The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Global Home Price Growth Slows to a 6-Year Low in Q3

Residential News » Monaco Edition | By Michael Gerrity | December 23, 2019 8:30 AM ET

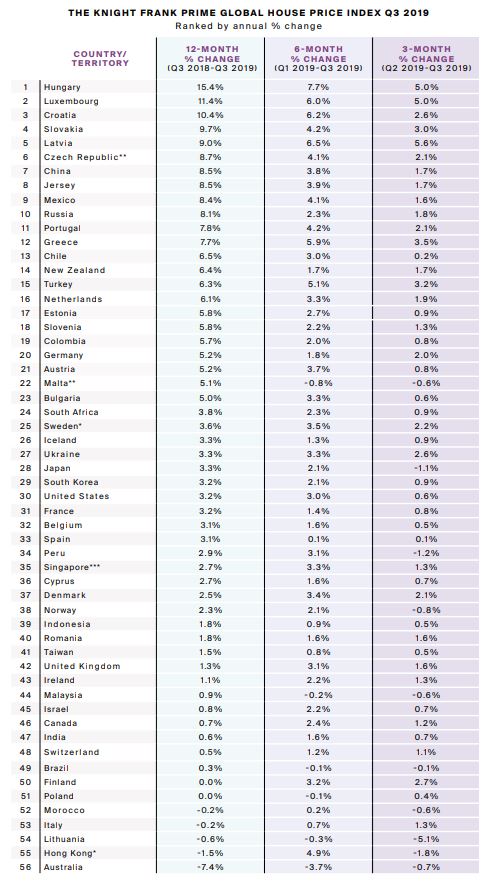

Countries of Hungary, Luxembourg, and Croatia enjoy biggest annual home price jumps

According to global real estate consultant Knight Frank, home prices across 56 countries and territories worldwide are rising at an annual rate of 3.7% on average. This marks the index's slowest rate of growth for over six years. This trend mirrors the pattern observed in Knight Frank's other global city indices - across both the mainstream and prime segments.

Analysis of the latest available data, shows Hungary leads the index this quarter with 15.4% annual price growth, boosted by a robust economy (4.9% GDP growth forecast in 2019*), low mortgage rates, high wage growth and a range of government subsidy measures.

However, other previous frontrunners from the last two years have cooled significantly - Slovenia (18th), Malta (22nd) and Iceland (26th) either due to weaker economic landscapes, affordability concerns or a decline in tourism.

In contrast, some countries and territories are rising up the rankings. A year ago, Greece sat in 24th place with price growth of 2.4%. Although prices still sit 37% below their 2008 peak, they are now rising at a rate of 7.7% per annum and Greece is ranked 12th out of 56 countries and territories.

Seven of the top ten rankings this quarter are European countries and most are located within Central and Eastern Europe. Here, prices are rising from a low base, economies are strengthening and borrowing costs are close to record lows.

On a world region basis, Russia & the CIS lead the rankings, registering average annual growth of 5.7% - prices in Russia are up 8.1% over the 12-month period and Ukraine has moved off the bottom rank in the last year and is now averaging 3.3% growth per annum.

Knight Frank publishes two indices tracking mainstream prices, its Global Residential Cities Index (150 cities) and their Global House Price Index (country level). A comparison of the two indices highlights two key trends. Firstly, the extent to which national house prices lag city markets by approximately six months and secondly, the degree to which the performance gap between the two has narrowed since 2018.

According to global real estate consultant Knight Frank, home prices across 56 countries and territories worldwide are rising at an annual rate of 3.7% on average. This marks the index's slowest rate of growth for over six years. This trend mirrors the pattern observed in Knight Frank's other global city indices - across both the mainstream and prime segments.

Analysis of the latest available data, shows Hungary leads the index this quarter with 15.4% annual price growth, boosted by a robust economy (4.9% GDP growth forecast in 2019*), low mortgage rates, high wage growth and a range of government subsidy measures.

However, other previous frontrunners from the last two years have cooled significantly - Slovenia (18th), Malta (22nd) and Iceland (26th) either due to weaker economic landscapes, affordability concerns or a decline in tourism.

In contrast, some countries and territories are rising up the rankings. A year ago, Greece sat in 24th place with price growth of 2.4%. Although prices still sit 37% below their 2008 peak, they are now rising at a rate of 7.7% per annum and Greece is ranked 12th out of 56 countries and territories.

Seven of the top ten rankings this quarter are European countries and most are located within Central and Eastern Europe. Here, prices are rising from a low base, economies are strengthening and borrowing costs are close to record lows.

On a world region basis, Russia & the CIS lead the rankings, registering average annual growth of 5.7% - prices in Russia are up 8.1% over the 12-month period and Ukraine has moved off the bottom rank in the last year and is now averaging 3.3% growth per annum.

Knight Frank publishes two indices tracking mainstream prices, its Global Residential Cities Index (150 cities) and their Global House Price Index (country level). A comparison of the two indices highlights two key trends. Firstly, the extent to which national house prices lag city markets by approximately six months and secondly, the degree to which the performance gap between the two has narrowed since 2018.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More