The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

European Rents Drop Lower in Q2 as Global COVID Crisis Continues

Residential News » Paris Edition | By Michael Gerrity | July 22, 2020 9:00 AM ET

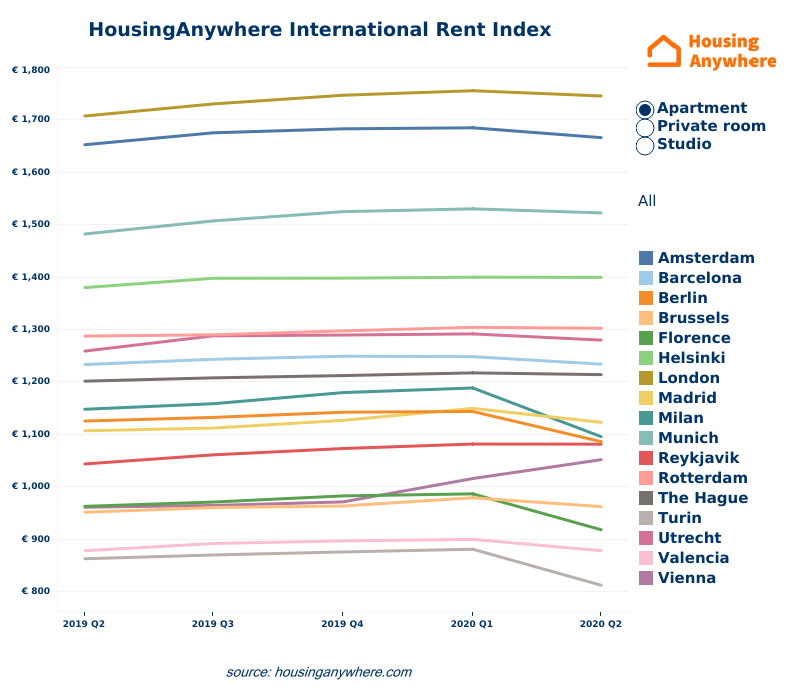

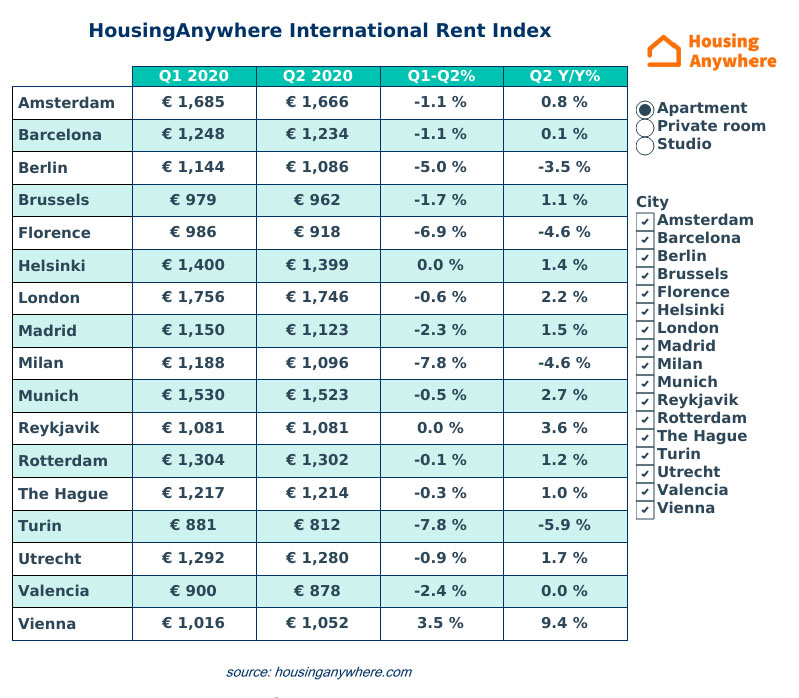

Based on the most recent HousingAnywhere International Rent Index Report for Q2 2020, quarterly rental prices have dropped in Q2 for nearly all European cities. While early signs of the impact of the Covid-19 pandemic on rental prices were already noticeable in the first quarter of 2020, the effects of the travel ban, which was valid from mid-March, are now fully visible.

