Residential Real Estate News

Black Homeowners Enjoyed Bigger Equity Gains in 2020 Than White Owners

Residential News » Atlanta Edition | By Michael Gerrity | March 10, 2021 8:15 AM ET

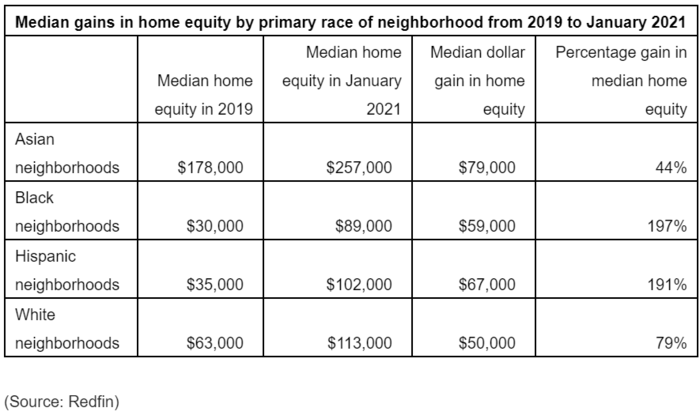

According to national property broker Redfin, people who bought homes in primarily black neighborhoods in 2019 gained a median $59,000 in home equity last year, compared with $50,000 for people who bought homes in primarily white neighborhoods.

Equity grew more for people who bought homes in primarily asian and hispanic neighborhoods--by $79,000 and $67,000, respectively.

For the purposes of Redfin's report, a neighborhood is considered primarily one race or another if more than 50% of the owner-occupied households are black, hispanic, asian or white, as identified in the U.S. Census Bureau's American Community Survey. They calculated home-equity gains throughout 2020 for each neighborhood type for homeowners who purchased a home anytime during 2019, using January 2021 Redfin Estimates as a proxy for current market value.

The terms "black homeowner," "white homeowner," etc. are used throughout the report to refer to a person who bought a home in a neighborhood of primarily one race or another in 2019.

While black homeowners gained more wealth through home equity than white homeowners last year, the trend is a reversal from the previous decade, when homeowners of color saw their home values and home equity recover more slowly from the Great Recession.

People who bought homes in primarily black neighborhoods in 2019 currently have a median of $89,000 in home equity, the smallest amount of the four races included in this analysis. That's compared with $257,000 for asian homeowners, $113,000 for white homeowners and $102,000 for hispanic homeowners.

Black homeowners started with much lower equity--a median of $30,000 in 2019--than their asian ($178,000) and white ($63,000) counterparts, and slightly less than the typical hispanic homeowner ($35,000). The difference in equity in 2019 was primarily driven by the fact that black homebuyers made smaller down payments than buyers of other races, due to lower home prices and putting down a smaller percentage of the sale price.

Even though black homeowners still have less equity than white homeowners, the home-equity gap between black and white Americans is narrowing. That's largely because significant gains in home values, which increase equity above initial down payments, fueled equity gains from 2019 to January 2021 for homeowners of all races. The typical homeowner in a primarily white neighborhood had $33,000 more home equity than the typical homeowner in a primarily black neighborhood in 2019, a gap that had shrunk to $24,000 by January 2021.

Homeowners in black neighborhoods experienced a nearly 200% home-equity increase in 2020, a huge increase that's mostly due to low equity pre-pandemic

Black homeowners nationwide who bought their homes in 2019 saw a 197% increase in home equity last year, a bigger percentage increase than the other races. Home equity increased 191% for Hispanic homeowners, 79% for white homeowners and 44% for asian homeowners. Black homeowners starting out with lower equity than the other races is a key reason for the larger percentage jump.

Black Americans are least likely to be homeowners. The homeownership rate for black families was 44.1% in the fourth quarter of 2020, the most recent time period for which data is available. That's steady from 44% in the fourth quarter of 2019, but it had been on the rise before the pandemic, with a jump up from the 42.9% rate in the fourth quarter of 2018. The current homeownership rate for white families is significantly higher than it is for black families: 74.5% in the fourth quarter of 2020, up slightly from 73.7% a year earlier. The homeownership rate for asian families increased from 57.6% to 59.5% over the same time period, and it went from 48.1% to 49.1% for hispanic families.

"Black homeowners benefited from 2020's hot housing market, and the trend is continuing into this year as Americans remain intensely interested in relocating and buying homes and home values continue to rise," said Redfin Chief Economist Daryl Fairweather. "But less than half of black Americans own the home they live in, so most of the Black community didn't benefit from the enormous wealth homeowners have gained in the past year. Especially compared with the three-quarters of white Americans who own their homes, the total benefit for black families across the country is relatively small. With higher unemployment rates and less overall wealth, black families were not as likely as white families to buy homes even when prices were comparatively low."

"Now that prices are so high and the pandemic has contributed to high unemployment, especially for black workers, it's even more difficult for people who don't already own homes to break into the housing market," Fairweather continued. "There is a major need and a big opportunity for policymakers to enact programs like down-payment assistance and zoning reform to help narrow the homeownership gap and enable more black families to build wealth through home equity."

Black homeowners in Chicago, Newark and Washington, D.C. have seen enormous home-equity gains, mostly because equity was so low pre-pandemic

People who bought homes in primarily black neighborhoods in Chicago in 2019 experienced the biggest percentage equity gain of the metro areas included in this analysis, with a 750% increase from 2019 to January 2021. The increase is so big partly because median home equity was just $8,000 in 2019, compared with $68,000 in January 2021.

Next come Newark and Washington, D.C., which also saw huge percentage increases for black homeowners from 2019 to January 2021: 626% and 425%, respectively. Median home equity went from $19,000 to $138,000 in Newark, and $16,000 to $84,000 in Washington, D.C.

All of the metros included in this analysis experienced home-equity gains for Black homeowners--and homeowners of all other races--over that time period. The typical black homeowner in Jacksonville gained 62% in equity from 2019 to January 2021, the smallest percentage gain of any metro included in this analysis, from $45,000 to $73,000.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership