Residential Real Estate News

Home Foreclosures Spike 22 Percent Annually in the U.S.

Residential News » Washington D.C. Edition | By WPJ Staff | April 21, 2023 8:15 AM ET

Driven by Rising Unemployment, Inflation and Ongoing Economic Challenges

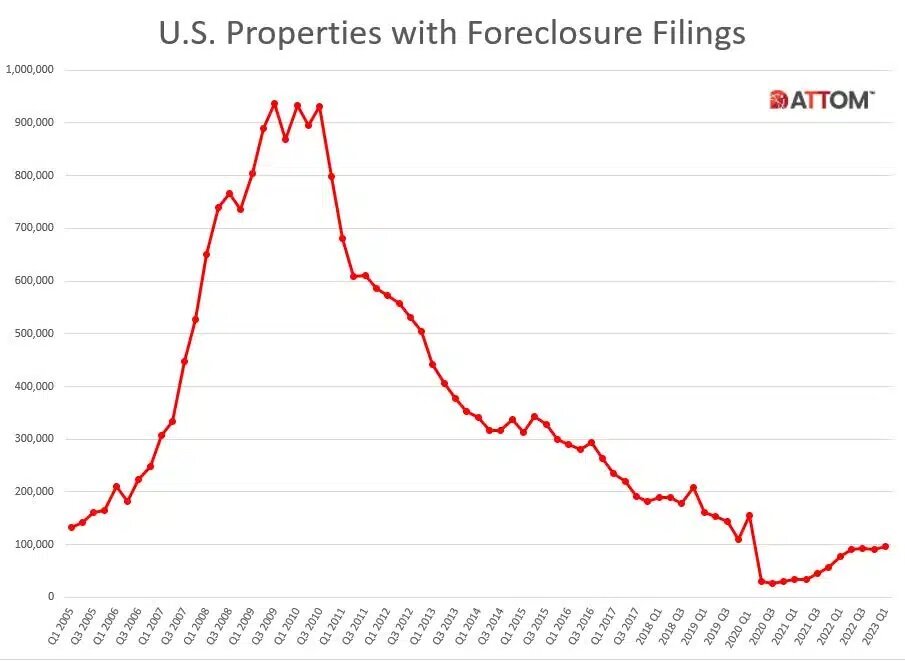

Based on ATTOM'S recently released Q1 2023 U.S. Foreclosure Market Report, there were a total of 95,712 U.S. properties with foreclosure filings during the first quarter of 2023, up 6 percent from the previous quarter and up 22 percent from a year ago.

The report also shows a total of 36,617 U.S. properties with foreclosure filings in March 2023, up 20 percent from the previous month and up 10 percent from a year ago -- the 23rd consecutive month with a year-over-year increase in U.S. foreclosure activity.

"Despite efforts made by government agencies and policy makers to try and reduce foreclosure rates, we are seeing an upward trend in foreclosure activity," said Rob Barber, chief executive officer at ATTOM. "This unfortunate trend can be attributed to a variety of factors, such as rising unemployment rates, foreclosure filings making their way through the pipeline after two years of government intervention, and other ongoing economic challenges. However, with many homeowners still having significant home equity, that may help in keeping increased levels of foreclosure activity at bay."

