Residential Real Estate News

Singapore Residential Property Sales Spike in November

Residential News » Singapore Edition | By Michael Gerrity | December 16, 2021 8:50 AM ET

Singapore based property broker Edmund Tie is reporting this week that private new home sales increased for a consecutive month by 70% to 1,547 units in November 2021 from 911 units in October.

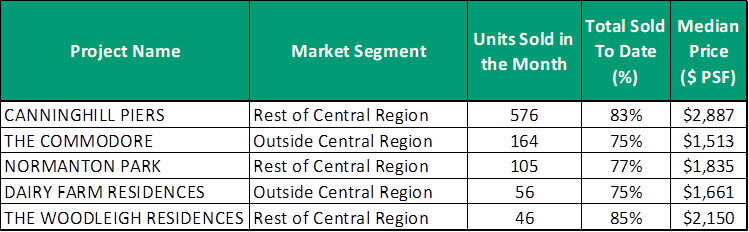

The robust sale was bolstered by the launch of CanningHill Piers and The Commodore, which sold 576 out of 696 units and 164 out of 219 units, making up a total of 47.8%, almost half, of the new home sales in November. The strong sale performance of CanningHill Piers had tilted the share of new private homes sold in RCR to 58.8% in November from 30.9% in October, while the CCR and OCR took a reduced shared of 11.5% and 29.7% respectively in November from 30.9% and 38.2% in October.

A total of 12,705 units sold for the eleven months this year has already exceeded the whole of last year's sales of 9,982 units by 27.3%. The strong take-up rate thus far for the year attested to the resilience of the residential property market, undeterred by the Covid-19 pandemic and disruption caused by the re-imposition of safe management measures.

Likewise, new homes launched last month rose by 94% to 1,283 units from 661 units in October, though a dip of 6.7% from 1,375 units a year earlier. Strong take up rate of more than 100% is observed across all segments with OCR registering the highest take up rate of 154%. Across the market segments, the RCR recorded the largest number of new units launched at 858 (66.9%), while OCR accounted for 23.3% (299 units) of the new units put on the market and 9.8% (126 units) for the CCR.

On the price front, the robust take-up of CanningHill Piers, which sold at an average median price of $2,887 psf, contributed to a 3.1% increase in average median price in RCR, from $2,154 psf in October to $2,221 psf in November. Out of the units sold in CanningHIll Piers, the sole super penthouse was transacted at $48 m or $5,360 psf. Meanwhile the OCR recorded an average median price increase of 2.8% from $1,628 psf to $1,674 psf. Prices in CCR remain similar to that in October with a marginal increase of 0.2% from $2,971psf to $2,976 psf.

November's top 5 seller projects were CanningHill Piers (RCR), The Commodore (OCR), Normanton Park (RCR), Dairy Farm Residences (OCR) and The Woodleigh Residences (RCR). Iconic developments such as the 99-years leasehold CanningHill Piers continue to attract homebuyers and support pricing with their unique attributes that are hard to replicate. While properties in OCR continue to remain attractive with demand driven by more spacious living space at a more affordable price tag.

The median size of new condo/apartment in the CCR was 694 sq. ft, RCR was 807 sq. ft. and OCR was 936 sq. ft. in November. The year-to-date median size of new condo/apartment in CCR is 678 sq. ft., RCR is 743 sq. ft. and OCR is 904 sq. ft. With WFH practices and hybrid work slated to be in for the long haul, buyers are continually wooed to larger units, in particular units that are located at the OCR due to their affordability.

As the current situation of demand exceeds supply remains unabated, units from previously launched projects, such as Normanton Park, Dairy Farm Residences and The Woodleigh Residences, continued to be soaked up by homebuyers.

Amid the backdrop of continued economic recovery, 7.1% YoY growth in Q3, the ongoing sale momentum is likely to result in full-year housing sales to reach an eight-year high of 13,500 to 14,000 units.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026