The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Singapore's Residential Market Expected to Uptick in 2015

Residential News » Singapore Edition | By Miho Favela | December 23, 2014 8:30 AM ET

According to a new report by Savills, Singapore's private residential market has been characterized by low sales volume but holding prices in 2014. The market is expected to carry into 2015 in the same fashion, barring any tweaking of the cooling measures and toning down of the Total Debt Service Ratio (TDSR) framework.

From Savills' viewpoint, the following is expected for Singapore's Residential market in 2015:

- Buyers of CCR units are likely to be opportunistic high net worth individuals, corporates or funds, all of whom find value in significantly price discounted assets.

- For the RCR and OCR, buyers are likely to be those who have the wherewithal to buy even within the current TDSR framework but have thus far held back due to expectations that prices will decline. As these people already have the purchasing power, it will be a battle between holding-out and expecting prices to decline further or committing because having not spent their money in the past 18 months, their store of wealth has built up further. We believe that this group is relatively large and may be enticed to purchase even if there is only a slight discount. They are also likely to be end-users of the properties.

- The alternative viewpoint. While the market may remain soft price wise in the near term, there is a possibility that it may rebound in time. The reason for this is that if we look at the slate of cooling measures and the TDSR framework, assuming they did not induce a change in market behaviour toward residential properties, what these did was merely raise the barriers for liquidity to flow into the market. The analogy is like a cup that was initially overflowing due to its inability to contain the constant replenishment of fluids. When the cup's height is raised, that is analogous to the implementation of the TDSR framework, the overflowing stopped. However, if the rate of filling is the same, like when the working population got a pay rise and increased their savings over time, a moment will come when even the raised cup height will be unable to contain the liquidity and overflowing happens again at the same rate.

If one accepts this analogy, buyers will return to the market. The zillion dollar question is when? It may not be that long because since the implementation of TDSR on 29th June 2013, by the first half of 2015, the workforce will have enjoyed two pay increases, one for 2014 and the other for 2015. On top of that 2 bonuses would have been paid out. The store of wealth is definitely increasing. In the meantime, the measures have been static. Barring a deflation of sentiments due to any cataclysmic event, fundamentals should prevail. Perhaps in 2015, there may be defining project that may bring about a pivotal reversal of sales volume.

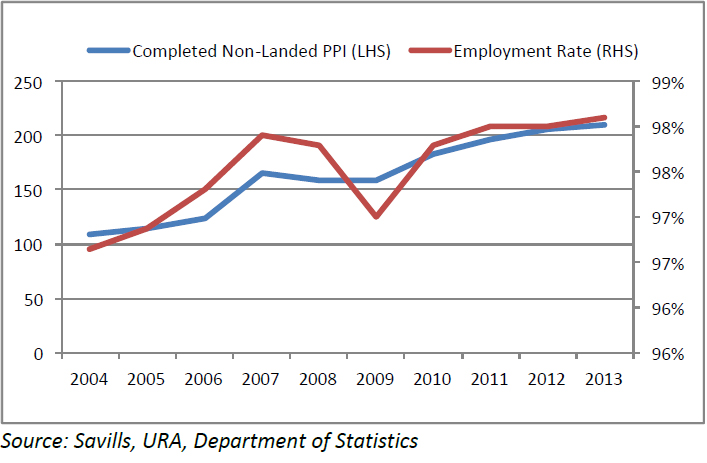

Savills believes the line of argument, that the gamut of new completions would soften rents, leading to yield compression and a potential sell off by weak holders when interest rates rise, is overly simplistic. Yes, rents are expected to remain soft but so too are interest rates in the foreseeable future. Even if yields are to compress another 50 basis points, it doesn't mean that owners will be forced to sell. The pressure to sell will only happen if the unemployment rate goes up. That is not the likely scenario and in turn, the argument of falling rents leading to a wave of force selling is not a likely scenario either. The following chart shows a high degree of co-relation between the URA Property Price Index for completed non-landed properties and the Employment rate.

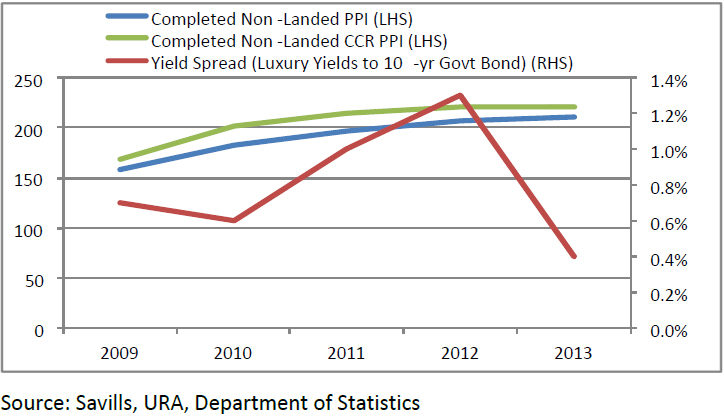

On the other hand, the recent relationship between prices of completed non-landed properties and the spread between the yield of a luxurious non-landed property and the Singapore Government 10-year bond is trivial.

On the other hand, the recent relationship between prices of completed non-landed properties and the spread between the yield of a luxurious non-landed property and the Singapore Government 10-year bond is trivial. Savills concludes with the prediction that Singapore's private residential market is expected to remain soft in 2015 with primary launches holding prices better than those in the resale market. Rents are expected to continue to decline due to the slew of new completions and limited budgets amongst overseas nationals working here. Corporate belt tightening and organisational revamps may result in less family units arriving. Small format homes, HDB flats and individual rooms in private developments may be the more lettable unit types both now and in 2015. Although yields are expected to compress further, prices may not react to this because the better driver of prices appear to be other economic factors like the unemployment rate which is still expected to remain low in 2015.

Savills concludes with the prediction that Singapore's private residential market is expected to remain soft in 2015 with primary launches holding prices better than those in the resale market. Rents are expected to continue to decline due to the slew of new completions and limited budgets amongst overseas nationals working here. Corporate belt tightening and organisational revamps may result in less family units arriving. Small format homes, HDB flats and individual rooms in private developments may be the more lettable unit types both now and in 2015. Although yields are expected to compress further, prices may not react to this because the better driver of prices appear to be other economic factors like the unemployment rate which is still expected to remain low in 2015.While Savills believes the market in 2015 continues to mull over the TDSR and the slate of cooling measures, the amount of household liquidity building up in the backdrop could rouse buyers and surprise everyone on the upside.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More