The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Despite COVID, Kitchen and Bath Market Index at Highest Point in 2020

Residential News » Atlanta Edition | By Monsef Rachid | December 3, 2020 8:45 AM ET

Bodes well for a strong 2021 for the home remodeling industry

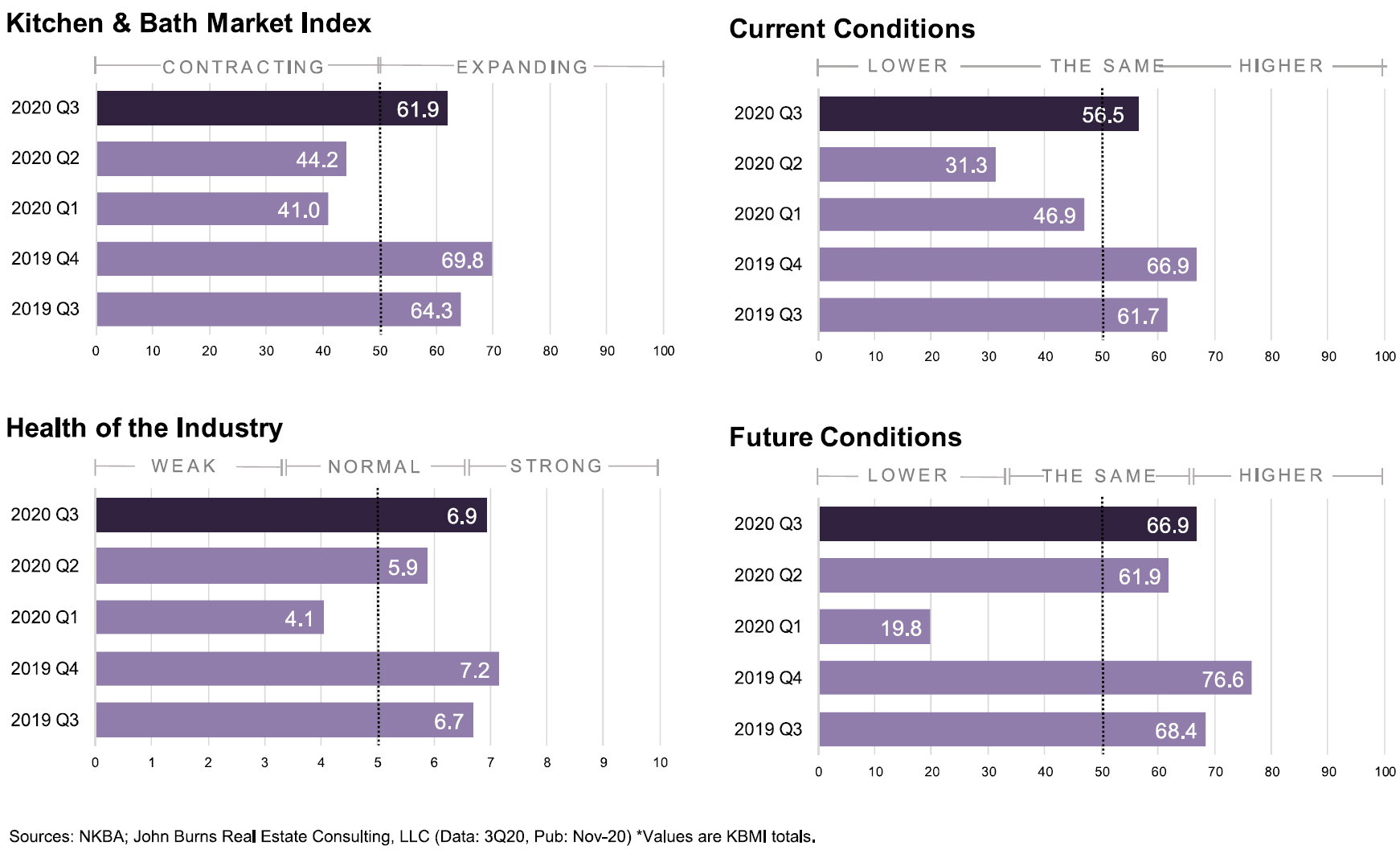

This week, the National Kitchen & Bath Association and John Burns Real Estate Consulting released their Q3 2020 Kitchen & Bath Market Index (KBMI). For the first time this year, the KBMI is above 50 -- at 61.9 -- up from 44.2 in Q2 and 41 in Q1. Scores of 50 indicate expansion and scores below indicate contraction.

NKBA members rank the overall health of the industry at 6.9 (on a scale of one to 10), just below the 7.2 reported in pre-COVID Q4 2019. While confident about current business conditions at 56.5, industry members are even more optimistic about future conditions, which they set at 66.9 as 2020 draws to a close.

"As we approach the end of an unprecedented year, the industry outlook is promising," said NKBA CEO Bill Darcy. "While COVID-19 will continue to present challenges to the supply chain, labor and spending, we're grateful to be one of a few industries that has actually seen growth in response to consumers spending more time at home and looking to make their spaces more functional in this new normal. Kitchen and bath professionals are well-positioned for continued success into the coming year."

"Consumers have undertaken a lot of remodeling in 2020, but significant opportunity remains, especially for the kitchen and bath market, going into 2021," notes Todd Tomalak, Principal at JBREC. "Much of the already completed renovation work has focused outside the home -- redoing decks, gardens and outdoor entertaining spaces -- in response to COVID-19 restrictions. For many families working and schooling from home, 2020 wasn't the ideal time to redo a space as essential as the kitchen or bathroom. As such, we anticipate continued activity for kitchen and bath remodeling next year."

