The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Latin, Black and Asian Households Most Threatened by Coronavirus Layoffs in U.S.

Residential News » Detroit Edition | By Monsef | April 28, 2020 8:00 AM ET

Based on a new report by Zillow, given the massive amount of job losses in the U.S. due to the COVID-19 pandemic, every industry is feeling the steep downturn.

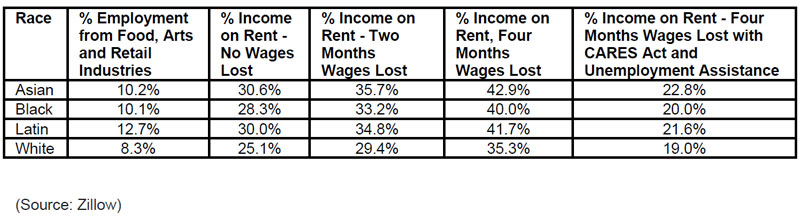

With more than 22 million Americans that have filed unemployment insurance claims over the past four weeks, including many in the food, arts and retail industries. Latin, Asian and black workers are disproportionately represented in these jobs compared to white workers -- nationwide, 8.3% of white workers are employed in these industries, compared with 12.7% of Latin workers, 10.2% of Asian workers and 10.1% of black workers.

This is compounded by these non-white households typically facing a greater rent burden, meaning after they pay rent they have less left over for other expenses or to save for an economic hardship. Typical renter households that receive the majority of their income from these industries are below or near the accepted 30% guideline for the amount of income spent on rent for each race included in Zillow's analysis. White households in these industries spend 25.1% of their income on rent, black households spend 28.3% on rent, Latin households are right at 30% and Asian households are just over at 30.6%.

For lower-income households that are already bumping against the affordability threshold, an income shock can push them into housing insecurity. If these workers were to go without income for two months, only white households would stay within the affordability guideline at 29.4% -- black households would jump to 33.2% of income spent on rent, Latin households to 34.8% and Asian households to 35.7%. In a more severe scenario where workers would go four months without pay, that would rise to 35.3% for white households and at least 40% for non-white households.

"This analysis highlights the financial tightrope many households walk in our vital service industries," said Skylar Olsen, senior principal economist at Zillow. "While it's encouraging that many who receive government assistance appear to be on solid footing for a few months, it's important to remember that some workers will see labor disruptions, such as a loss of hours, that don't qualify them for these unemployment benefits that are so crucial right now. And if the pandemic were to last beyond the summer, it could have lasting impacts that push many more into housing insecurity."

Financial assistance from the CARES Act -- which provides unemployment insurance at standard levels for up to 39 weeks, with an additional $600 a week through July 31 -- and state-level unemployment insurance appear likely to play a crucial role during this crisis. White households that go four months without work but receive direct payments from the CARES Act and state and federal unemployment assistance would see their rent burden reduced to 19%, and Asian households would have the highest rent burden at 22.8%, well below what it would have been without any lost wages. This assumes workers can smooth their expenditures over an entire year, qualify for benefits and are able to receive these payments in a timely manner, which has not always been the case recently as state unemployment programs have been overwhelmed by the unprecedented volume of applications. And the July 31 expiration of the additional CARES Act assistance will change the equation for households that experience wage losses beyond that date.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More