The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

The Calm Before the Coming Coronavirus Foreclosure Storm in U.S.

Residential News » Irvine Edition | By Michael Gerrity | July 31, 2020 7:30 AM ET

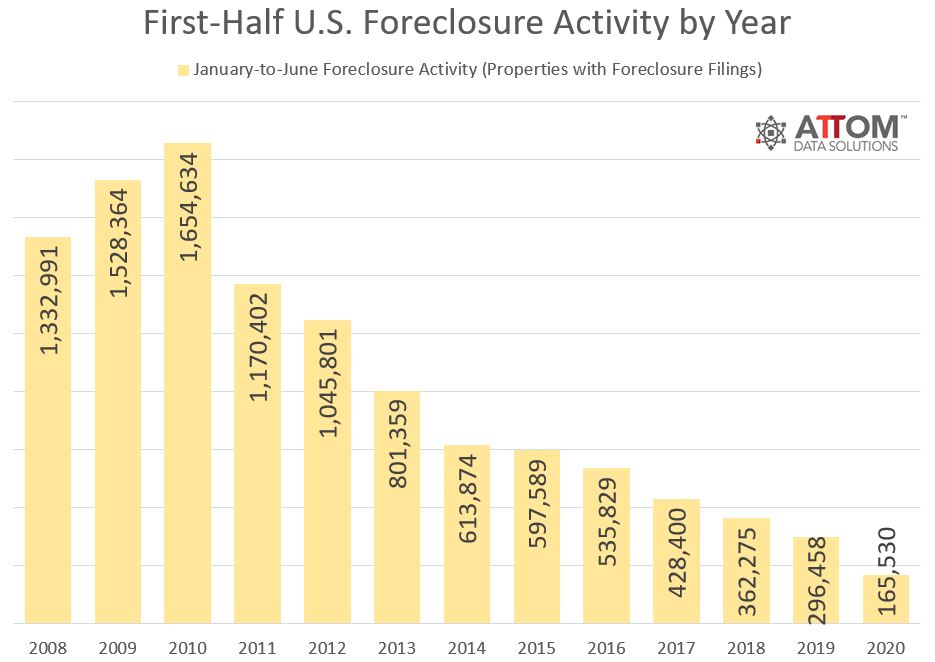

Record low 165,530 U.S. foreclosure filing recorded in first half of 2020, as 13 million evictions loom later this year

Based on ATTOM Data Solutions' Midyear 2020 U.S. Foreclosure Market Report, there were a total of 165,530 U.S. properties with foreclosure filings -- default notices, scheduled auctions or bank repossessions -- in the first six months of 2020, down 44 percent from the same time period a year ago and down 54 percent from the same time period two years ago.

Bucking the national trend with increasing foreclosure activity compared to a year ago were 10 of the 220 metro areas analyzed in the report, including Stockton, California (up 161 percent); Chico, California (up 61 percent); McAllen, Texas (up 42 percent); Lake Havasu, Arizona (up 39 percent); and Fort Wayne, Indiana (up 21 percent).

"The residential foreclosure market across the nation continues to contract amid a combination of booming housing market conditions before the current Coronavirus pandemic hit and a moratorium on activity while the country struggles to overcome the crisis," said Ohan Antebian, general manager of RealtyTrac. "Foreclosure starts and completions were already declining rapidly last year because the housing market and the economy were riding so high. Now they're down to lows not seen for at least 15 years as the federal government has banned lenders from pursuing most delinquent loans until at least the end of August 2020 to help people weather the pandemic. Distressed property volume is almost guaranteed to increase significantly once the moratorium is lifted because millions of Americans missed their mortgage payments in June and will continue to because of unemployment. But for now, everything is on hold and the foreclosure numbers reflect that pause."

Delaware, New Jersey, Illinois post highest state foreclosure rates

Nationwide 0.12 percent of all housing units (one in every 824) had a foreclosure filing in the first half of 2020.

States with the highest foreclosure rates in the first half of 2020 were Delaware (0.28 percent of housing units with a foreclosure filing); New Jersey (0.25 percent); Illinois (0.24 percent); Maryland (0.21 percent); and Connecticut (0.18 percent)

Other states with first-half foreclosure rates among the 10 highest nationwide were South Carolina (0.18 percent); Florida (0.17 percent); Ohio (0.16 percent); North Carolina (0.14 percent); and Georgia (0.14 percent).

Highest metro foreclosure rates in Peoria, Trenton, Rockford

Among 220 metropolitan statistical areas with a population of at least 200,000, those with the highest foreclosure rates in the first half of 2020 were Peoria, Illinois (0.37 percent of housing units with foreclosure filings); Trenton, New Jersey (0.36 percent); Rockford, Illinois (0.36 percent); Atlantic City, New Jersey (0.32 percent); and Lake Havasu, Arizona (0.30 percent).

Other metro areas with foreclosure rates ranking among the top 10 highest in the first half of 2020 were Fayetteville, North Carolina (0.27 percent of housing units with a foreclosure filing); Bakersfield, California (0.27 percent); Columbia, South Carolina (0.25 percent); Chicago, Illinois (0.25 percent); and Cleveland, Ohio (0.25 percent).

Foreclosure starts down nationwide, up in three states

A total of 99,028 U.S. properties started the foreclosure process in the first six months of 2020, down 44 percent from a year ago to the lowest six-month total going back to the second half of 2005, the earliest data available.

