The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Government Shutdown Now Impacting U.S. Housing, Mortgage Markets

Residential News » Washington D.C. Edition | By Michael Gerrity | January 9, 2019 8:57 AM ET

Unpaid Federal Workers Now Owe $438 Million in Back Mortgage and Rent Payments

Since the start of the U.S. Government shutdown on December 21, 2018, all aspects of the federal housing, mortgage, and programs of the real estate industry have been impacted.

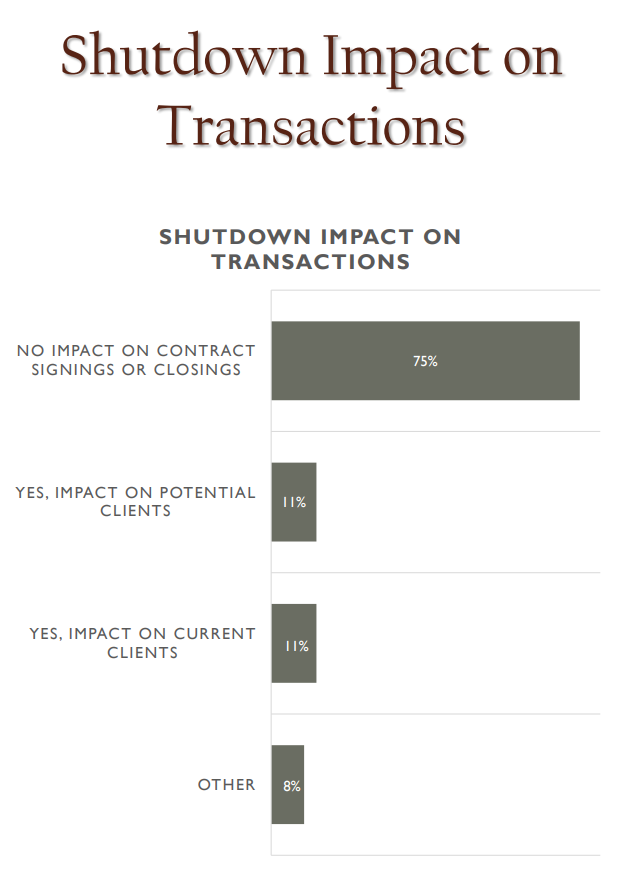

According to a new survey by the National Association of Realtors of 2,211 NAR members found 75 percent had no impact to their contract signings or closings. However, 11 percent did report an impact on current clients and 11 percent on potential clients.

The National Association of Realtors Chief Economist Lawrence Yun commented, "The housing industry was already facing market challenges before any government closure. The shutdown has made matters worse. A home purchase is a major expenditure that simultaneously involves a high level of excitement and anxiety, and the current government shutdown adds another layer of unnecessary complication to the home buying process. The shutdown is causing tangible harm to potential buyers, the real estate market and economic growth."

If NAR respondents reported an impact on current or potential clients, they were asked further details. Respondents were allowed to pick more than one response, as they may be working with more than one client. The most common impact, at 25 percent, was the buyer decided not to buy due to general economic uncertainty, though they were not a federal government employee. Nine percent of these members had clients who decided not to buy, as their clients are federal government employees. Six percent had a seller who could not sell because their move was impacted by their employment. Three percent had a buyer who was unable to buy due to lender rejection based on furlough (Federal Government employee or contractor).

Three percent had a buyer client who decided not to buy because of lost income or furlough (they are a Federal Government contractor).

Among those impacted by the shutdown, 17 percent had a delay because of a USDA loan, 13 percent had a delay due to IRS income verification, nine percent had a delay due to FHA loans, six percent had a delay due to a VA loan, and nine percent did not cite the reason for the delay.

Other members had lost bids on homes due to the shutdown. These members reported buyers had lost bids due to the following reasons: six percent said buyer was using a FHA loan, four percent buyer was using a USDA loan, and three percent buyer was using a VA loan.

Impacted members also had contracts that were terminated due to the shutdown. Two percent had contracts terminated for each of the following reasons: buyer was using a VA loan, buyer was using a USDA loan, and other reasons not noted. One percent had contracts terminated because the buyer was using a VA loan.

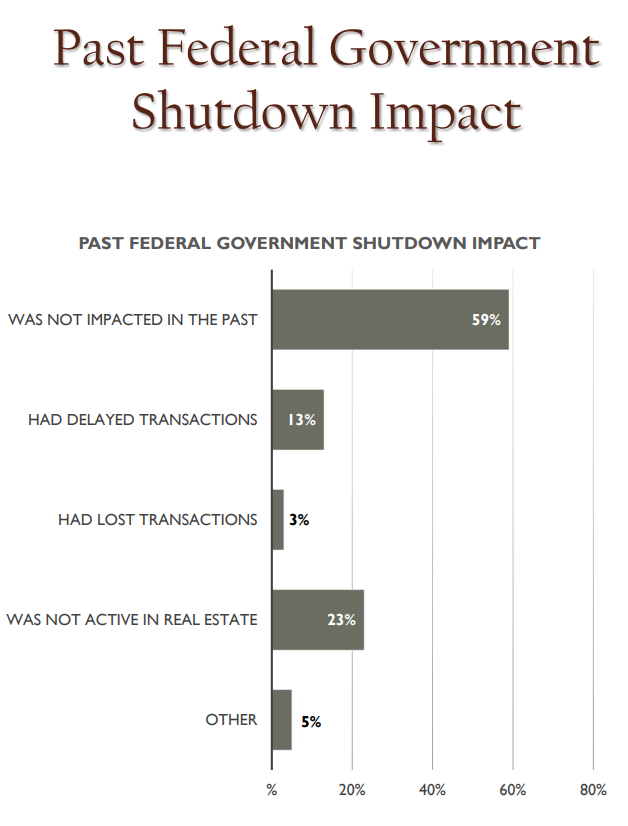

In past shutdowns, 59 percent of respondents were active in real estate and were not impacted. However 13 percent had delayed transactions and three percent had lost transactions.

Zillow research also reports the federal government shutdown will likely delay the processing of approximately 3,500 federally backed purchase mortgages each business day that government offices remain closed.

Zillow further reports about 800,000 workers aren't being paid (some 380,000 are furloughed and another 420,000 are working without pay), and still must find ways to pay for their housing as the shutdown heads into its third week. Zillow estimates that federal employees who are not being paid during the shutdown and own their homes make about $249 million in monthly mortgage payments. A recent HotPads analysis found that renters within that group pay about $189 million for housing each month.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More