Rents for single rooms have dropped the most by year-on-year comparison, while prices for apartments and studios are less impacted. This is a result of strengthening local markets: even though demand for these properties has decreased significantly among expats and young international professionals, it remains high among the local inhabitants of larger European cities. More single rooms are left vacant as there is less demand for these properties from international markets. Cities that were less impacted by Covid-19, in countries that were able to reopen their borders in mid-June, are showing smaller drops in rental prices as a result.

Despite the impact on the rental prices being evident, the effects differ per city. London remains the most expensive city to rent in Europe, but the rental price growth seen in the city in recent years is slowing down even further. In Milan, Barcelona, and Berlin, rental prices are now lower than in Q2 2019.

Most notable changes: Italian cities drop while Helsinki and Reykjavik remain stable

Italian cities are showing the biggest drops in rental prices of all cities featured in the Rent Index. Milan, the capital of Lombardy and the region where the virus struck the country the hardest, saw the biggest decreases in rent of all the cities in the Rent Index. Compared to the previous quarter, one-bedroom apartments dropped by -7,8% to EUR1,096 per month, a drop of -4,6% compared to Q2 2019. Turin, located 140 km from Milan, is showing a quarterly decrease of -7,8% for one-bedroom apartments to EUR 812 per month, a decrease of -5,9% compared to last year. In Florence, rental prices for one-bedroom apartments dropped by -6,9% to EUR 918, a drop of -4,6% compared to last year.

Helsinki shows a small impact on rental prices compared to the previous quarter: -0.1% for single rooms, -0.07% for studios, and -0.02% for one-bedroom apartments. In Reykjavik, we see a similar trend: -0,06% for single rooms, -0,07% for studios, and -0,02% for one-bedroom apartments, compared to Q1. Both cities have positive year over year rental price increases for apartments. Compared to 2019, rental prices for one-bedroom apartments in Helsinki increased by 1,4% to EUR 1,399. In Reykjavik, the price for one-bedroom apartments increased by 3,6% compared to last year to an average of EUR 1,081 per month. Helsinki had a peak in the number of Covid-19 cases in mid-April. Starting June 15, Finland has reopened its borders for the Baltic countries and the other Nordic countries, except Sweden. Reykjavik's peak also came mid-April and they reopened their borders on June 15.

Germany taking action and an optimistic outlook for Spain

Rental prices are dropping for rooms, studios, and apartments evenly for Berlin with -5%. As a popular destination for internationals, the city was hit hard by the travel ban. At the same time, rents have been decreasing since February when the Mietendeckel (rent cap) became active. In an effort to boost the economy after the coronavirus pandemic shutdown, the German government has reduced the VAT for 6 months, from July 1 until December 31st. German VAT rates will drop from 19% to 16% (the regular VAT rate) and from 7% to 5% (the rate applied to food, medical supplies, public transport, et cetera).

Apartment prices in Madrid dropped by -2.3% to an average of EUR1123 per month. With the country opening up again for international travel, rents for June have started to recover to January levels again. For Spanish cities, the longer-term expectations are quite favorable. Spanish economists studying the impact on the real estate market agree that the impact of Covid-19 will be most visible in Q3 of this year. However, they also expect a speedy recovery as there is a high demand for accommodation and the country is in a much stronger financial situation than it was in 2008.

More bang for your buck

As a result of people having to (partly) work and study from home, there is a greater demand for higher quality accommodation, outdoor space, and green areas. Tenants are searching for apartments and studios with plenty of space including gardens and balconies. Tenants are also switching places more, in search of an upgrade from their current place. Accommodation that provides a separate study or work area, or that can offer these facilities near the accommodation, are also highly sought after.

As a continuation of a trend already visible in Q1 of 2020, more and more landlords are making the switch from short term rentals to midterm rentals. Also, landlords diversifying their portfolio is a continuing trend that was first visible in Q1.

