Residential Real Estate News

Global Home Price Growth Further Slows in Mid-2023

Residential News » U.A.E. (Dubai) Edition | By Michael Gerrity | October 13, 2023 8:22 AM ET

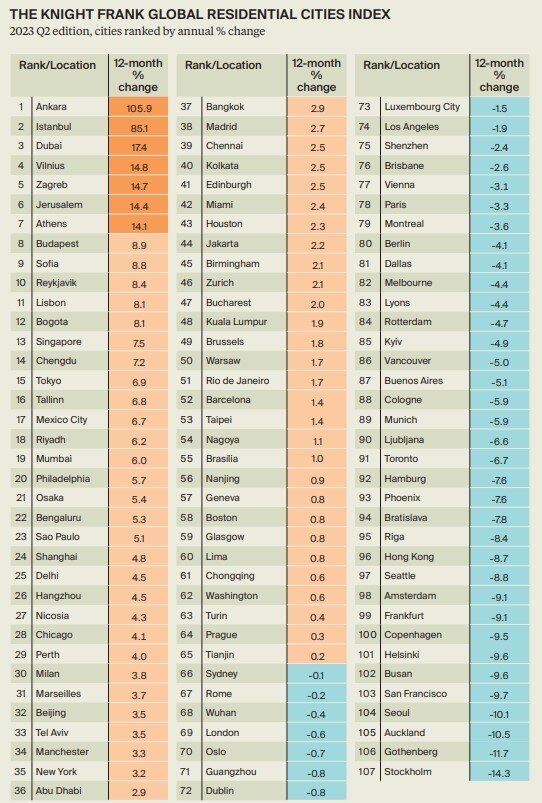

Based on Knight Frank's latest Global House Price Index, average annual price growth slowed across a cohort of world cities in Q2 2023, falling to 1.7% from 3.2% in Q1 of 2023.

However, more timely quarterly price change data reveals the beginnings of a revival in some key global markets. While considerable headwinds remain, Knight Frank anticipates a growing number of cities transitioning from falling to stable prices over the next two quarters.

This quarter's key takeaway is that average annual house price growth continues to slow globally. The shift from 3.2% in Q1 this year to 1.7% in Q2 marks the fourth consecutive quarterly slowdown from the recent peak in Q2 2022 when the post pandemic housing market boom drove annual growth to 11.8%.

Current growth is lower than that experienced in the first wave of the pandemic, when growth reached a low of 2.9% in Q2 2019. In fact, the last time growth was this slow was in Q1 2012, when the European Debt Crisis was putting sharp downward pressure on that region's housing markets.

Liam Bailey, Knight Frank's global head of research says, "There is early evidence that conditions are beginning to improve in a number of key global city markets. While it's likely that rising rates are now behind us, homeowners can expect to contend with current interest rate levels for the foreseeable future, which will limit the pace of the global housing market's recovery."

More recent numbers

However, more timely quarterly price growth shows a more complex story. From a high of 3.7% in Q1 2022, quarterly price growth fell sharply and turned negative in the final quarter last year. But growth has since ticked up with prices higher by 1.3% on average across our city markets in the three months to June 2023.

In the first quarter of this year some 48% of cities were seeing price declines in Q2, but this share had fallen to 40%. Improvements over the last three months are widespread - but the US, Canada, and Australia are standout examples.

At the end of 2022, 10 of the 12 US markets Knight Frank tracks were seeing quarterly price falls, by Q2 this year all 12 were seeing positive price growth. Similarly in Canada, all three of the markets tracked were falling in Q4 last year and are now rising - and at a strong quarterly rate. In Australia it is the same story with all cities in our basket seeing quarterly price growth in Q2.

Other markets have seen improvements - there are several strong examples in Europe with positive quarterly growth - in particular Oslo, Stockholm, and Glasgow.

While some key markets are strengthening, others are experiencing tougher conditions. Chinese mainland city markets have weakened, in Q1 nine of our 10 markets were rising on further slowing in price growth, but signs of recovery emerge 2023 Q2 Edition Knight Frank's Global Residential Cities Index provides a quarterly snapshot of trends in mainstream housing markets across more than 100 world cities Global Residential Cities Index a quarterly basis, this quarter half saw prices fall.

While still very strong, price growth in Turkey slowed sharply this quarter. Singapore saw a moderation in growth, and confirming the mixed nature of global markets, a number of European cities saw pricing conditions tighten further - most notably: Brussels, Marseilles, Athens, Barcelona and Madrid.

What's changed?

Knight Frank can see a number of drivers that are helping to underpin prices that include:

Reduced rate uncertainty: we are moving towards a more certain environment, with rate rises likely behind us, even if rates remain at levels which are high by recent historical standards.

Limited housing stock: a lack of new construction activity in recent years, coupled with lower market liquidity, has created a shortage of available properties to buy. This liquidity squeeze has been prompted by households avoiding moving to retain the benefit of low long-term fixed-rate mortgages.

Demographic shifts: some countries, most noticeably Australia, are experiencing a resurgence in inward migration after a pandemic-induced pause, leading to an increase in housing demand and prices.

Price corrections: some markets have already experienced significant residential market repricing. Eight markets have experienced drops of over 10%, and 25 markets have seen declines of over 5% since their 2022 market peak. Auckland led the way with a 20% fall to date. These adjustments, combined with high inflation rates, mean a number of markets have already seen an adjustment in real terms equivalent to that experienced during the Global Financial Crisis.

The evidence from this quarter's results points to an embryonic improvement in market conditions. As noted above, the impact of higher rates may be stabilising, but it hasn't disappeared. There will be a lagged impact from higher mortgage costs - which will be felt as a rising number of borrowers remortgage over the next 12 to 18 months, says Knight Frank.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026