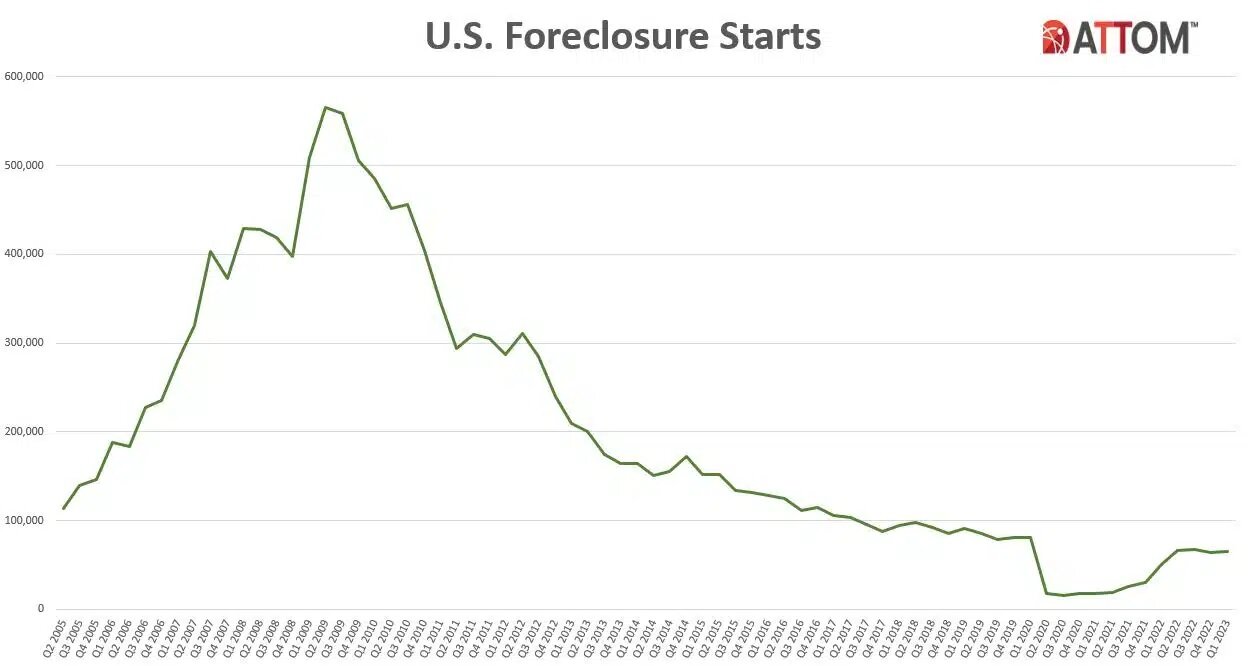

Foreclosure starts increase nationwide

A total of 65,346 U.S. properties started the foreclosure process in Q1 2023, up 3 percent from the previous quarter and up 29 percent from a year ago.

States that had the greatest number of foreclosures starts in Q1 2023 included, California (6,867 foreclosure starts); Texas (6,764 foreclosure starts); Florida (5,724 foreclosure starts); New York (4,345 foreclosure starts); and Illinois (4,006 foreclosure starts).

Those major metros with a population of 200,000 or more that had the greatest number of foreclosures starts in Q1 2023 included, New York, New York (4,674 foreclosure starts); Chicago, Illinois (3,549 foreclosure starts); Los Angeles, California (2,210 foreclosure starts); Houston, Texas (2,120 foreclosure starts); and Philadelphia, Pennsylvania (1,985 foreclosure starts).

Highest foreclosure rates in Illinois, Delaware, and New Jersey

Nationwide one in every 1,459 housing units had a foreclosure filing in Q1 2023. States with the highest foreclosure rates were Illinois (one in every 762 housing units with a foreclosure filing); Delaware (one in every 812 housing units); New Jersey (one in every 824 housing units); Maryland (one in every 897 housing units); and Nevada (one in every 947 housing units).

Among 223 metropolitan statistical areas with a population of at least 200,000, those with the highest foreclosure rates in Q1 2023 were Fayetteville, North Carolina (one in every 526 housing units); Cleveland, Ohio (one in 582); Atlantic City, New Jersey (one in 661); Columbia, South Carolina (one in 671); and Bakersfield, California (one in 688).

Other major metros with a population of at least 1 million and foreclosure rates in the top 15 highest nationwide, included Cleveland, Ohio at No.2; Chicago, Illinois at No. 6; Las Vegas, Nevada at No. 10; Philadelphia, Pennsylvania at No. 12; and Riverside, California at No. 14.

