The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

India's Foreign Investment Changes Aid UK Student Housing Market

Residential News » Mumbai Edition | By WPJ Staff | January 27, 2015 8:28 AM ET

According to The Mistoria Group, the recent legislation by the Indian government which increased the limit to USD 125,000 per financial year (April-March) from USD 75,000 is boosting demand for student property in the UK.

Now the threshold for investment in real estate outside the country is for the equivalent of USD 125000 per person, per financial year. The scheme can now be used for acquisition of immovable property outside India and banks are allowed to remit the funds per financial year, for any permitted current or capital account transaction, or a combination of both.

Over the last few years, the yields in India for residential rental property has been low at around 1-2%, but appreciation is high, between 10-30 % per annum. Though property prices have corrected, rentals have not improved. Hence, Indian investors are keen to look overseas.

Investing in UK student accommodation offers investors a long-term investment option, as typical rents are significantly higher than a comparable buy-to-let property in the same city.

The average gross cash rental yields for the student property sector in the North West of England were 13% for the first three quarters of 2014, well ahead of the 6.37% forecast for average student property yields across the UK, for this year.

Mish Liyanage, Managing Director of The Mistoria Group explains, "We have experienced an increase in demand from Indian Investors over the last few months, all of whom are looking for investment opportunities in student accommodation.

"Since 2011, student accommodation has outperformed all other traditional property assets and has been the strongest growing investment property market in the UK.

"It has also continued to be one of the most resilient investment sectors, with rental incomes and property values remaining stable, or increasing. The attraction of the student accommodation sector has been driven by structural undersupply and positive rental growth year on, despite the economic downturn.

"Our research shows that students will pay more in the UK for high quality, well-maintained accommodation than for the traditional run down and neglected shared houses, because there really isn't a big price difference between poor and high quality accommodation. A HMO (House in Multiple Occupation) property can provide an 8% minimum cash yield, though we provide a typical 13% cash yield, including 5% capital appreciation.

"What's more, the domestic student population is continuing to expand, with an extra 30,000 university places offered in 2014. UCAS have reported they are expecting an all-time high of 500,000 applications this year."

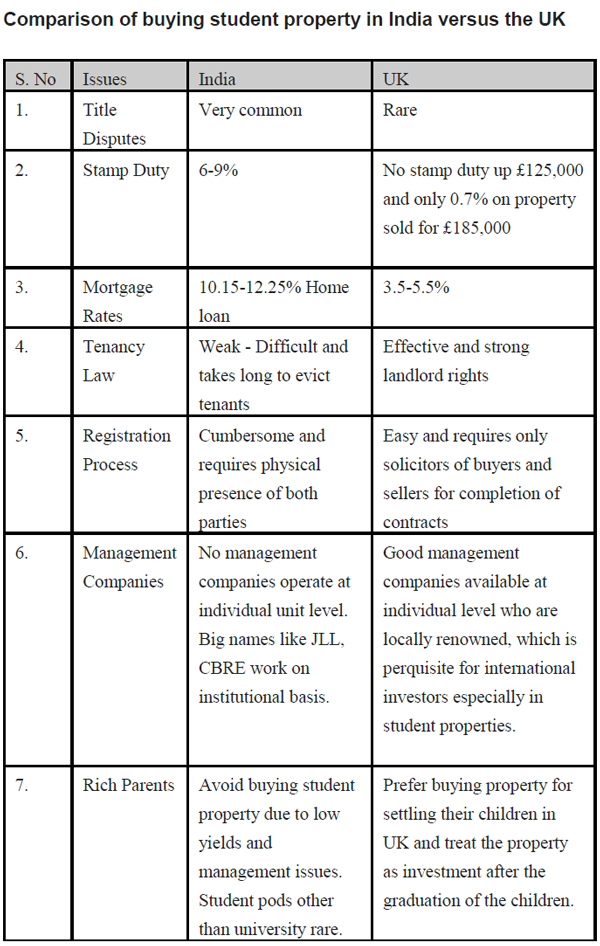

Sandeep Singh, an Indian lawyer and a Masters in Real Estate from University of Reading, UK comments, "The UK is considered a safe market without a lot of hassles for overseas landlords looking for passive income. The UK law does not prohibit international investment from foreign nationals. To add to this, there are no legal hassles regarding title of property and the prices of real estate in Indian cities are very much comparable with prices in UK major cities.

"Since the legislative changes, the UK student market has become highly attractive for Indian investors as it offers high yields, good asset growth and hands off investment."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More