The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Despite Stimulus, 3 Million Renters Still Face COVID-19 Unemployment in U.S.

Residential News » Washington D.C. Edition | By David Barley | January 13, 2021 8:10 AM ET

Zillow research is reporting that despite the recently finalized fiscal stimulus package, millions of U.S. renters who remain unemployed during the COVID-19 pandemic still desperately need relief. The additional payments will bring their typical rent burdens from more than 80% of their income to less than half.

While the extra assistance helps on a monthly basis, millions behind on their rent still face an incredible challenge in catching up on payments that have piled up before temporary eviction moratoriums expire.

Renters have carried much of the financial burden throughout the COVID-19 pandemic, in large part because of dramatic job losses in high-contact industries that are often staffed by renters. Zillow estimates at least 3 million renters who were employed last March 2020 had lost their jobs and were still out of work in November 2020, including more than a million in the accommodation and food services industries that have been devastated by restrictions aimed at limiting the spread of COVID-19.

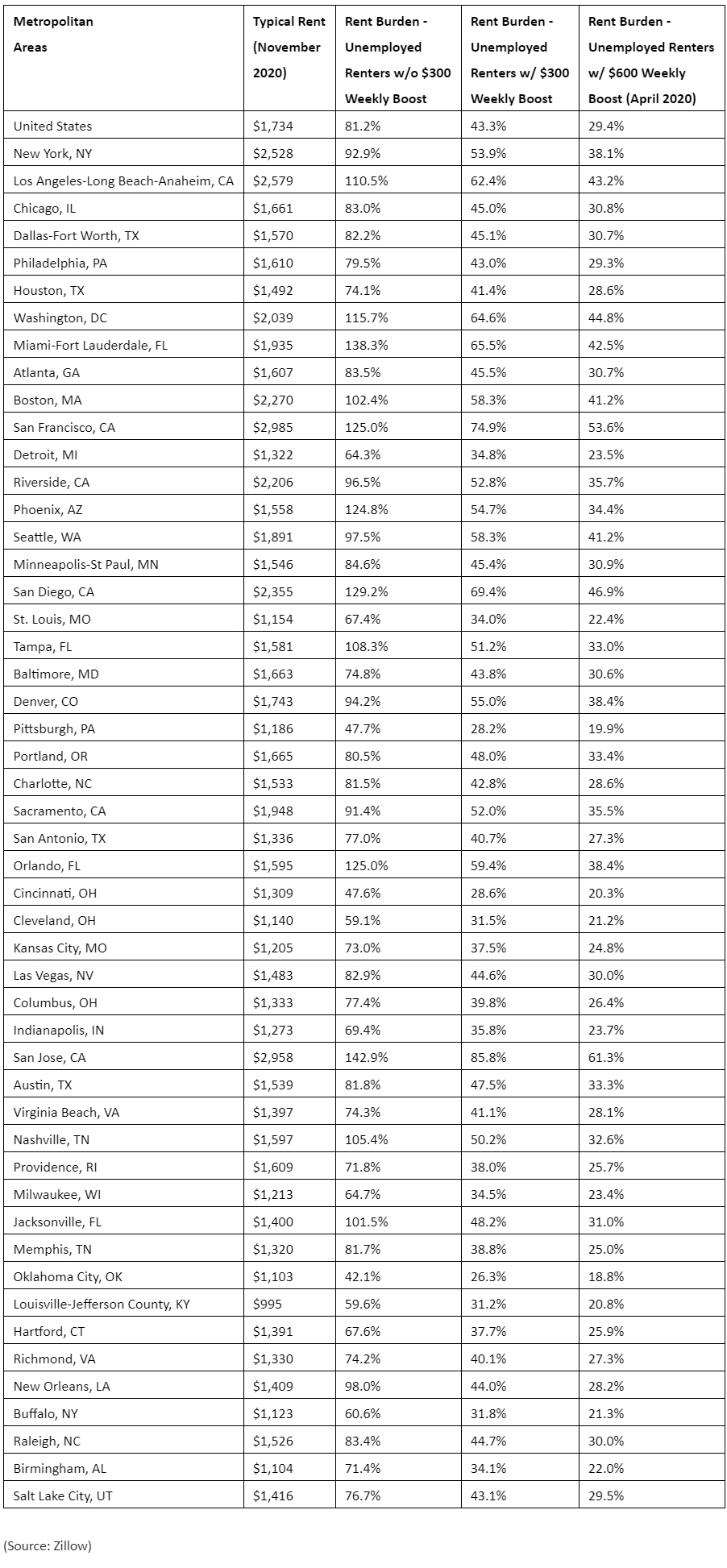

Federal and state unemployment insurance is now the primary source of income for these renters who have lost their jobs. In November, a typical unemployed renter living alone spent 81.2% of that income on rent. The additional $300 a week from the current stimulus package will bring the typical rent burden down to 43%.