Bank repossessions increase 8 percent from last quarter

Lenders repossessed 12,518 U.S. properties through foreclosure (REO) in Q1 2023, up 8 percent from the previous quarter and up 6 percent from a year ago.

Those states that had the greatest number of REOs in Q1 2023 were Michigan (1,819 REOs); Illinois (1,039 REOs); California (846 REOs); Pennsylvania (788 REOs); and New York (774 REOs).

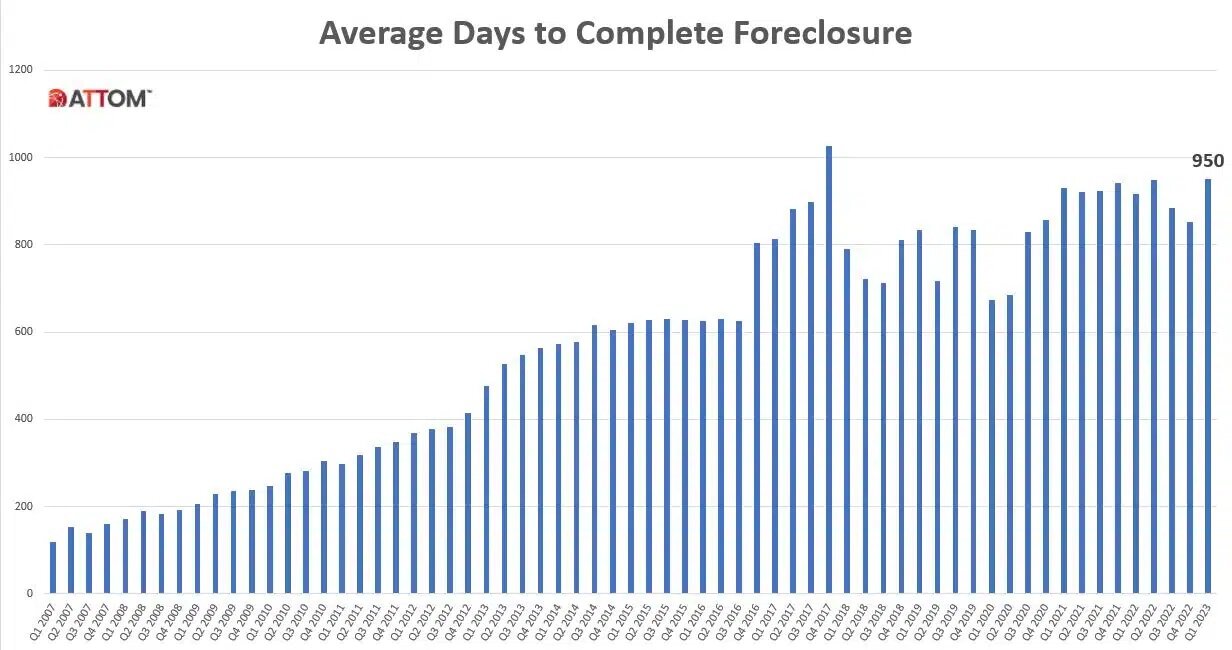

Average time to foreclose increases 12 percent from previous quarter

Properties foreclosed in Q1 2023 had been in the foreclosure process an average of 950 days, the highest number of average days to foreclose since Q1 2018. This is up 12 percent from the previous quarter and up 4 percent from Q1 2022.

States with the longest average foreclosure timelines for homes foreclosed in Q1 2023 were Louisiana (2,770 days); Hawaii (2,486 days); New York (1,963 days); Kentucky (1,881 days); and New Jersey (1,697 days).

States with the shortest average foreclosure timelines for homes foreclosed in Q1 2023 were Wyoming (111 days); Minnesota (141 days); Montana (143 days); Texas (146 days); and Arkansas (157 days).

March 2023 Foreclosure Activity High-Level Takeaways

Nationwide in March 2023, one in every 3,813 properties had a foreclosure filing.