In the first half of 2020, NKBA members predicted negative sales for the year, but Q3 brought better news for the industry, which now expects a 1.1% increase in YOY sales compared to 2019. In fact, Q3 sales in 2020 were up 2.1% from 2019, and sales grew 5.9% since last quarter overall -- ranging from designers, who saw a smaller 3.2% increase, to manufacturers, who experienced a significant 9.6% rise.

More than half (62%) of all companies surveyed report COVID-19 drove higher demand to their business in Q3. While the crisis continues to have some adverse effect on the industry, with 29% reporting the pandemic has led to lower demand, its negative impact has lessened each quarter and, at 5.9 (on a scale of one to 10), is nearly 30% lower than the Q1 rating of 8.1. Among those industry professionals who haven't seen demand return to normal levels, 29% expect it to do so in 2021.

The following trends are expected to impact homeowners and the industry into 2021:

Each sector of the kitchen and bath market faces unique challenges and opportunities:

This week, the National Kitchen & Bath Association and John Burns Real Estate Consulting released their Q3 2020 Kitchen & Bath Market Index (KBMI). For the first time this year, the KBMI is above 50 -- at 61.9 -- up from 44.2 in Q2 and 41 in Q1. Scores of 50 indicate expansion and scores below indicate contraction.

NKBA members rank the overall health of the industry at 6.9 (on a scale of one to 10), just below the 7.2 reported in pre-COVID Q4 2019. While confident about current business conditions at 56.5, industry members are even more optimistic about future conditions, which they set at 66.9 as 2020 draws to a close.

"As we approach the end of an unprecedented year, the industry outlook is promising," said NKBA CEO Bill Darcy. "While COVID-19 will continue to present challenges to the supply chain, labor and spending, we're grateful to be one of a few industries that has actually seen growth in response to consumers spending more time at home and looking to make their spaces more functional in this new normal. Kitchen and bath professionals are well-positioned for continued success into the coming year."

"Consumers have undertaken a lot of remodeling in 2020, but significant opportunity remains, especially for the kitchen and bath market, going into 2021," notes Todd Tomalak, Principal at JBREC. "Much of the already completed renovation work has focused outside the home -- redoing decks, gardens and outdoor entertaining spaces -- in response to COVID-19 restrictions. For many families working and schooling from home, 2020 wasn't the ideal time to redo a space as essential as the kitchen or bathroom. As such, we anticipate continued activity for kitchen and bath remodeling next year."

In the first half of 2020, NKBA members predicted negative sales for the year, but Q3 brought better news for the industry, which now expects a 1.1% increase in YOY sales compared to 2019. In fact, Q3 sales in 2020 were up 2.1% from 2019, and sales grew 5.9% since last quarter overall -- ranging from designers, who saw a smaller 3.2% increase, to manufacturers, who experienced a significant 9.6% rise.

More than half (62%) of all companies surveyed report COVID-19 drove higher demand to their business in Q3. While the crisis continues to have some adverse effect on the industry, with 29% reporting the pandemic has led to lower demand, its negative impact has lessened each quarter and, at 5.9 (on a scale of one to 10), is nearly 30% lower than the Q1 rating of 8.1. Among those industry professionals who haven't seen demand return to normal levels, 29% expect it to do so in 2021.

The following trends are expected to impact homeowners and the industry into 2021:

- For the first time, supply chain disruption is reported as the industry's greatest challenge, beating out economic uncertainty and recession and further hinting at an optimistic outlook for 2021 as manufacturers ramp up production in response to demand. Appliances and cabinets are most impacted, while other luxury products, particularly from Europe, are facing delays in lead times and backorders as well.

- Increased pipeline demand is another promising indicator for 2021, with 53% seeing larger pipelines of projects or project orders in Q3 2020 compared to the same period in 2019.

- Still, uncertainty remains. When asked if they think COVID-19 will "shut down" the economy again in Q4, 39% of NKBA members are unsure. Almost the same percentage (37%) do not expect another shutdown, but 24% do anticipate shutdowns as infection rates climb.

- Despite strong remodeling interest, consumers are still more price-conscious than they were pre-COVID, with designers especially noting smaller budgets. Customers are leaning toward smaller-scale remodels and temporary solutions that are low-cost and largely DIY.

Each sector of the kitchen and bath market faces unique challenges and opportunities:

- Perhaps unexpectedly given COVID-19 restrictions, retail sales foot traffic rose 8% in 2020 over 2019. With much of the foot traffic driven by DIY'ers, the increase in foot traffic has not necessarily led to increased revenue.

- In response to a heightened demand for products, especially appliances, manufacturing sales increased 5.8% YOY in Q3, despite some COVID-19-related disruptions and difficulties finding qualified labor to meet ramped-up production needs. Manufacturers also rated the KBMI highest of any sector, at 67.7. The majority (55%) of manufacturers are back to operating at 100% or more of their normal workforce, with 14% employing more workers than pre-COVID.

- Lower price points and cutbacks in discretionary design services have propelled homeowners to DIY projects - but designers are seeing marked improvement in Q3, with more than half (57%) reporting higher bids in the last quarter than Q1 and Q2. Additionally, 39% reported no canceled or postponed projects in Q3.

- Building and construction companies also continue to see fewer postponements and cancellations, with 49% reporting zero of either in Q3. More than half (54%) of companies with postponed jobs expect those to resume in 2021.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More