That is a huge improvement, but still well above the 30% threshold at which a household is officially "rent burdened." Previous research from Zillow and collaborators at the University of Pennsylvania and Boston University found that homelessness rates in a community rise sharply once typical rent burdens climb above 30%. The additional $600 a week in unemployment insurance payments from the CARES Act passed in late March brought the rent burden down to 29.5% for unemployed renters paying the typical rent.

"This analysis shows how much even relatively modest amounts of financial assistance can mean to struggling renters," said Chris Glynn, senior economist at Zillow. "Even though supplemental assistance has resumed, there are financial wounds to heal from the three-month period when some renters were sending more than 80% of their unemployment benefits out the door on the first of the month. Temporary eviction moratoriums and unemployment insurance alone may not be enough to keep some renters who have steadily accumulated debts in their homes long term. Housing vulnerability for renters will be a top issue for the incoming administration."

A federal eviction moratorium remains in place to keep those unable to pay in their homes, though industry estimates show only small drops in the share of renters making payments in full compared to a year earlier. But the rent owed continues to accrue even without the looming threat of an eviction. A study by Moody's Analytics estimated that nearly 12 million renters will owe an average of about $6,000 in back rent and utilities by this month. While unemployed renters remain significantly rent burdened, the additional $300 payments may help reduce the debt they will eventually owe when eviction moratoriums expire.

Renters who maintained stable employment in 2020, however, saw their rent burdens stabilize during the pandemic due to slowing rent growth for much of the year. In November, the typical U.S. renter who did not receive unemployment benefits paid an estimated 29.6% of their income on rent, a small improvement from 29.8% in March. Rent growth has shown the first signs of a bounceback, potentially reversing the small gains employed renters made in 2021 and making it more difficult for the millions who have fallen behind on payments.

Catching up any debts accrued will likely prove difficult for many who did not have much financial breathing room to begin with. Low-income renters typically spent 53.1% of their income on rent in 2019, and Zillow research from before the pandemic and resulting recession showed that only 51% of renters said they could afford an unexpected $1,000 expense.

Zillow reports another potential cliff looms on March 14, 2021 when the current $300 weekly supplement expires.

While the extra assistance helps on a monthly basis, millions behind on their rent still face an incredible challenge in catching up on payments that have piled up before temporary eviction moratoriums expire.

Renters have carried much of the financial burden throughout the COVID-19 pandemic, in large part because of dramatic job losses in high-contact industries that are often staffed by renters. Zillow estimates at least 3 million renters who were employed last March 2020 had lost their jobs and were still out of work in November 2020, including more than a million in the accommodation and food services industries that have been devastated by restrictions aimed at limiting the spread of COVID-19.

Federal and state unemployment insurance is now the primary source of income for these renters who have lost their jobs. In November, a typical unemployed renter living alone spent 81.2% of that income on rent. The additional $300 a week from the current stimulus package will bring the typical rent burden down to 43%.

That is a huge improvement, but still well above the 30% threshold at which a household is officially "rent burdened." Previous research from Zillow and collaborators at the University of Pennsylvania and Boston University found that homelessness rates in a community rise sharply once typical rent burdens climb above 30%. The additional $600 a week in unemployment insurance payments from the CARES Act passed in late March brought the rent burden down to 29.5% for unemployed renters paying the typical rent.

"This analysis shows how much even relatively modest amounts of financial assistance can mean to struggling renters," said Chris Glynn, senior economist at Zillow. "Even though supplemental assistance has resumed, there are financial wounds to heal from the three-month period when some renters were sending more than 80% of their unemployment benefits out the door on the first of the month. Temporary eviction moratoriums and unemployment insurance alone may not be enough to keep some renters who have steadily accumulated debts in their homes long term. Housing vulnerability for renters will be a top issue for the incoming administration."

A federal eviction moratorium remains in place to keep those unable to pay in their homes, though industry estimates show only small drops in the share of renters making payments in full compared to a year earlier. But the rent owed continues to accrue even without the looming threat of an eviction. A study by Moody's Analytics estimated that nearly 12 million renters will owe an average of about $6,000 in back rent and utilities by this month. While unemployed renters remain significantly rent burdened, the additional $300 payments may help reduce the debt they will eventually owe when eviction moratoriums expire.

Renters who maintained stable employment in 2020, however, saw their rent burdens stabilize during the pandemic due to slowing rent growth for much of the year. In November, the typical U.S. renter who did not receive unemployment benefits paid an estimated 29.6% of their income on rent, a small improvement from 29.8% in March. Rent growth has shown the first signs of a bounceback, potentially reversing the small gains employed renters made in 2021 and making it more difficult for the millions who have fallen behind on payments.

Catching up any debts accrued will likely prove difficult for many who did not have much financial breathing room to begin with. Low-income renters typically spent 53.1% of their income on rent in 2019, and Zillow research from before the pandemic and resulting recession showed that only 51% of renters said they could afford an unexpected $1,000 expense.

Zillow reports another potential cliff looms on March 14, 2021 when the current $300 weekly supplement expires.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More