Counter to the national trend, three states posted year-over-year increases in foreclosure starts, including Tennessee, Idaho, and Indiana. States that saw an annual decrease included Florida (down 63 percent); New Jersey (down 43 percent); Illinois (down 37 percent); Georgia (down 33 percent); and California (down 29 percent).

Bank repossessions drop to lowest level

Lenders foreclosed (REO) on a total of 37,917 U.S. properties in the first six months of 2020, down 44 percent from a year ago to the lowest six-month total since we began tracking in 2005.

States that saw the posted the greatest year-over-year decreases in REOs in the first half of 2020, included Mississippi (down 76 percent); South Dakota (down 65 percent); Kansas (down 64 percent); Idaho (down 64 percent); and Nevada (down 61 percent). The only state that posted a year-over-year increase in REOs in the first half of 2020 was Nebraska, with a 76 percent increase.

Q2 2020 foreclosure activity below pre-recession averages in 93 percent of markets

There were a total of 30,656 U.S. properties with foreclosure filings in Q2 2020, down 80 percent from previous quarter as well as a year ago to lowest quarterly total since Q1 2006.

The national foreclosure activity total in Q2 2020 was 89 percent below the pre-recession average of 278,912 per quarter from Q1 2006 to Q3 2007, making Q2 2020 the 15th consecutive quarter with foreclosure activity below the pre-recession average.

Second quarter foreclosure activity was below pre-recession averages in 205 out 220 (93 percent) metropolitan statistical areas with a population of at least 200,000 and sufficient historical foreclosure data, including Los Angeles, Chicago, Dallas, Houston, Miami, Atlanta, San Francisco, Riverside-San Bernardino, Phoenix and Detroit.

Metro areas with second quarter foreclosure activity above pre-recession averages included Portland, McAllen, Huntsville, Salisbury, and Gulfport.

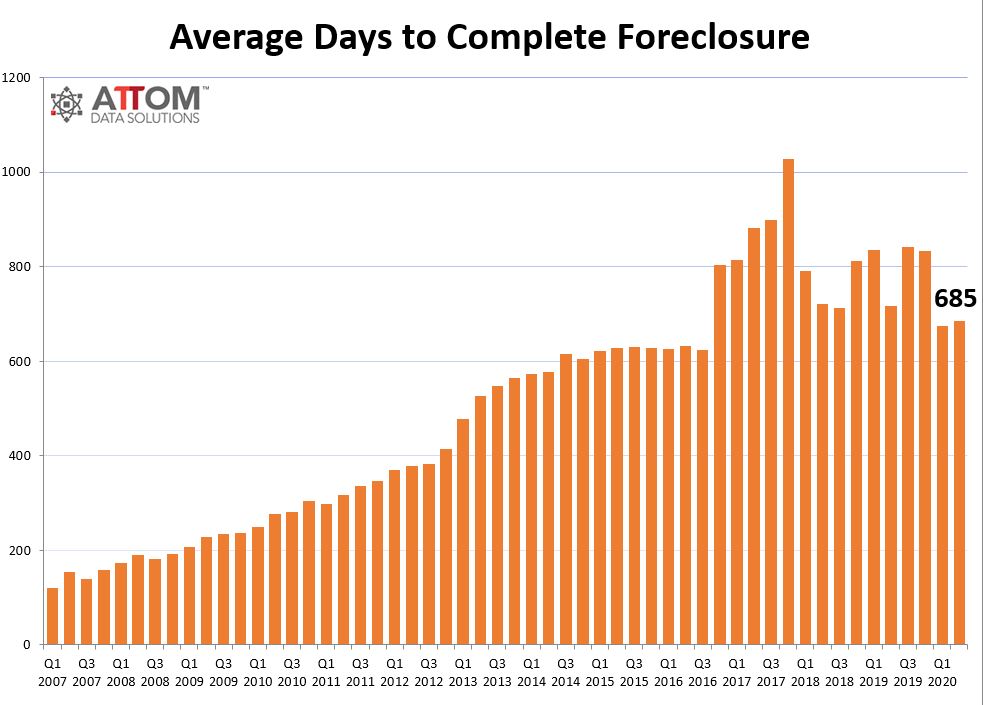

Average foreclosure timeline drops from last year

Properties foreclosed in the second quarter of 2020 took an average of 685 days from the first public foreclosure notice to complete the foreclosure process, up from 673 days in the previous quarter but down from 716 days in the second quarter of 2019.

States with the longest average foreclosure timelines for foreclosures completed in Q2 2020 were Hawaii (1,558 days), Louisiana (1,341 days), New York (1,242 days), New Jersey (1,202 days), and Indiana (1,033 days).

States with the shortest average foreclosure timelines for foreclosures completed in Q2 2020 were Arkansas (181 days), Minnesota (212 days), Arizona (233 days), West Virginia (254 days), and Michigan (265 days).

June 2020 Foreclosure Activity High-Level Takeaway

- Nationwide in June 2020 one in every 14,798 properties had a foreclosure filing

- States with the highest foreclosure rates in June 2020 were Maryland (one in every 5,393 housing units with a foreclosure filing); New Mexico (one in every 6,346 housing units); Delaware (one in every 6,798 housing units); New Jersey (one in every 8,800 housing units); and South Carolina (one in every 9,326 housing units).

- 4,869 U.S. properties started the foreclosure process in June 2020, up 12 percent from the previous month but down 80 percent from a year ago.

- Lenders completed the foreclosure process on 2,504 U.S. properties in June 2020, down 12 percent from the previous month and down 76 percent from a year ago.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More