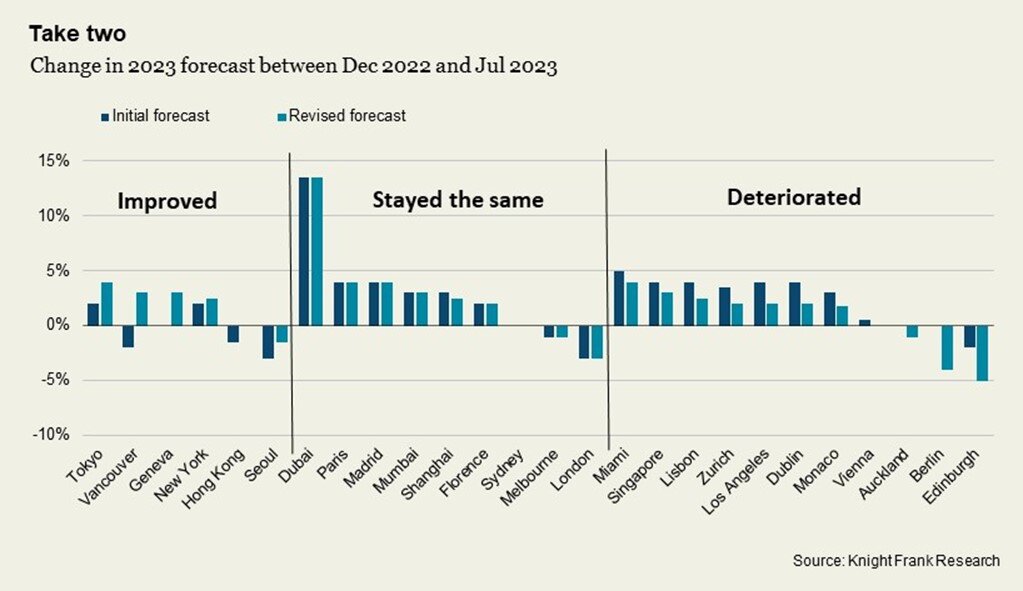

Of the 26 cities tracked, six cities are expected to see stronger performance than that predicted six months ago, nine have remained the same and the remaining eleven expect weaker growth.

Forecasts for Geneva and Vancouver have improved the most in percentage point terms, whilst Berlin, Edinburgh, Dublin, Los Angeles, Zurich and Lisbonn have deteriorated the most, albeit the declines remain relatively small at between 2% and 4%.

What's the outlook for 2024?

Prime prices are set to improve in 2024, averaging 2% growth, excluding Dubai.

Auckland and Mumbai lead the forecast for 2024, both tipped to see 5% growth over the 12-month period. Auckland is moving into recovery mode having seen prime prices dip 17% since their peak in Q3 2021.

Meanwhile, in Mumbai, improving GDP figures, the city's relative value and investment in infrastructure will push prices higher, whilst in Singapore (4%) demand will continue to outpace supply.

Madrid (4%), Paris (3%) and Dublin (2.5%) are expected to be the top performers, with a lack of luxury stock and relative economic resilience behind the positive outlook.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026