"We currently see a tenants' market, where supply outnumbers demand," says Djordy Seelmann, CEO of HousingAnywhere. "Whether demand will recover, depends on when and to what degree international mobility will return. With a second wave looming, the international rental market remains turbulent. While international student numbers are expected to drop in the upcoming academic year, educational institutions expect programs to return to normality by January 2021."

Despite the rental market shifting towards tenants, many key university cities still have a housing shortage. With the blended approach universities have announced for September, and the high number of enrolments European universities are expecting in January 2021, it remains to be seen how long rental prices will stay at this level or even start increasing again.

Top 5 biggest rental decreases compared to Q1 2020

1. Florence is showing the biggest decrease in rental prices compared to the previous quarter. Single rooms have dropped by -9.6% to EUR 415, studios by -6.1% to EUR 649, and one-bedroom apartments with -6.9% to EUR918 per month.

2. The second Italian city in this top 5 is Milan, with a decrease of -9.1% to EUR 580 for single rooms, -5,5% for studios to EUR 859, and a decrease in rental prices for one-bedroom apartments of -7.8% to an average of EUR 1,096 per month.

3. Rental prices are dropping for rooms, studios, and apartments evenly for Berlin with -5% As a popular destination for internationals, the city was hit hard by the travel ban. At the same time, rents have been decreasing since February when the Mietendeckel (rent cap) became active.

4. Madrid's rental prices for single rooms dropped by -5.8% compared to last quarter, resulting in an average rental price of EUR 514 per month. Rental prices for studios dipped by -1,1% to EUR 837, and prices for one-bedroom apartments dropped by -2.3% to an average of EUR 1123 per month.

5. Compared to last quarter, rental prices for single rooms in Valencia dropped by -4.9% to an average of EUR 319 per month. Rental prices for studios decreased by -1.4% to EUR 592, and the rental price of a one-bedroom apartment decreased by -2.4% to EUR 878.

Top 5 biggest rental increases, compared to Q2 2019

1. In Q2 of 2020, Vienna saw the highest overall year-over-year increase in rental prices: 9.5% for apartments, bringing the monthly rent to an average of EUR 1052, an increase of 3.1% for studios, to EUR 814, and an increase of 0.9% for single rooms, to EUR 478 per month. Similar to our last report, Vienna is ranked first as the city with the biggest increase in rental prices. This is the direct outcome of a changing market in the city, where zoning regulations cause short term providers to make the switch to midterm rental. As a result, there is a big increase in supply in the higher price segment. Mid-March, rental prices started dropping, a trend that continued until the end of May, when the borders of Austria opened up again. Currently, rental prices in Vienna are back to the same level they were in January.

2. Munich saw the second-highest overall increase in rent prices year over year. Apartment prices increased by 2.7% to EUR 1,523. Prices for studios crept up by 1.4% to EUR 1,031 and single rooms by 3.7% to EUR 686. This city, known for its high rental prices and its large shortage of accommodation, continues to be one of the most expensive cities in the Rent Index.

3. In third place ranks Reykjavik, with an increase in rental prices of one-bedroom apartments of 3.6% to EUR 1,081 and studio prices by 14% to EUR 902. The average rental price for a single room increased by 1.7% compared to last year to EUR 625.

4. Average rental prices for one-bedroom apartments rose in Rotterdam by 1.2% to EUR 1,302 per month. Studio prices increased by 2.4% to EUR 803, and prices for single rooms saw an increase of 2.2% to an average of EUR 559 per month. This is the second time Rotterdam is featured in the list of cities with the biggest increases in rental prices. However, the pace at which prices are increasing has been slowing down since Q3 2019.

5. Brussels saw rental prices for apartments creep up by 1.1% to EUR 962. Studio prices increased by 2% to EUR 690, and single rooms by 2% to EUR 582. In 2019, Brussels showed moderate rental increases in apartments, ranging from 3.9% to 5.4%. Near the end of 2019 and in Q1 of 2020, the increase in rental prices for one-bedroom apartments in Brussels approached 7%.

