Residential Real Estate News

Tuscany's Property Boom Driven by Wealthy Foreign Buyers

Residential News » Rome Edition | By Monsef Rachid | May 14, 2025 6:17 AM ET

France, the United States and United Kingdom are top feeder markets

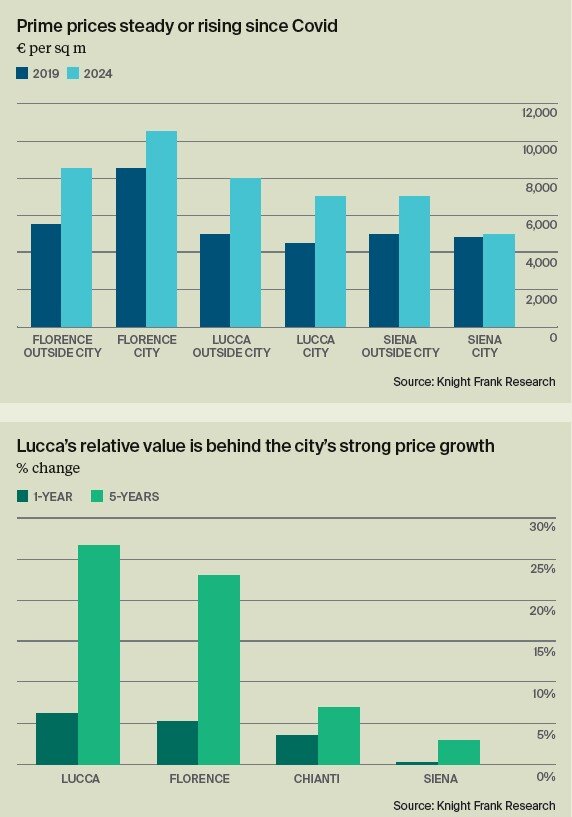

The Italian city of Lucca has emerged as a top performer in Tuscany's luxury real estate market, with property prices soaring 27% over the past five years, according to a new report from global property consultancy Knight Frank. The surge, attributed to Lucca's relative affordability and growing international demand, outpaces other Tuscan hotspots and highlights a broader trend of rising interest in Italy's prestigious property markets.

Tuscany remains a magnet for wealthy international buyers, particularly from France, the United States, the United Kingdom, Benelux countries, and Germany. These high-net-worth individuals (HNWIs) are drawn by the region's superior quality of life, educational offerings, and ease of access to global transport hubs.

Government incentives are also playing a pivotal role. Italy's flat tax regime, reduced registration fees for primary residences, and the "Return of the Brains" program--which encourages expatriate professionals to relocate--are helping to fuel investment and relocation decisions among ultra-high-net-worth individuals (UHNWIs). As of 2025, Italy is home to 40,010 individuals with net assets exceeding $10 million, and 573 billionaires, according to The Wealth Report 2025.

Increasingly, buyers are favoring turnkey, move-in-ready homes over renovation projects, a shift influenced by global economic uncertainty and rising construction costs. High-value areas such as Siena and Val d'Orcia are also gaining popularity as buyers seek out secure, long-term lifestyle investments.

Florence continues to be a central hub, recording a 4.3% increase in property prices in the 12 months leading up to January 2025--the strongest annual growth rate in Tuscany. Meanwhile, the number of foreign residents living in Tuscany has risen by 11.2% over the past decade, according to Italy's national statistics agency, Istat.

Despite the appeal of Italy's flat tax--which has attracted around 5,000 applicants since its inception--take-up remains modest when compared to other jurisdictions. By contrast, the UK had approximately 70,000 non-domiciled residents before abolishing its non-dom tax regime in April 2025, prompting many to reassess their residency status.

As global trade tensions, tax reforms, and geopolitical uncertainty continue to shape wealth migration patterns, Tuscany's real estate market remains a sanctuary of stability, culture, and opportunity for the world's elite.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026