Residential Real Estate News

Hong Kong Developers Losing Appetite for Buying Luxury Residential Sites

Residential News » Hong Kong Edition | By Michael Gerrity | February 14, 2023 8:45 AM ET

Slow sales velocity, longer payback periods are creating project barriers

According to JLL's latest Hong Kong Residential Market Monitor report, property developers are losing appetite for acquiring luxury residential sites and have shifted their focus to mass residential sites due to slow sales velocity, increasing financing costs and longer payback periods of luxury residential developments.

Developers have become more conservative in land bidding in late 2022, with various government sites sold below or close to the lower end of market expectations. In stark contrast to a residential site (RBL 1203) in Repulse Bay breaking the government land sale record a year ago at an A.V. of HKD 62,352 per sq ft, the recent tender of a residential site (RBL 1204) in Stanley was withdrawn after all bids failed to meet the reserve price.

Joseph Tsang, Chairman of JLL in Hong Kong commented, "Luxury residential sites have lost their shine. Developers are now gravitating towards acquiring mass residential sites rather than luxury residential sites under the current weakening sentiment in the luxury housing market. Unlike mass residential projects that take only two years to pre-sales, luxury developments are mostly launched upon completion around six years after land acquisition, on average. Cash inflow does not begin to occur until then. Since the sales performances were weak in the luxury housing market, the payback period would be even longer, and the developers need to afford a higher investment cost and risk."

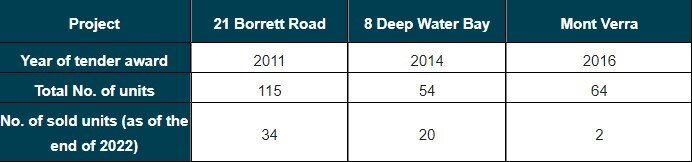

Norry Lee, Senior Director of Projects Strategy and Consultancy Department at JLL also commented, "With interest rates having risen considerably in 2022 and likely to rise further, financing costs on development projects are substantially higher. Also, track records of recently completed luxury projects show that they had taken multiple years to reach reasonably high sales rates, which in turn lengthened the investment / payback period further.

For example, '21 Borrett Road (Phase 1)' offloaded 6 out of 115 units in 2022, compared to 28 units in 2021. Meanwhile, the new supply of luxury units has surged and may put pressure on the luxury home prices.

"The completion of Class E (saleable area of 160 sq m or above) units reached 513 units in the first 11 months of 2022, around three times higher than in 2021. Coupled with high financing costs, such projects' expected profit margins would be eroded," he added.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026