Seattle Real Estate News

Seattle

International Buyer Demand for U.S. Homes Upticks in Early 2025

A new report from Realtor.com reveals a modest uptick in international interest in U.S. real estate, with 1.9% of the platform's traffic in the first quarter of 2025 coming from global home shoppers -- up slightly from the same period in 2024.

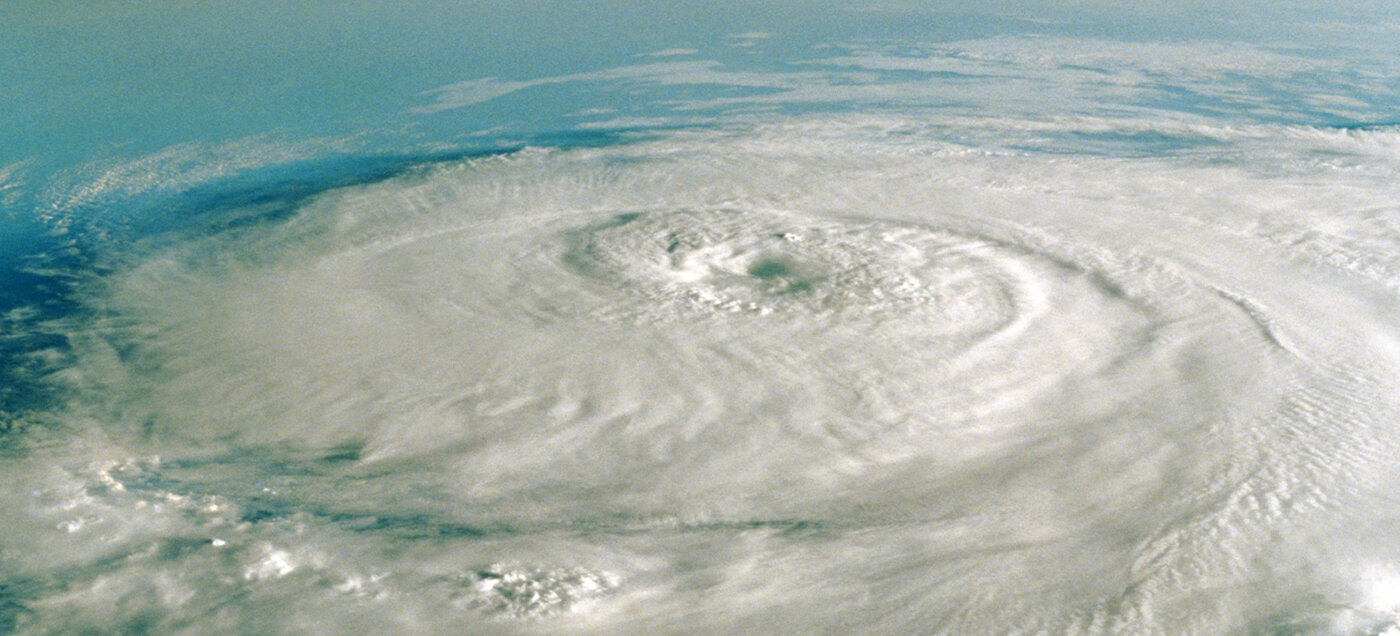

2025 Hurricane Season Puts 6.4 Million U.S. Homes at Risk of Storm Surge

Now that the 2025 hurricane season has officially begun, according to NOAA, a new and growing concern is emerging for homeowners along the U.S. coast -- especially in an already tight housing market with historically low inventory.

U.S. Home Sales Continue Slump in April Despite Growing Inventory

According to new data released by the National Association of Realtors, existing-home sales dipped again in April 2025, reflecting ongoing challenges in the U.S. housing market despite growing inventory and continued buyer interest.

Record 45.1 Million Americans to Travel Over 2025 Memorial Day Weekend

Americans are gearing up for a record-breaking Memorial Day weekend, with AAA forecasting that 45.1 million people will travel at least 50 miles from home between Thursday, May 22 and Monday, May 26. The figure marks a 1.4 million increase from last year and breaks the previous travel record of 44 million, set in 2005.

Developer Spotlight

Seattle Property News

More Results: 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 | 35 | 36 | 37 | 38 | 39 | 40 | 41 | 42 | 43 | 44 | 45 | 46 | 47 | 48 | 49 | 50 | 51 | 52 | 53 | 54 | 55 | 56