States with the highest foreclosure rates in March 2022 were Illinois (one in every 2,050 housing units with a foreclosure filing); Delaware (one in every 2,161 housing units); Nevada (one in every 2,178 housing units); Indiana (one in every 2,223 housing units); and New Jersey (one in every 2,299 housing units).

24,234 U.S. properties started the foreclosure process in March 2023, up 19 percent from the previous month and up 8 percent from March 2022.

Lenders completed the foreclosure process on 4,791 U.S. properties in March 2023, up 25 percent from the previous month and up 9 percent from March 2022.

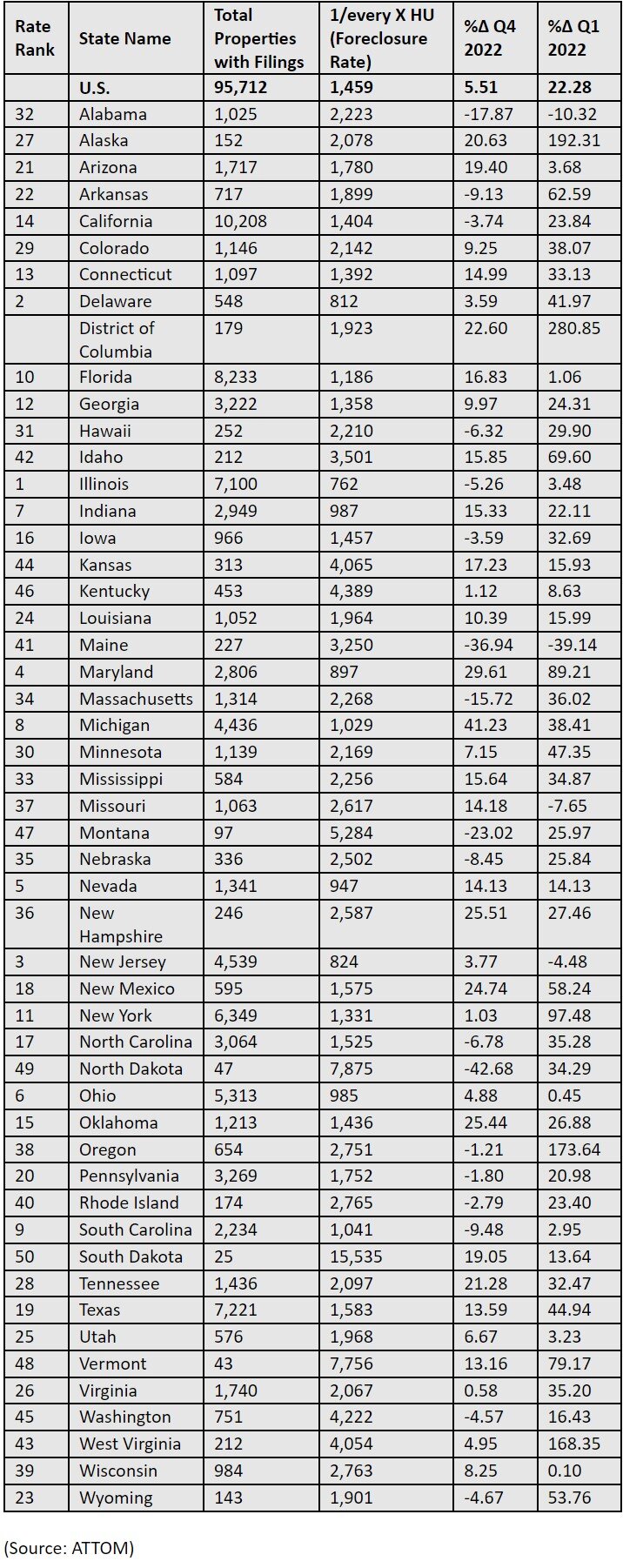

U.S. Foreclosure Market Data by State - Q1 2023

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026