Rents for single rooms have dropped the most by year-on-year comparison, while prices for apartments and studios are less impacted. This is a result of strengthening local markets: even though demand for these properties has decreased significantly among expats and young international professionals, it remains high among the local inhabitants of larger European cities. More single rooms are left vacant as there is less demand for these properties from international markets. Cities that were less impacted by Covid-19, in countries that were able to reopen their borders in mid-June, are showing smaller drops in rental prices as a result.

Despite the impact on the rental prices being evident, the effects differ per city. London remains the most expensive city to rent in Europe, but the rental price growth seen in the city in recent years is slowing down even further. In Milan, Barcelona, and Berlin, rental prices are now lower than in Q2 2019.

Most notable changes: Italian cities drop while Helsinki and Reykjavik remain stable

Italian cities are showing the biggest drops in rental prices of all cities featured in the Rent Index. Milan, the capital of Lombardy and the region where the virus struck the country the hardest, saw the biggest decreases in rent of all the cities in the Rent Index. Compared to the previous quarter, one-bedroom apartments dropped by -7,8% to EUR1,096 per month, a drop of -4,6% compared to Q2 2019. Turin, located 140 km from Milan, is showing a quarterly decrease of -7,8% for one-bedroom apartments to EUR 812 per month, a decrease of -5,9% compared to last year. In Florence, rental prices for one-bedroom apartments dropped by -6,9% to EUR 918, a drop of -4,6% compared to last year.

Helsinki shows a small impact on rental prices compared to the previous quarter: -0.1% for single rooms, -0.07% for studios, and -0.02% for one-bedroom apartments. In Reykjavik, we see a similar trend: -0,06% for single rooms, -0,07% for studios, and -0,02% for one-bedroom apartments, compared to Q1. Both cities have positive year over year rental price increases for apartments. Compared to 2019, rental prices for one-bedroom apartments in Helsinki increased by 1,4% to EUR 1,399. In Reykjavik, the price for one-bedroom apartments increased by 3,6% compared to last year to an average of EUR 1,081 per month. Helsinki had a peak in the number of Covid-19 cases in mid-April. Starting June 15, Finland has reopened its borders for the Baltic countries and the other Nordic countries, except Sweden. Reykjavik's peak also came mid-April and they reopened their borders on June 15.

Germany taking action and an optimistic outlook for Spain

Rental prices are dropping for rooms, studios, and apartments evenly for Berlin with -5%. As a popular destination for internationals, the city was hit hard by the travel ban. At the same time, rents have been decreasing since February when the Mietendeckel (rent cap) became active. In an effort to boost the economy after the coronavirus pandemic shutdown, the German government has reduced the VAT for 6 months, from July 1 until December 31st. German VAT rates will drop from 19% to 16% (the regular VAT rate) and from 7% to 5% (the rate applied to food, medical supplies, public transport, et cetera).

Apartment prices in Madrid dropped by -2.3% to an average of EUR1123 per month. With the country opening up again for international travel, rents for June have started to recover to January levels again. For Spanish cities, the longer-term expectations are quite favorable. Spanish economists studying the impact on the real estate market agree that the impact of Covid-19 will be most visible in Q3 of this year. However, they also expect a speedy recovery as there is a high demand for accommodation and the country is in a much stronger financial situation than it was in 2008.

More bang for your buck

As a result of people having to (partly) work and study from home, there is a greater demand for higher quality accommodation, outdoor space, and green areas. Tenants are searching for apartments and studios with plenty of space including gardens and balconies. Tenants are also switching places more, in search of an upgrade from their current place. Accommodation that provides a separate study or work area, or that can offer these facilities near the accommodation, are also highly sought after.

As a continuation of a trend already visible in Q1 of 2020, more and more landlords are making the switch from short term rentals to midterm rentals. Also, landlords diversifying their portfolio is a continuing trend that was first visible in Q1.

"We currently see a tenants' market, where supply outnumbers demand," says Djordy Seelmann, CEO of HousingAnywhere. "Whether demand will recover, depends on when and to what degree international mobility will return. With a second wave looming, the international rental market remains turbulent. While international student numbers are expected to drop in the upcoming academic year, educational institutions expect programs to return to normality by January 2021."

Despite the rental market shifting towards tenants, many key university cities still have a housing shortage. With the blended approach universities have announced for September, and the high number of enrolments European universities are expecting in January 2021, it remains to be seen how long rental prices will stay at this level or even start increasing again.

Top 5 biggest rental decreases compared to Q1 2020

1. Florence is showing the biggest decrease in rental prices compared to the previous quarter. Single rooms have dropped by -9.6% to EUR 415, studios by -6.1% to EUR 649, and one-bedroom apartments with -6.9% to EUR918 per month.

2. The second Italian city in this top 5 is Milan, with a decrease of -9.1% to EUR 580 for single rooms, -5,5% for studios to EUR 859, and a decrease in rental prices for one-bedroom apartments of -7.8% to an average of EUR 1,096 per month.

3. Rental prices are dropping for rooms, studios, and apartments evenly for Berlin with -5% As a popular destination for internationals, the city was hit hard by the travel ban. At the same time, rents have been decreasing since February when the Mietendeckel (rent cap) became active.

4. Madrid's rental prices for single rooms dropped by -5.8% compared to last quarter, resulting in an average rental price of EUR 514 per month. Rental prices for studios dipped by -1,1% to EUR 837, and prices for one-bedroom apartments dropped by -2.3% to an average of EUR 1123 per month.

5. Compared to last quarter, rental prices for single rooms in Valencia dropped by -4.9% to an average of EUR 319 per month. Rental prices for studios decreased by -1.4% to EUR 592, and the rental price of a one-bedroom apartment decreased by -2.4% to EUR 878.

Top 5 biggest rental increases, compared to Q2 2019

1. In Q2 of 2020, Vienna saw the highest overall year-over-year increase in rental prices: 9.5% for apartments, bringing the monthly rent to an average of EUR 1052, an increase of 3.1% for studios, to EUR 814, and an increase of 0.9% for single rooms, to EUR 478 per month. Similar to our last report, Vienna is ranked first as the city with the biggest increase in rental prices. This is the direct outcome of a changing market in the city, where zoning regulations cause short term providers to make the switch to midterm rental. As a result, there is a big increase in supply in the higher price segment. Mid-March, rental prices started dropping, a trend that continued until the end of May, when the borders of Austria opened up again. Currently, rental prices in Vienna are back to the same level they were in January.

2. Munich saw the second-highest overall increase in rent prices year over year. Apartment prices increased by 2.7% to EUR 1,523. Prices for studios crept up by 1.4% to EUR 1,031 and single rooms by 3.7% to EUR 686. This city, known for its high rental prices and its large shortage of accommodation, continues to be one of the most expensive cities in the Rent Index.

3. In third place ranks Reykjavik, with an increase in rental prices of one-bedroom apartments of 3.6% to EUR 1,081 and studio prices by 14% to EUR 902. The average rental price for a single room increased by 1.7% compared to last year to EUR 625.

4. Average rental prices for one-bedroom apartments rose in Rotterdam by 1.2% to EUR 1,302 per month. Studio prices increased by 2.4% to EUR 803, and prices for single rooms saw an increase of 2.2% to an average of EUR 559 per month. This is the second time Rotterdam is featured in the list of cities with the biggest increases in rental prices. However, the pace at which prices are increasing has been slowing down since Q3 2019.

5. Brussels saw rental prices for apartments creep up by 1.1% to EUR 962. Studio prices increased by 2% to EUR 690, and single rooms by 2% to EUR 582. In 2019, Brussels showed moderate rental increases in apartments, ranging from 3.9% to 5.4%. Near the end of 2019 and in Q1 of 2020, the increase in rental prices for one-bedroom apartments in Brussels approached 7%.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More