Cleveland Real Estate News

Cleveland

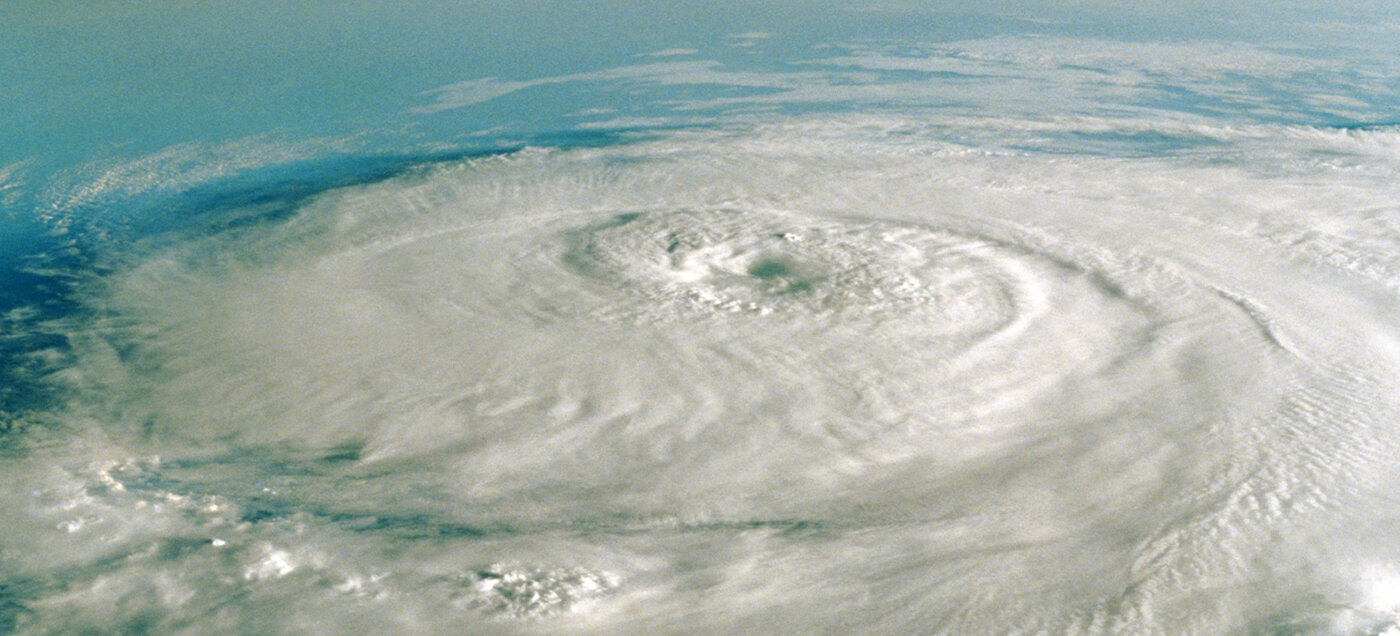

2025 Hurricane Season Puts 6.4 Million U.S. Homes at Risk of Storm Surge

Now that the 2025 hurricane season has officially begun, according to NOAA, a new and growing concern is emerging for homeowners along the U.S. coast -- especially in an already tight housing market with historically low inventory.

U.S. Home Sales Continue Slump in April Despite Growing Inventory

According to new data released by the National Association of Realtors, existing-home sales dipped again in April 2025, reflecting ongoing challenges in the U.S. housing market despite growing inventory and continued buyer interest.

Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

In a notable shift in the housing market, baby boomers have surpassed millennials as the largest generational group of home buyers, according to the National Association of Realtors (NAR).

Homebuyer Demand in America Drops to 5-Year Low in Early 2025

According to national brokerage Redfin, U.S. homebuyers currently have the most options available since 2020. However, rising housing costs are deterring many from making purchases, making monthly mortgage payments increasingly difficult.